Ascendix consulting steers proptechs into profit

Recently as a part of my private research I spent two weeks analysing 1,327 property technology companies, I started with a list of 912 companies that I had complied and analysed in 2020. Revised it to those who had not exited and were still trading and added 136 clients and a number of start-ups.

From this work a number of trends and observations became clear, most notably that funding; some companies having had five or more rounds of funding sometimes over £60M, often did not translate into guaranteeing a penny of profit. Whereas a number of companies had exited who never took V/C or P/E cash.

The other thing that was blatantly obvious is that a huge swathe of zombie technology companies exist, stumbling along, and they need not, all they require is to undertake some professional external help, (and I am not particularly talking about engaging my services at Proptech-PR) I am actually suggesting a lot of Founders, CTO’s and indeed investors should be using the services of Ascendix.

To be clear I have no commercial tie up with this company so if you use them or do not use them it will not make and difference to me financially, but I just know what good looks like. And having known Wes Snow for some years he really is person that can tell you where you are, and the best and most profitable way forward. As there a huge number of Proptechs out their just languishing and need a clear picture of what to do.

In his own words Wes Snow, CEO and co-founder of Ascendix puts it this way, ‘Whether you want to optimize existing software or assess the feasibility of integrating emerging technologies like AI, we’re here to help. Our proptech consulting and software development audits entail a thorough analysis of your existing processes and software.

We identify risks and outline growth opportunities to ensure a successful product launch, scale-up, or improvement in a corporate clients systems’ performance. As a result, you can eliminate and foresee multiple issues like pricey software maintenance, compliance failures, and security vulnerabilities.’

‘We are trusted by market-leading companies like JLL and Flibco, we’ve helped multiple brands increase both service delivery and flow of new Saas clients. Harnessing the power of AI we enhance their existing proptech software with AI document processing, resulting in increased efficiency and optimized workflows’.

Ascendix proptech consulting & software audit is the right fit when you need to:

Increase MRR and ARR – By having a correct market fit and distribution strategy that scales.

Eliminate Product Quality Issues – Get rid of ever-growing bug backlogs, performance volatilities, scalability barriers, and unstable connections to ensure end-users get the best experience possible.

Avoid Deployment Burdens – Avoid common pitfalls that lead to long-run, pricey, and unstable deployment and implementation that might otherwise cause way more hassle in production.

Upgrade Outdated UI/UX Product Design – Transform outdated UX and design interfaces into fresh and user-friendly UI/UX architecture that meets end-users’ needs and dispels their concerns.

Identify Error-Prone Issues In SDLC – Eliminate any potential flaws within your software development lifecycle by entrusting audits of your products and processes to a technology vendor.

Speed Up Time to Market – Accelerate the product go-to-market period by identifying underperforming parts of your solutions and processes to save time and release faster.

Future-Proof the Product Roadmap – Refine your strategic vision and ensure smooth and high-capacity operations by building a solid product framework with a third-party expert.

Minimize Post-Release Risks – Entrust end-to-end app performance audit to a third-party partner and identify potential software artifacts and defects to prevent post-release issues and avoid brand hurdles.

Improve Business Maturity – Evaluate project artifacts and put documentation and software outputs (development, QA, BA, UX, DevOps) through their paces to enhance business maturity.

Wes Snow adds, ‘Getting an unbiased Ascendix audit of your current product means that our clients can leverage the complex examination of their current processes and software, to identify risks and define growth points for a successful product launch or scale-up. Often we find the c-suite is just too close to the product to get a balanced view of all factors.’

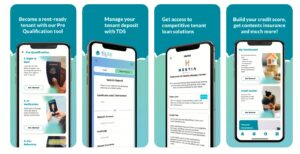

Adam Pigott CEO of tlyfe outlines the possible future landscape of the Private Rented Sector

‘As we head towards the end of the year, the present Renters’ Rights Bill, introduced to Parliament in September 2024, looks to be on the statute book by summer 2025, and whilst its aims are laudable, there may unintended consequences. Bolstering tenants’ rights, the new Act will ban ‘no-fault’ section 21 evictions, and see an end to fixed-term tenancies which will become periodic tenancies, with a two month notice period by tenants. There will be a private rented sector database for all landlords.

It will be illegal for landlords and agents to discriminate against prospective tenants on benefits or who have children, and it will stop offers being made above advertised rents. There will be a Private Rented Sector Landlord Ombudsman for landlords and tenants in England, and a set standard (DHS) for PRS. With Awaab’s Law being adhered to, ensuring damp and other health endangering hazards are dealt.

With only perhaps seven-months to prepare for this seismic shift in the rental sector, my worry is that maybe no-one has thought about, for example the need to change overnight literally millions of the existing tenancy agreements, or that this new raft of legislation may take out a number of rental properties from the sector.

Anecdotally, many sources are reporting an exodus of private Landlords, some of whom were spurred to sell up prior to The Chancellor’s Autumn statement. Others selling in advance of the new Act.

How to navigate trends, challenges, and opportunities in the 2025 real estate sector

Tom Brown, MD Ingenious Real Estate comments, ‘As we move toward 2025, the UK real estate market is navigating a complex and ever-evolving landscape. Investors must weigh evolving factors such as political uncertainties, shifts in rental demand, and the impact of economic pressures on borrowing costs. Here’s five areas to watch in real estate in 2025:

Political uncertainty and real estate risks

The political landscape continues to present risks for real estate in 2025. Key uncertainties include potential changes in global leadership, especially within major economies like the United States, and the ongoing repercussions of the UK’s post-Brexit relationship with the European Union. Challenges around trade deals, tariffs, and economic isolation remain a threat to market confidence and transaction volumes.

For property investors and developers, these uncertainties make long-term planning increasingly complex. In a volatile political climate, many may adopt a more cautious approach, focusing on adaptable strategies to mitigate risk and anticipate shifts in policy.

A stronger rental market

The rental market is expected to maintain strong momentum as homeownership remains difficult for many. The discontinuation of government schemes like Help to Buy, combined with high mortgage rates and inflation, have left first-time buyers struggling. Consequently, rental demand, particularly in urban areas, is set to grow, with residential rents seeing double-digit increases.

Traditional buy-to-let investors continue to feel the pinch from a changed tax framework, increased regulations and a tougher compliance environment, reducing rental supply. This can only further elevate rents by reducing supply and underscores a shift towards Build-to-Rent developments. These purpose-built projects are designed with long-term renters in mind, providing stable and attractive returns for investors.

Interest rates and borrowing challenges

Interest rates will remain a key driver for the real estate market in 2025. Although expectations are for gradual reductions, borrowing costs will stay elevated compared to pre-pandemic norms due to broader economic pressures, such as high global debt and inflation concerns. For homebuyers, developers, and the buy-to-sell market, this means persistent challenges in accessing affordable financing and moving forward with large-scale investments. (Picture – Tom Brown, MD Ingenious Real Estate)

Inflation and construction challenges

The construction industry remains vulnerable to high inflation, despite anticipated base rate reductions. Rising costs for materials and labour have already strained smaller contractors, and a resurgence of inflation could see further financial stress. The introduction of a stricter regulatory environment under the Building Safety Act adds another layer of complexity and cost, potentially leading to delays in project timelines and further contractor difficulties.’

Andrew Stanton Founder & Editor of 'PROPTECH-X' where his insights, connections, analysis and commentary on proptech and real estate are based on writing 1.3M words annually. Plus meeting 1,000 Proptech founders, critiquing 400 decks and having had 130 clients as CEO of 'PROPTECH-PR', a consultancy for Proptech founders seeking growth and exit strategies. He also acts as an advisory for major global real estate companies on sales, acquisitions, market positioning & operations. With 200K followers & readers, he is the 'Proptech Realestate Influencer.'