There has been a lot of recent debate about stamp duty land tax, or SDLT, levied by HMRC on land and property purchases.

With the Chancellor freezing the usual banding of the SDLT for property or land transactions completing at £500,000 or less, it has been estimated that close to a million buyers may have in some way gained from paying no or less SDLT.

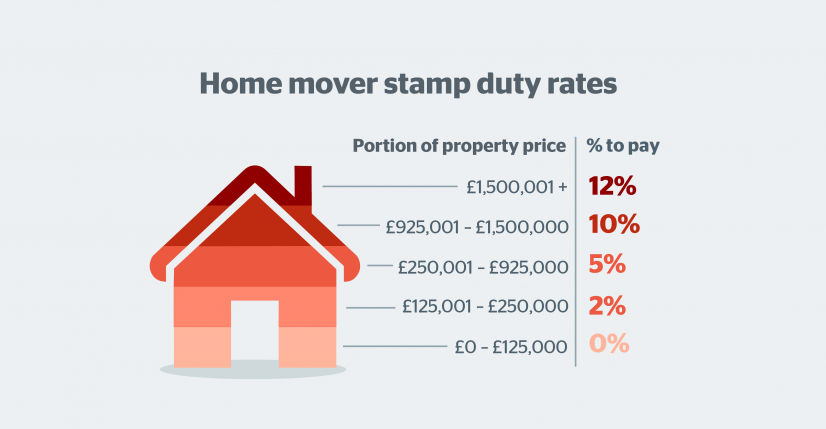

In case anyone does not know, the rates in England as of the 1st of October 2021 returned to normal. Normal being zero tax up to £125,000, 2% tax on the next £125,000 (the band of £125,001 to £250,000), 5% tax on the next £675,000 (the band £250,001 to £925,000), 10% tax on the next £575,000 (the band £925,001 to £1.5M) and then 12% on anything above this.

If you are a first-time buyer in England, there is zero stamp duty land tax on purchases up to £300,000, but you pay 5% on the band £300,001 to £500,000. However, if the purchase is over £500,000 there is no relief, and first-time buyers have to pay SDLT the same as a normal buyer.

If you are an investment buyer, a person buying a second home, or several homes, the SDLT payable is the same as the normal rate quoted above, plus 3%. If you are a buyer from outside of the UK, buying in England as an investment, you’d have to add another 2% in all the categories that a normal investment buyer pays.

Why all of this matters is that depending on where you live, and the value of your home, SDLT can be a real factor. For example, in Middlesbrough, the average house price is £167,000 and in London it is £695,000.

So at £167,000, a first-time buyer is paying no stamp duty, and a normal buyer is only paying £840. At £695,000 a first-time buyer gets no relief and will pay the same as a normal buyer, £24,750.

If you look closer, the recent higher taxation for non-domicile buyers who look to buy prime property in London, for example, at a value of £5 million, will now pay £613,750. Will that dampen the actual sale prices being achieved?

Though, of course, we can always rely on some to game any taxation system, such as an ex-prime minister and his barrister wife who recently were shown to have swerved a £312,000 SDLT bill, as per the Pandora Papers.

All forms of property and land taxation are unfair at the margins. There will always be winners and losers. Removing some of them altogether as the Chancellor did, with a known end date, was always going to cause a stampede.

With an austere outlook now coming into view, fuelled by inflation and increased taxation, will the full return of stamp duty land tax in all its incarnations pour water on the overheated housing market?

Andrew Stanton is the founder and CEO of Proptech-PR, a consultancy for Founders of Proptechs looking to grow and exit, using his influence from decades of industry experience. Separately he is a consultant to some of the biggest names in global real estate, advising on sales and acquisitions, market positioning, and operations. He is also the founder and editor of Proptech-X Proptech & Property News, where his insights, connections and detailed analysis and commentary on proptech and real estate are second to none.