Ascendix thought leadership on real estate software and commercial real estate trends

Wes Snow CEO of Ascendix shares once again more thoughts and analysis, giving his personal overview on real estate software and commercial real estate technologies that simplify workflows and soften the challenges in adopting great products. He also dives into the latest Commercial Real Estate technology trends to help you strategize and adopt the latest technology before it becomes mainstream.

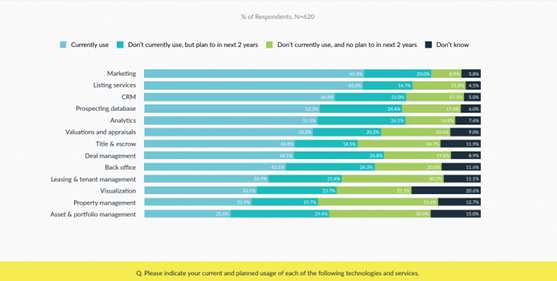

Here then is some comprehensive thought leadership from Wes Snow CEO of Ascendix, ‘Today, when technology is conquering the world and makes people’s lives easier it is impossible to believe that many commercial real estate brokers are still using Excel spreadsheets, google docs, and other unautomated resources. In fact, only 25.6% of brokers utilize technology for asset and portfolio management, and slightly more – 31.9% – for property management.

Source: 2022 DNA of CRE report by Buildout

As a result, property professionals spend most of their time editing, writing, and managing data instead of closing the deals. Fortunately, the real estate industry has not been left behind in the technological revolution. Numerous advanced technologies and software solutions are available to streamline the work processes of landlords and tenants, making their workflow more efficient and fruitful.

What are the benefits of Commercial Real Estate Technology for Brokers?

While some brokers tend to stick to the old-fashioned ways to contact landlords and tenants, others are effectively leveraging various CRE technologies to make their work process effective and fruitful. Here are some statistics highlighting how CRE technology helps brokers save time.

According to a survey by Altus Group, 78% of brokers reported that using online marketplaces and listing platforms saves them time in finding and showcasing properties. A study by Altus Group found that 71% of brokers believe that automating administrative tasks using technology saves them significant time. In a survey conducted by Deloitte, 67% of real estate executives reported that advanced analytics tools save brokers time by providing quick access to market data and property insights.

A report by Deloitte stated that using online transaction platforms can save brokers an average of 3-5 hours per transaction by streamlining the closing process and reducing paperwork. PwC’s survey found that 70% of real estate professionals believe that effective collaboration and communication tools save brokers time by enabling efficient communication with clients, colleagues, and stakeholders.

According to a survey by Accenture, 69% of real estate professionals reported that using CRM systems saves them time by centralizing client information and facilitating streamlined communication. So it can be seen that commercial real estate tools prove very helpful in automating real estate business once you get to use them, as reported by more and more brokers worldwide.

So, what are the commercial real estate technologies and software that property brokers can use?

CRM for Commercial Real Estate

The first and most vital commercial real estate software is an industry-tailored CRM. Those specifically designed with commercial real estate workflows in mind, meaning they have functionality like commission tracking and listing management. Examples of Commercial Real Estate CRMs are: AscendixRE, Clientlook, PropertyBase, Buildout CRM, Left Main REI, Rethink CRM.

With a CRM system tailored to CRE needs, property professionals can: Get a 360-degree view of every contact, Perform map search of Properties/Contacts/Availabilities, Track the lifecycle of every deal and make revenue forecasts, Match Contacts with relevant Deals, Easily navigate through massive amounts of data around contacts, companies, and properties applying custom fields and filters, produce Generate reports/flyers/brochures without leaving a system.

A perfect CRM also provides personalized engagement, Closes deals and collaborate with clients within a CRM, Allows teams to show up prepared and ready to have a very specific conversation with clients about their needs and Increase team’s productivity.

Commercial Real Estate CRM is a reliable and money-worthy assistant.

According to DNA of CRE report by Buildout, 30% of respondents (N=620), plan to keep investing in CRM software because it brings valuable results in lead generation, marketing, and data management. Other reasons that motivate brokers to keep investing in this CRE technology are:

Efficient organization and management of vast amounts of real estate data ability to customize the platform in the way you need to. The secure storage of client information, deals, assets, tenants, partners, leases, inquiries, and commissions in a single, protected location, eliminating concerns of data leakage.

Automation of repetitive tasks within real estate transactions, enabling agents to focus on higher-priority responsibilities. Strategic planning of follow-up activities and email campaigns with systematic cadence. Tracking and managing relationships between clients, contacts, properties, and deals.

As the Founder of Massimo Group Rod Santomassimo puts it, ‘Most brokers feel they are savvy because they have a CRM… They have the edge; they have a CRM (sarcastically) …CRM is a staple to the business. Every successful broker has a CRM.’

CRE Report Generating Software

Another example of commercial real estate technology is report generating software. Real estate agencies on tight budgets often turn to Adobe InDesign, Canva, or Microsoft Publisher for their design needs. While these tools are useful, they may not be ideal for generating real estate reports, flyers, and brochures because they are not directly targeting real estate. In fact, those report building tools are used by any sphere.

However, there are template-based real estate flyer generation tools like Composer that offer do-it-yourself functionality at reasonable prices. By using Composer, you can:

Access a library of pre-designed templates for various types of documents and marketing materials. Create branded brochures, property tour books, activity reports, and any other real estate flyers in a few clicks. Extract the data from a CRM and generate a report available in PDF or HTML format.

Eliminate the manual input of property information and images by syncing these tools with your existing systems. Create marketing brochures, activity reports, and other documents quickly and without relying on external assistance. In just a few clicks of a button, you can choose a desired design or build your own template if you’re feeling creative, and the system will do the rest by pulling the information you already have in your CRM. Time is saved and your clients get the opportunity to appreciate your properties in a new, visually appealing way.

Commercial Property Listings Software

The third example of commercial real estate technology is property listing software. Property listings serve as a channel for showcasing properties to potential buyers or tenants. Property listings are typically published in various mediums, both online and offline, to reach a wide audience and attract potential clients.

Publication on third-party platforms is possible due to the listing syndication. CRE property listing syndication refers to the process of distributing commercial real estate (CRE) property listings to multiple online platforms, websites, and listing services. Examples of commercial property listing software: CoStar, LoopNet, 42Floors, Officespace, Reonomy and Catylist.

Compared to traditional marketing channels, property listing software can yield a remarkable return on investment, potentially reaching up to 112% ROI while targeting a broader audience within a shorter timeframe. According to the 2022 DNA of CRE survey conducted by Buildout, only 15% of real estate professionals (out of 620 respondents) planned to decrease their budget and investment in listing services. In contrast, 44% indicated their intention to maintain their existing budget levels, underscoring the significance of listing services.

Property listings software allow you to create your own listings but you need to pay to post your listings there and the traffic from your listings will be directed not to your website, but the MLS platform. Adding property listings functionality to your website is a whole different approach that requires another software that we’ll describe in the next passage.

Property Listing Management Solutions for Your Website

This example of commercial real estate software allows you to automate your property listings publication directly on your website and have your data stored safely in one place.

MarketSpace is one of the examples of that kind of commercial real estate property listing software. Using property listing management software you can easily update property information (e.g., price, leasing dates, occupancy rate, vacant spaces), add new images and descriptions and be sure that all changes will be automatically applied on the website as well.

Property listing management software also provides brokers with relevant stats and analytics. You can see who viewed your listings, what were the most viewed listings and when was the peak interest, and much more. Based on the performance results, you can edit change the position of your listings (place the most popular to the top), send follow-ups to those who were interested in the listing, make more personalized offerings, and more.

Property Valuation Software

Property valuation software is a computer program or application designed to help individuals or professionals estimate the market value of real estate properties. These software tools use various data points and algorithms to analyse property-related information and provide a valuation or appraisal report.

The top five most popular property evaluation software tools: ARGUS Enterprise, HouseCanary, Clear Capital, RIO Genesis, and PriceHubble. Property valuation software is used by various real estate professionals (appraisers, agents, brokers), property investors, financial institutions, government agencies, and individuals seeking to buy or sell properties.

It offers a more objective and data-driven approach to property valuation compared to traditional methods, and it can save time and effort in conducting property appraisals. However, it’s essential to remember that while property valuation software can be a valuable tool, human expertise and judgment remain crucial in the final determination of property values.

Property Management Software

A property management system (PMS) is a software platform designed to help property managers and landlords streamline property marketing, tenant screening, lease management, rent collection, maintenance tracking, financial reporting, and more.

The top five examples of popular property management software: AscendixRE, Buildium, AppFolio Property Manager, Yardi Breeze and TenantCloud. When choosing a property management system, consider the specific needs of your property portfolio and the scale of your operations to find the best fit for your requirements.

Virtual Tour Software

Virtual tour software for commercial real estate is a technology tool that enables real estate professionals, property owners, and commercial brokers to create immersive and interactive virtual tours of commercial properties. Virtual tours allow potential buyers, tenants, or investors to explore the property remotely as if they were physically present, providing a realistic and engaging experience. Virtual tours include 360-degree panoramas, interactive floor plans, and multimedia elements like images, videos, and property information.

According to stats by Digitalintheround, 54% of purchasers won’t even consider a house if it doesn’t include virtual pictures or representation. The top five examples of the most popular virtual tour software for commercial real estate: Matterport 3D, Roundme, Kuula, EyeSpy360 and iStaging.

Investment Management Software

Investment management software for commercial real estate is a specialized tool designed to assist real estate investors, asset managers, and financial professionals in making data-driven decisions, tracking property performance, and maximizing real estate ROI. The top five most popular investment management software for commercial real estate: Dealpath, Juniper Square, Credify, RealPage Investment Management (IPM) and Cadre.

It’s important to note that the availability and popularity of investment management software may vary based on the specific needs and preferences of real estate investors and asset managers. When choosing investment management software, it’s essential to consider the features, scalability, and integration capabilities that align with your investment objectives and portfolio size.

Commercial Sales and Lease Comps Software

Lease and asset management software helps property owners, landlords, and asset managers centralize lease-related data, automate lease administration tasks, track and optimizing lease agreements. Additionally, it assists in managing the various assets associated with commercial properties, such as equipment, fixtures, and furnishings.

The top five most popular lease and asset management software for commercial real estate: MRI Software, VTS, Coyote software, ProLease, LeaseQuery and Drone Technology.

Drone usage is a growing trend in both residential and commercial real estate industry.

According to Multiple Listing Service Statistics, homes that are displayed with an aerial shot made by drones are 68% more likely to sell. Additionally, commercial real estate drone services are quite inexpensive in comparison with the value it adds. However, it’s important to note that drone usage is subject to local regulations and restrictions. To overcome them, you need to: familiarize yourself with the specific regulations in the area to perform drone operation. Obtaining the correct documentation to offer the service.

As you can see, CRE technology provides time-saving benefits to brokers by automating administrative tasks, simplifying property search and listing processes, facilitating efficient communication, and providing quick access to data and insights. By leveraging these technologies, brokers can allocate more time to strategic activities such as building relationships, negotiating deals, and providing personalized services to clients.

What CRE Tech Trends Brokers Should Follow?

The list of must-have commercial real estate technologies is formed based on the current trends in CRE tech field. Let’s have a look at the latest trends brokers should follow:

AI-based tools – AI technologies have been conquering the commercial real estate market step-by-step. The list of AI tools for brokers includes AI-driven property analytics, predictive modeling for investment decisions, automated property valuation, AI-powered chatbots for customer support, text-generative tools like ChatGPT.

Internet of Things (IoT) – The integration of IoT devices and sensors in commercial buildings can provide valuable data on energy usage, security, maintenance, and occupancy. IoT applications may include smart building management systems, energy optimization, and enhanced tenant experiences.

Data analytics and visualization – Advanced commercial real estate data analytics tools will continue to be essential for analysing large datasets, extracting insights, and making data-driven decisions. Visualization technologies such as interactive dashboards and augmented reality (AR) can further enhance data interpretation and presentation.

Sustainability and Green Tech standards – As sustainability becomes a key focus in both CRE and real estate industries, technology will play a vital role in achieving energy efficiency and reducing environmental impact. This includes innovations in smart energy management, renewable energy integration, green building certifications, and sustainable materials.

Collaborative platforms and marketplaces – Collaborative platforms like MarketSpace will continue facilitating networking and deal-making in the commercial real estate industry. These platforms enable efficient property listings, investment opportunities, tenant sourcing, and service provider connections.

It’s important to note that these trends are speculative and based on current industry developments. The commercial real estate tech landscape is dynamic, and new trends may emerge as technology evolves.

To summarise, Commercial real estate technology continues to revolutionize the industry, and throughout this article, we explored various real estate software and technological trends shaping the commercial real estate landscape. From AI-driven analytics to following GreenTech standards, these advancements offer immense potential for streamlining processes, making data-driven decisions, and delivering exceptional client experiences.

Those property professionals, brokers and agents who proactively embrace and invest in commercial real estate technology will position themselves at the forefront of progress, unlocking untapped potential and reaping the rewards of a tech-driven era in this dynamic and thriving industry.

Lastly as you can see we have a huge breadth of knowledge having been dominant in this ever evolving space for a long time. So if you need help with commercial real estate technology? Remember The Ascendix team is a CRE technology consulting partner you can trust to diligently deliver a project of any complexity, to find out more click HERE.

Fintales with Griffin: Powering the proptech sector with embedded finance

Full disclosure because there is a connection via my NED role at nurtur.accelerator to nurtur group and then to Garret Foxon’s LettsPay.

Last Thursday I was kindly invited by Griffin Bank to a very nice location in London to listen to a number of experts talking about fintech and banking. Unfortunately I had a lunch engagement in another part of the country so I could not go, luckily Nkechinyere Ogueri-Onyeukwu for Griffin has put together an excellent summation on what happened at the event. Given the speed at which property, banking, fintech and proptech are moving and melding together I though it important to let more people know what went on.

‘Last week, we held the very first edition of Fintales with Griffin – a quarterly customer-focused interactive session on new developments and trends in the banking and fintech space. For our inaugural event, we teamed up with our partners at Lettspay to do a deep dive on how the property sector is dealing with increased regulatory enforcement.

As many landlords and property managers scramble to make sure their banking arrangements are compliant, can a new approach to banking technology help them meet their requirements and increase efficiency? This was the key question we set out to explore.

Here are major highlights from the event:

Keynote: Griffin’s MLRO Alex Nash on risk, compliance and banking in proptech

The event kicked off with a keynote from Griffin’s MLRO (Money Laundering Reporting Officer), Alex Nash. Alex’s primary role at Griffin is to act as a focal point for all economic crime prevention activities we carry out as a bank.

He explained that the 5th Money Laundering Directive (5MLD), introduced in 2020, had notable implications for letting agents, ushering in increased scrutiny for the sector, and a subsequent shift in banks’ risk appetite for proptech providers and letting agents.

In 2020, the National Risk Assessment was introduced as a way to classify industries based on risk. Property businesses were tagged as “high risk”, while estate and letting agents were considered “medium risk”. The inherent risks associated with the letting industry included the concealment of beneficial owners, rapid fund transfers, and illicit property purchases. However, despite outlining these risks, the NRA admitted to not fully understanding them, further complicating the risk assessments that banks carry out on proptech companies. Many banks, wary of facing hefty fines due to lapses in money laundering protocols, have chosen to shy away from the property industry altogether rather than adapting their controls and due diligence processes to mitigate the inherent risk in this sector.

But risk in itself is not the enemy. As Alex explained, the core problem is that, as the rules have become more stringent, traditional banks are finding it harder to adapt their legacy systems to carry out the required due diligence checks. In many banks, due diligence on prospective customers is an almost entirely manual process – and so they see dedicating whole teams to deal with the specific requirements thrown up by the proptech industry as costly and ineffective.

Alex also explained the concept of “friction” in customer due diligence (CDD). While friction, in the form of comprehensive questions during onboarding or periodic reviews, can be essential for certain customers, implementing it uniformly across the entire customer base can be counterproductive. Using the right level of friction for different customer groups – depending on the level of risk they present – ensures a balance between robust risk management and a smooth customer experience.

He concluded by discussing simplified due diligence – a minimal-friction method used to onboard new customers. Simplified due diligence is primarily intended for new entries to existing, well-understood customer groups within banking entities rather than onboarding new external customers. He expressed strong reservations against its applicability for estate or letting agents in the UK, given their turnover and risk profile.

Discussion: On embedded finance and the proptech sector

Alex’s keynote was followed by a discussion moderated by Miroslava Betinova, Head of Fintech at Griffin. The panellists were Adam Moulson, Chief Commercial Officer at Griffin; Garrett Foxon, CEO and founder at LettsPay; Jamie Brind, Operations manager at KWMove; and Alex Nash, MLRO at Griffin. The session highlighted the challenges and opportunities posed by regulatory changes and how collaboration between different entities could provide solutions to these challenges.

Some key points from the discussion:

Regulatory shifts: Miroslava introduced the conversation with a reference to the Tenant Fees Act 2019, which mandates that letting agents must hold their client funds directly with a bank or a building society authorised by the FCA. This was a departure from previous practices where funds could be held using fintech solutions, such as virtual accounts provided by electronic money institutions (EMIs). Now that this regulation is being enforced in earnest, proptech companies like LettsPay have had to navigate the challenge of moving funds away from EMIs and into bank accounts.

Lettspay seeks collaborators: Garrett talked about how Lettspay’s partnership with Griffin was born. Griffin focuses on building banking technology solutions, but does not offer products directly to consumers. Instead, it develops products that can be easily embedded into other specialised systems, providing a modular and flexible approach to banking.

Lettspay is a client accounting system that helps letting agents manage client money. They had previously held customer funds with an EMI and were looking for a banking partner who could provide modern technology, seamless integration, and the versatility to meet the peculiar requirements of the sector. A key requirement for Lettspay was the ability to reconcile customer funds daily and programmatically open accounts for letting agents.

Griffin was selected after a long road of consultations with several banks. Garrett explained that the big draw of Griffin is that it has similar values to Lettspay in terms of being an open, honest organisation with a problem-solving mindset. Griffin also demonstrated willingness to do the hard work of understanding the sector and building a future-proof solution that actually worked.

Adam added that Griffin’s objective is to truly add value to a diverse range of industries. This means a deep level of collaboration with specialists, where Griffin gets to leverage its “superpower” as a technology-focused bank.

Leveraging expertise: Alex mentioned that the more the Griffin team researched the proptech sector, the more they were shocked at how badly existing banks were serving the industry. He explained that the current regulations combined with the typically conservative risk appetite of banks created a very difficult environment. He also emphasised that there is also a lot of misrepresentation and misinterpretation of the rules out there.

“We’ve deeply researched the rules, we understand how they work and we have a solution that we are sure will address the client money needs of the sector,” he said. To onboard clients in this sector, you need to carry out KYC (Know Your Customer) and CDD. He explained that Griffin’s onboarding product can be modified to cater to the unique CDD needs of letting agents (both small and large), such as factoring in whether they are HMRC-registered or not.

A modern business model: Adam outlined how Griffin “effectively provides components and platform pieces”. Banking can be quite technical in nature, with expertise hidden inside specialist teams. At Griffin, we build these specialist skills directly into our technology and offer them as tools to other organisations. We collaborate on system design, user experience design and the business model, because at the end of the day there’s no point delivering a solution if the end customer isn’t going to feel any benefit.

Seamless onboarding: Alex talked about Griffin’s purpose-built APIs and how they make the onboarding process seamless. Some traditional banks take as much as six months to onboard a customer, and key data is collected by emailing multi-page spreadsheets back and forth. In comparison, ours at Griffin takes days and is made possible by API integrations with leading databases and other state-of-the-art verification and risk assessment tools. This helps us streamline the process based on the customer’s industry, business model, and product set. We also collect the information we need via an online questionnaire to make the process as painless as possible.’

Article by Nkechinyere Ogueri-Onyeukwu – for Griffin

Andrew Stanton’s PROPTECH-X in association with Estate Agent Networking & NewsNow publications.

Andrew Stanton is the founder and CEO of Proptech-PR, a consultancy for Founders of Proptechs looking to grow and exit, using his influence from decades of industry experience. Separately he is a consultant to some of the biggest names in global real estate, advising on sales and acquisitions, market positioning, and operations. He is also the founder and editor of Proptech-X Proptech & Property News, where his insights, connections and detailed analysis and commentary on proptech and real estate are second to none.