Full material Information Guidance B & C published by NTSELAT all you need to know

30th November 2023 • Posted in News Articles Section of NTSELAT

- New guidance for sales and letting agents covers all three phases of programme

- Aim is to help agents to meet their existing legal requirements under the CPRs

- Material information guides also available to support landlords, tenants, buyers and sellers

‘Parts B and C* of the process to improve material information disclosure in property listings are published today within comprehensive new guidance for sales and letting agents.

Use this LINK to access the full new guidelines on Material Information on Property Listings (SALES).

Use this LINK to access the full new guidelines on Material Information on Property Listings (LETTINGS).

Representing the culmination of a programme of work led by the National Trading Standards Estate and Letting Agency Team (NTSELAT) alongside industry leaders and the UK’s major property portals including Rightmove, Zoopla, OnTheMarket and Property Pal**, the guidance has been developed in response to agents’ calls for clarity on what constitutes material information.

Part B is information that should be covered for all properties – such as the type of property, the building materials used, the number of rooms and information about utilities and parking. Part C is information that only needs to be established if the property is affected by the issue – such as flood risk or restrictive covenants. Part A was announced last year and includes council tax band or rate, property price or rent and tenure information (for sales).

Agents are already obliged under the Consumer Protection Regulations (CPRs) not to omit any material information on property listings. Although material information is any information that is important in helping an average consumer make a decision about a property, until now there hasn’t been a defined list of the basic information required. This has left agents vulnerable to enforcement action, and the aim of this guidance is to help them meet their obligations and reduce this risk. By engaging conveyancers to help them prepare the relevant details at the start of the sales or letting process agents will reap the benefits, with shorter transaction times and fewer fall-throughs that result from important information coming to light.

Offilancer has key answers to Work and who and where and how it will be done in the 2030’s

The fallout from the collapse and bankruptcy of WeWork a co-working provider as we know is just beginning. A behemoth that had a market capitalisation of $47 billion, raised over $13 billion in funding and had over 45 million square feet of commercial real estate in its operations. Its value or now non-value hinged on many things, aside from the antics of Adam Neumann, mostly it was about the fact that WORK was changing globally. Who was doing it, where it was being done and how, and the fact that coming into the office or other commercial real estate asset was no longer a given as hybrid work is here to stay.

The change in the landscape of work was speeded by Covid-19 which forced huge swathes of workers to work from home, and left many commercial real estate assets empty or partially utilised causing a massive financial headache for operators and owners. An industry that have been a very solid and predictable business, where long term returns were baked into known business models was thrown into the wind. And for a time WeWork was seen as a saviour a way to fractionalise the commercial buildings, and safeguard the payment of rents and keep occupation levels high, with a type of pay on demand model.

If WeWork is not the answer it is clear that there definitely is a global watershed regarding work, and in my day job I have worked and spoken to and been consulted on what the future of work will be and as importantly what this means for the owners and operators of commercial real estate, and all the other stakeholders in that vertical, with businesses themselves sitting at the apex, because most of all Capitalism works best when all things flow.

At present occupancy of buildings is at an all-time low, and there is a push from workers to have a WFH element to their work week, and businesses are feeling that they need to get workers back in the office, even governments, to mind the skills gap and get … productive results.

Putting it bluntly – someone needs to find a trusted fix for all of what is happening now, which addresses the needs and wants of everyone, a very tall order, which is until I came across a person and a company you probably have never heard of Hojjat Attar CEO and co-founder of a company based in the Netherlands Offilancer.

How are UK rental yields being affected by the rise in interest rates

Michael Joyner Chief Data Scientist at Bricks&Logic explains in his own words how the current high interest rate environment is impacting rental prices.

‘The world of property investment has always been a dynamic and ever-changing landscape, influenced by various economic factors and market conditions. One of the most crucial aspects of property investment is understanding rental yields and how they correlate with interest rates, property values, and market stability.

So let’s explore how low and high-interest rates impact rental yields, the historical trends since the 2008 financial crash, and the role of capital appreciation in the calculations for landlords. We will also discuss the challenges faced by landlords today and how Bricks&Logic can provide valuable assistance in navigating this complex environment.’

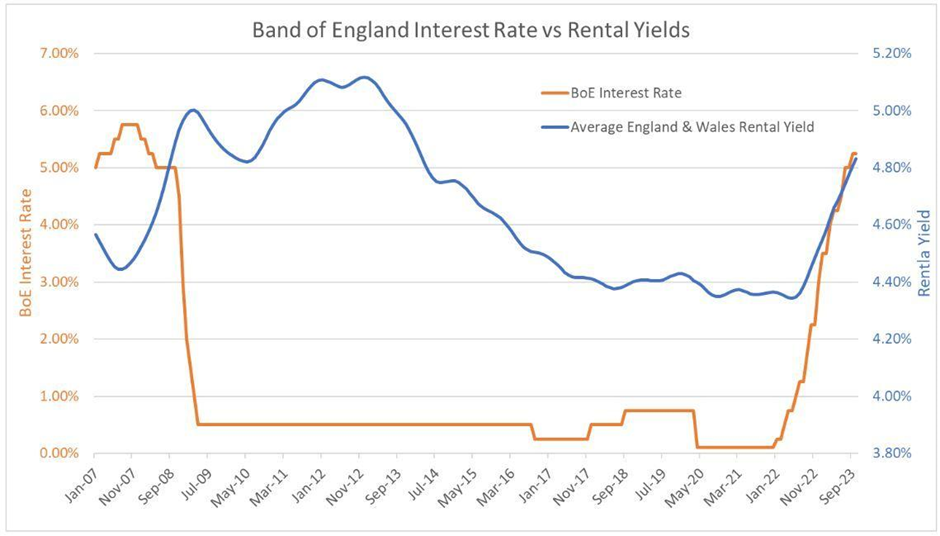

Low Rates and Low Yields, High Rates and High Yields ‘Understanding the relationship between interest rates and rental yields is fundamental for any property investor. Low-interest rates typically result in lower rental yields, as landlords find it harder to make a substantial profit on their investments. Conversely, higher interest rates require higher rental yields to make it worthwhile for landlords. This correlation between interest rates and rental yields can significantly impact the decisions of both novice and seasoned property investors.’

Andrew Stanton’s PROPTECH-X ‘Proptech & Property News’ in association with Estate Agent Networking & News Now publications. #proptech #property #realestate #digitaltransformation #startups

Andrew Stanton is the founder and CEO of Proptech-PR, a consultancy for Founders of Proptechs looking to grow and exit, using his influence from decades of industry experience. Separately he is a consultant to some of the biggest names in global real estate, advising on sales and acquisitions, market positioning, and operations. He is also the founder and editor of Proptech-X Proptech & Property News, where his insights, connections and detailed analysis and commentary on proptech and real estate are second to none.