AI: Reshaping the property industry in a good way

Full disclosure as a NED of the related nurtur.group accelerator, I (Andrew Stanton) do have a commercial tie to the nurtur.group. The following though is a press release and has been submitted to a number of trade publications, and as we receive dozens of press releases a week we have decided to run it as it is newsworthy.

PRESS RELEASE LONDON 2nd Oct 2023 – Artificial Intelligence (AI) has rapidly emerged as a transformative force across various industries, and the property industry in the UK is no exception. There is no doubt that the property business is a people business, and rather than trying to replace the human element, AI can be a tool that helps agents to understand and process far more data than ever before. This means the potential to vastly improve aspects such as marketing, advertising, and the overall customer experience, to name a few.

According to Richard Combellack, Chief Commercial Officer at nurtur.group, the key benefit of AI for estate agents is the ability to streamline operational processes and handle repetitive tasks so that agents have more time to spend on the aspects of their jobs that a machine can’t do, such as build relationships with customers. “Estate agencies are people-driven businesses, and AI complements this by freeing up valuable time for property professionals to focus on strategic and value-added activities,” he adds.

CEO of novvy weighs up impact of any Inheritance Tax Threshold change on UK Real Estate

Inheritance Tax (IHT) is a subject that continuously sparks discussion and excitement in this country where a substantial proportion of every household’s inheritance is property. IHT regulations have stayed constant for years, and their effects on the real estate market have generated a lot of conjecture. Recent discussions about raising the inheritance tax threshold or reducing the rate of levy have brought this issue to the fore of economic and real estate discussions, says Ashish Saraff, CEO of Novyy Technologies.

‘The idea of raising the Inheritance Tax (IHT) threshold has generated a lot of interest and debate. The IHT threshold is currently just £325,000, and the excess is subject to a 40% tax rate. Thanks to the addition of a new allowance in 2017, couples can leave property worth up to £1 million tax-free to their next generation. The primary home nil-rate band allows for a £175,000 tax-free allowance in the tax year 2023–24, which equates to £500,000 for individuals and £1 million for couples.’

Ashish Saraff highlights the potential advantages of this increased allowance for estate planning. The fact that HMRC collected merely £7 billion in inheritance tax last year demonstrates its insignificance in the UK revenue system, being less than 1% of the total tax collection. While the headline rate for IHT is 40%, HMRC data shows that the effective rate paid by most estates after adjusting for reliefs and allowances is under 15%, says Saraff. So why have a negative headline at all!

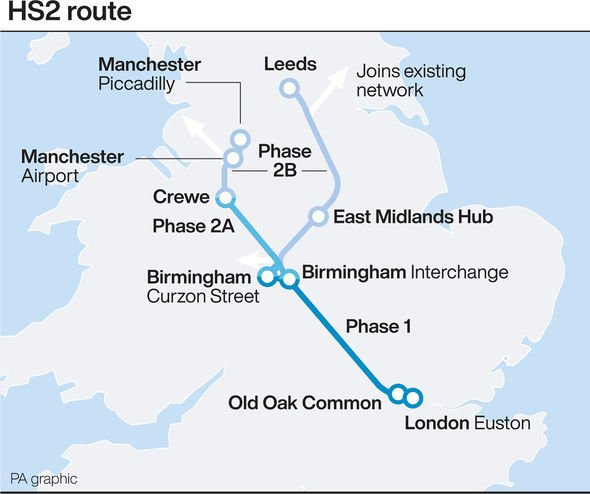

Cancelling HS2 Northern line means hundreds of homes and land will sit in limbo

After the next UK General election in all probability the incumbent PM will fade out of politics and retreat into a wealthy future of directorships and speaking engagements. But one large legacy will be the stockpile of nearly a thousand properties and vast tracts of land ‘up North’ that the tax payer has bought, in the expectation that HS2 trains would be speeding through the space they occupied.

Some of these properties may be sold or auctioned off, but will of course always be on the ‘route’ should in decades to come a railway come. But the bigger injustice perhaps is the distress caused to those who have had to sell under a compulsory order, who now will see their homes inhabited buy others.

The government has made it clear that no additional payout will be made to anyone who sold their property under the circumstances they had to, and all would have had a fair market sale price, but the scale of lives upturned is pretty large, as it was not just homes, but farms and other businesses that came to an end when the route was given the greenlight.

There are vague noises being made that some of the housing will in the future need to be flattened when localised rail changes have to be made. With perhaps this housing stock being rented out until such a time. But what about the large amount of other housing stock and the land that now has to be managed in some way?

PROPTECH-X in association with Estate Agent Networking & NewsNow publications.

.

Andrew Stanton is the founder and CEO of Proptech-PR, a consultancy for Founders of Proptechs looking to grow and exit, using his influence from decades of industry experience. Separately he is a consultant to some of the biggest names in global real estate, advising on sales and acquisitions, market positioning, and operations. He is also the founder and editor of Proptech-X Proptech & Property News, where his insights, connections and detailed analysis and commentary on proptech and real estate are second to none.