novvy says surging rental prices, will outpace slowing house price growth

As Rightmove announces today that residential house sale completions are down by 20%, one real estate industry expert has some good news for those in the property sector, and why the lettings sector for investors is likely to pay dividends.

“I’ve witnessed first-hand the seismic shifts in the UK’s real estate landscape. The dynamics of surging rental prices juxtaposed against a backdrop of slowing house price growth have created a housing market narrative that demands our attention,” says Ashish Saraff, Founder and CEO of novvy.

The UK property market is going through an exciting metamorphosis in an unexpected turn that has stunned market analysts. According to Ashish Saraff, recent figures acquired from reliable sources reflect this transition. The tug-of-war between rising rental prices and a discernible slowdown in house price increases best illustrates this dynamic and paints a clear picture of the market’s current position.

Remarkable numbers from August this year set the stage for this story. Rightmove has reported a 1.9% decline in average asking prices, or £7,012. This decline contradicts the typical summer slowdown, which registered an August decline of 0.9%. What seems to have sparked this change? The Bank of England’s Base Rate is impressively high at 5.25%, the highest level since 2008, amidst strong inflation. Potential investors have been discouraged by rising borrowing costs, which has led to a considerable 15% decrease in the number of completions agreed upon year over year.

Saraff says, “Reality is setting in, albeit slowly. Vendors who wish to sell either must face reality and lower their prices or be ready to hold for a couple of years until BBR comes back to 2-3%. One cannot keep expecting their property to sell at 5-6% cap rate with BBR being where it is.”

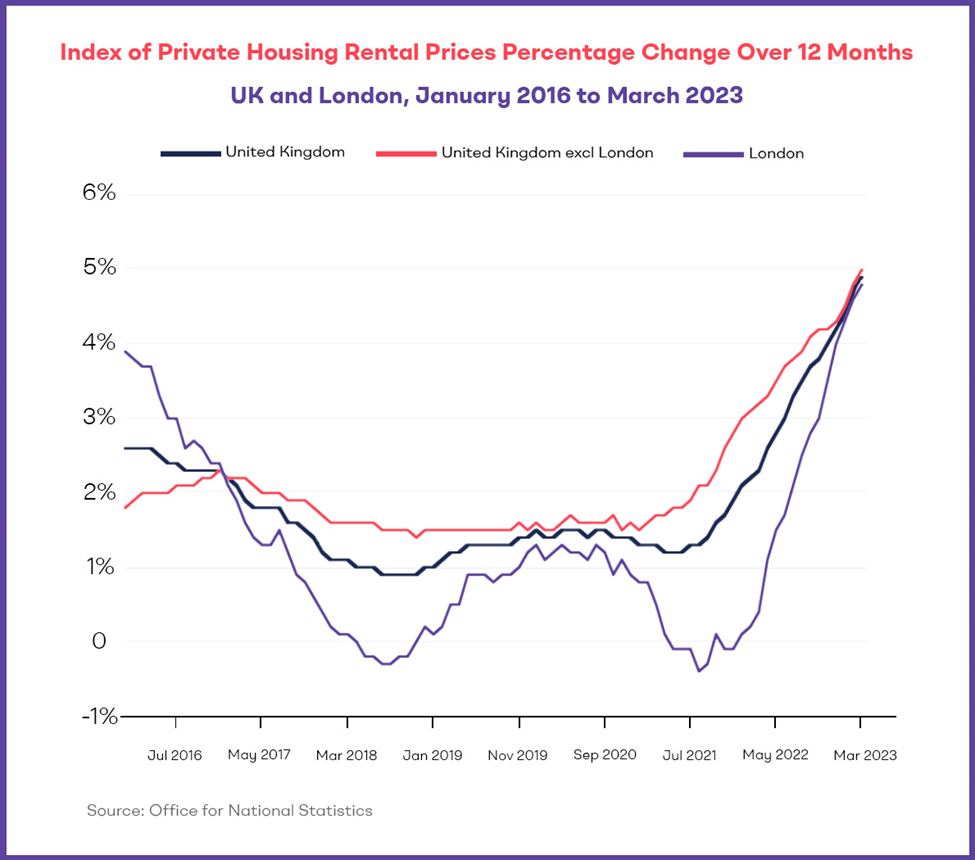

However, despite the challenges facing the growth of property values, rental rates have begun an astounding ascent. Recent government data confirms this, revealing that residential rents surged by an all-time high of 5.3% in the 12 months leading up to July. The sharp increase in rental costs stands in stark contrast to the stagnant expansion in house prices. Rental appeal grows as the affordability of ownership is questioned.

This effect has been especially noticeable in London, where rents saw an extraordinary 5.5% increase in July. This explains why sellers are not in a hurry and we are not seeing deeper cuts in prices unlike the rest of the West. Some states in the USA and Western Europe have seen 20-30% price cuts.

Resilience in the First-Time Buyer Market and Impact on Availability

Yet, amidst these fluctuations, one trend remains resilient – the first-time buyer market. Even with the enormous difficulties brought on by rising interest costs, first-time buyers still find the idea of becoming homeowners intriguing. Encouraged by record-high rentals that have increased by an astonishing 33% since 2019, enquiries from this segment have even managed to beat 2019 levels by 1%. However, the increased trend towards renting has made it harder to find rental homes, adding further pressure to an already tight market.

Housing Trends Redefined: Exploring Bidirectional Currents

Contrary to conventional wisdom, Nikolaos Antonakakis’ research casts doubt on the idea that the UK housing market has a one-way ripple effect. The study, which looked at 13 regions between 1973 and 2014, sheds light on a more complex dynamic in which London not only impacts but also absorbs short-term housing price shocks from different regions.

This dual function highlights London’s position as a major financial hub, and the study’s dynamic framework demonstrates how interconnections become more intense during recessions. Beyond the ripple effect, the study highlights the various dynamics influencing the housing market, serving as a reminder that housing patterns are the result of a complex interaction of factors rather than a straightforward progression.

UK Housing Price Trends

The UK housing market is anticipated to see changes over the next five years (2023–2027), caused by a variety of causes. The latest drop in property values, which is blamed on inflation and higher interest rates, deviates from the steep post-pandemic trajectory. Due to predicted base rate rises and accompanying high mortgage rates, projections point to a slowdown, making it difficult for investors to afford houses.

House price declines of between 5% and 10% are predicted by estate agents including Savills, Knight Frank, and Capital Economics for the year 2023-24. Capital Economics anticipates an 8.5% decline by Q4 2023 compared to the same quarter the previous year. While opinions on the rate of fall vary, consensus develops that by the end of 2024, home values will be 10% lower, negating gains made during the pandemic boosted by SDLT relief.

UK Rental Price Trends Predicted for the Next 5 Years (2023-2027)

The rental market in the UK is changing, especially in big cities like London and Birmingham. The rise of Build-to-Rent (BTR) complexes in London’s housing market is changing renting conventions with managed properties that offer a variety of facilities. While this is going on, Birmingham’s creative strategy involves using forward-thinking rental agencies to rent out entire homes to student groups. Despite these developments, there has been a downturn in the rental market this year, with student occupancy levels around 60% as opposed to the customary 95%, presumably because of changing enrolment trends.

Future rental growth in the UK is anticipated to increase by 3-4% per year between 2023 and 2026, with considerable regional variances. Notably, city centres show a variety of development rates, ranging from a solid 6% in Manchester and London to 1% in Edinburgh and Glasgow. According to Zoopla‘s Rental Market Report, the post-pandemic return of students and young professionals has boosted rental demand, as evidenced by a 46% increase in rental inquiries above the 5-year average. While the supply of rental homes lags, sitting 38% below the 5-year normal. This discrepancy is expected to endure, which suggests that rental demand will remain high through 2023.

Ashish Saraff concludes by saying, ‘The UK property market’s dynamic environment offers an enticing mix of difficulties and possibilities. The contrast between rising rental rates and a background of slowing home price increases perfectly captures the market’s dynamic nature. One thing is very evident as we traverse the complexities of shifting trends, from the anticipated changes in house prices to the changing rental market: the real estate industry is influenced by a variety of factors and is continually changing.

The difficult choices that tenants, buyers, and investors alike must make are highlighted by the delicate interplay between the rental and housing markets. As we look into the future, these insights illuminate the many directions that lie ahead and lead us through a market that is moulded by a variety of forces and complex processes’.

Utopi and Delphi Care Solutions Unite To Drive Sustainability

Press Release – Glasgow, UK, 29 August 2023 – Utopi, the ESG technology specialist, today announces that it has joined forces with Delphi Care Solutions to transform the health and social care sector, enabling it to drive sustainability, reduce energy costs, and improve resident wellbeing.

Bringing together Utopi’s ESG data capabilities and Delphi Care’s unrivalled sector-specific knowledge and predictive analytics potential, the strategic alliance is set to drive sustainable improvements and deliver unparalleled value to organisations operating within the health and social care industry.

The collaboration will provide the industry with an opportunity to tackle the cost of living crisis and reduce energy wastage, providing organisations with improved benchmarking, measurement capabilities, and real-time insights that can help reduce their energy consumption by 20%. Both companies will also address the wider challenges facing the health and social care sector related to talent acquisition and retention, digital transformation, access to funding, and operational efficiency.

Ben Roberts, Co-Founder and Chief Growth Officer at Utopi says, “Our partnership will create a unique synergy, offering the industry a comprehensive solution to improve their operational and sustainability performance.

“By combining Utopi’s comprehensive ESG data collection capabilities with the predictive analytics and financial forecasting features of Delphi’s VISION platform, we aim to create an even more robust and valuable solution for customers. This will enhance the decision-making process for organisations, investors and other stakeholders, providing them with a holistic view of their environmental, social, and financial performance.”

The industry is experiencing an increase in the rollout of off-site inspections and remote monitoring by the Care Quality Commission (CQC), the independent regulator of health and adult social care in England. Delphi Care Solutions has a multidisciplinary team of former-CQC inspectors, commissioners, policy writers, SI investigators and experienced crisis management and turnaround consultants, giving them a deep understanding of the sector’s intricacies and challenges.

The Utopi-Delphi Care joint solution will empower organisations to boost their CQC ratings and achieve net zero goals, allowing them to monitor their ongoing environmental performance in real-time.

“Moving into the health and social care sector has been a natural progression for Utopi, and having the expertise of Delphi alongside us will be a great asset to our expansion. Currently, our ESG platform is in over 22,000 beds across the UK, Ireland and Europe; and we’re thrilled to see it bolster the ESG capabilities of the health and social care sector and help the industry move towards Net Zero,” adds Roberts.

Helen Cooper, Director at Delphi Care Solutions comments, “It is crucial to us to work with organisations whose values align with ours. We felt a strong sense of shared values with Utopi from the very beginning.

“Utopi is committed to reducing the carbon footprint within the sector. This partnership will open exciting possibilities for joint product development and innovation to drive positive change. We are excited to work with Utopi on this ground-breaking project and share Utopi’s state-of-the-art solutions with our existing clients and the wider sector.”

The partnership comes following a £5 million investment that Utopi received earlier this year from the Scottish National Investment Bank to scale up and target new global markets. Utopi is now in a high-growth phase as it looks to expand to the US market, secure strategic partnerships and customers, and grow its team across the UK and abroad.

Delphi Care Solutions provides wrap-around care software and consultancy services. VISION by Delphi software identifies trends, analyses data and predicts regulatory and financial performance, highlighting business-critical risks to care providers in advance of them taking hold. Delphi Taskforce is a multidisciplinary team of expert leaders on hand to improve regulatory performance whilst maximising opportunities to increase provider profitability without compromising the delivery of care. To find out more, please visit https://delphi.care/about-us/

Utopi is the specialist ESG technology platform for multi-tenant real estate. The platform collects data, engages with residents, and reports on how buildings perform to ESG standards, allowing users to act and increase their asset value while reducing the environmental impact of their real estate portfolio. For more information, please visit https://www.utopi.co.uk

PROPTECH-X in association with Estate Agent Networking & NewsNow publications.

Andrew Stanton is the founder and CEO of Proptech-PR, a consultancy for Founders of Proptechs looking to grow and exit, using his influence from decades of industry experience. Separately he is a consultant to some of the biggest names in global real estate, advising on sales and acquisitions, market positioning, and operations. He is also the founder and editor of Proptech-X Proptech & Property News, where his insights, connections and detailed analysis and commentary on proptech and real estate are second to none.