Bricks&Logic on how Covid-19, Help to buy, and Grenfell Tower impacted on house and flats values.

Michael Joyner, Chief Data Scientist at Bricks&Logic examines how four-key events affected the UK housing market. Showing how schemes like ‘Help to Buy’ and crises like COVID-19 and the Grenfell Tower disaster impacted on houses and flats.

Michael Joyner, ‘At Bricks&Logic, we frequently emphasise that the geographical proximity of two properties doesn’t necessarily equate to identical market performances. The type of property greatly influences its performance. A recent report by the Financial Times vividly illustrated this point, examining the aftermath of the Grenfell Tower disaster and how flats struggled compared to houses.

In light of this, we sought to delve deeper into the matter, conducting a comprehensive analysis of the market behaviour of houses and flats following four significant events: 1- The introduction of the ‘Help to Buy’ scheme in 2012. 2 – The Grenfell Tower disaster in 2017. 3 – The onset of COVID-19 in early 2020. 4 – Rising Interest Rates towards the end of 2022 and into 2023.

The Financial Times article observed that, “London house prices have ascended by 17 per cent since 2017, while flat prices in the capital have declined by 1 per cent over the same duration.” However, it’s worth noting that this comparison doesn’t take into account the typical central city location of flats relative to houses. Hence, the comparison may not be as straightforward or as ‘apples-to-apples’ as it first appears.

The Introduction of Help to Buy

The UK’s ‘Help to Buy’ scheme, introduced in 2012, aimed to help first-time buyers and those struggling to purchase property. It comprised three key parts:

Equity Loan: The government provided an interest-free loan for five years, covering up to 20% (or 40% in London) of a newly built home’s cost. Buyers needed a 5% deposit and a 75% mortgage. Shared Ownership: Buyers could purchase a portion (25-75%) of their home and pay rent on the rest. Over time, they could acquire larger shares. Mortgage Guarantee: This part, active until December 2016, promoted lenders to offer 95% mortgages by providing a government-backed guarantee for a part of the mortgage.

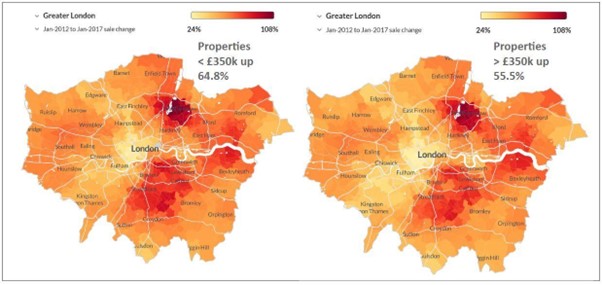

Typically, the scheme was used by buyers to purchase more affordable housing options, such as newly built lower value flats and houses. What we saw over the next 5 years was a tendency for lower value properties to close the gap on their more expensive neighbours. Below shows how cheaper vs more expensive homes moved in London over this period. With properties worth less than £350k increasing on average by almost 10% more than their more expensive counterparts.

comparison of performance of cheaper and more expensive homes across London after the “help to buy” scheme was introduced

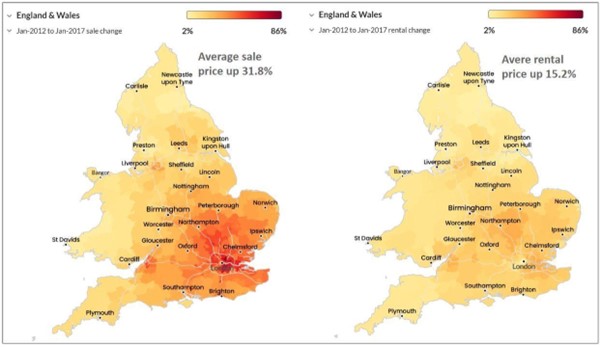

Another impact during this time was the rise of the buy to let landlord. With Interest rates at an all-time low, investors were looking for new ways to generate yield on their cash. As more buy-to-let landlords entered the market and existing ones added to their portfolios we saw a huge divergence between rental and sale prices, with average sale prices increasing over 15% more than rental prices during the same period.

Comparison of sale vs rental prices between 2012 and 2017

Grenfell Tower Disaster

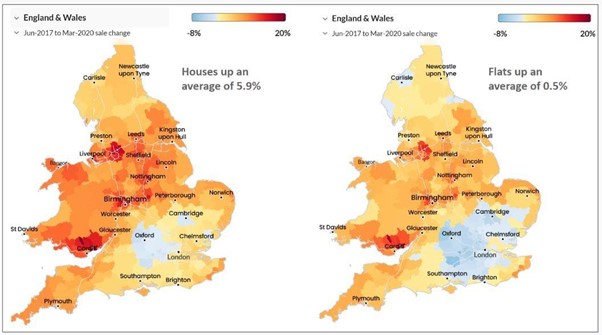

The Grenfell Tower disaster was a tragic fire that occurred in London, on June 14, 2017. Grenfell Tower, a 24-story residential building located in North Kensington, became engulfed in flames, resulting in a significant loss of life and property. The aftermath of the tragedy prompted widespread criticism of building regulations particularly relating to the use of flammable cladding. As the article for the FT notes we saw a divergence of approximately 5% between Flats and Houses over the next 3 years.

Comparison of Houses vs Flats sale price performance between 2017 and 2020

Covid Pandemic – the race for space

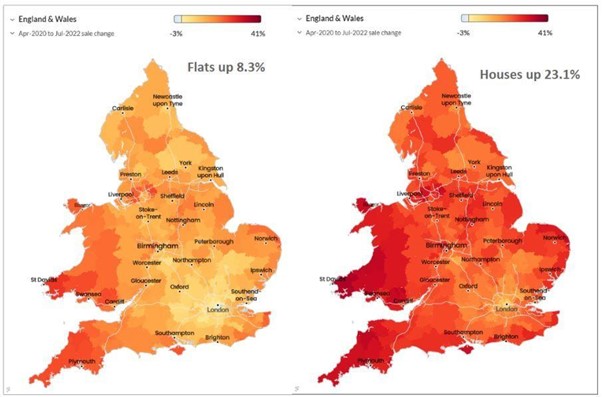

Between April 2020 and July 2022 the average home price surging by nearly 20%. This growth was fuelled by a number of factors including: Continued record low interest rates making mortgages very affordable. Increased savings as people unable to spend during lockdowns. Stamp duty holiday. Change in working dynamics with an increase in working from home causing a “race for space.”

These dynamics led to houses far out performing flats during this period.

Comparison of Houses vs Flats sale price performance between 2020 and 2022

A world of high interest rates

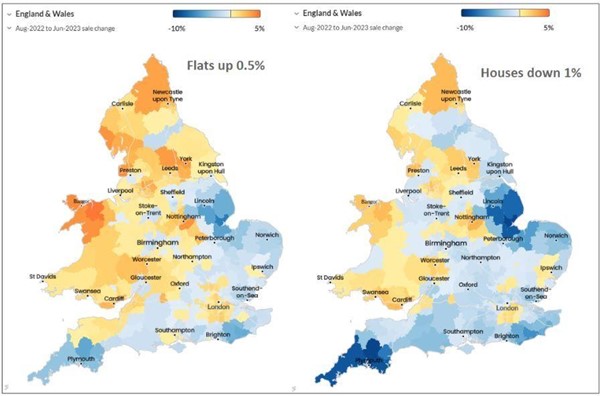

In the latter half of 2022 and into 2023, the housing market experienced a notable reversal of fortunes. This shift was primarily driven by rising interest rates, influenced by global events like the war in Ukraine and the consequences of Brexit, in addition to domestic monetary policies. The housing market, which had been booming post-Covid, cooled down as a result. Unlike the past decade of historically low interest rates, mortgage holders now faced significant impacts on their bills due to the recent uptick. This impact was particularly pronounced for homeowners of houses, which typically command much higher prices than flats. As a consequence, potential buyers became more cautious, leading to a more restrained market as individuals meticulously assessed their financial commitments. Since August 2022, flats have still seen modest growth, while houses experienced a slight drop in prices.

Comparison of Houses vs Flats sale price performance between Oct 2022 and Jun 2023

Conclusion

The Bricks&Logic analysis of the UK housing market over the last decade has revealed divergences between houses and flats. The ‘Help to Buy’ scheme in 2012 led to a trend of lower-value properties narrowing the gap on more expensive ones. The Grenfell Tower disaster in 2017 caused a 5% divergence between flats and houses. The COVID-19 pandemic sparked a race for space, surging house prices by over 20% from April 2020 to July 2022, while flats lagged behind.

However, in late 2022 and 2023, rising interest rates cooled the market, with houses being more significantly affected than flats. Consideration of property types is crucial for analysing market performances, as proximity alone does not dictate their trajectories. If you would like to find out more the services that Bricks&Logic provide then please contact us here LINK.

Neil Sinclair appointed Chair of leading Norwegian Proptech Unloc – ‘the future is keyless’

Press Release – 19/09/2023

Property industry heavyweight, Neil Sinclair, who co-founded Palace Capital plc in July 2010 and was CEO until June 2022, has been appointed Chairman of Unloc AS, a Norwegian PropTech company.

Unloc, founded six years ago in Oslo, has developed software that enables building owners and tenants to no longer have the necessity for physical keys, making the locking process completely digital.

Unloc now represents Scandinavia’s largest network of keyless solutions, opening doors one million times every month. Thanks to the unique platform and software, their customers, who include both the largest property manager and the largest housing developer in Scandinavia, can open doors faster and more sustainable due to no longer having to rely on physical keys.

Neil is assisting Unloc in approaching and meeting UK based property owners and managers to convince them that “The Future is Keyless.” Newly appointed Chairman Neil Sinclair commented: “I’m really excited to help Unloc break into the UK market as they are a pioneering company in the proptech sector and the potential for their growth is enormous.”

The company was founded by Kris Riise and is now hoping to break into the UK market, as part of a vision to open doors – for everyone, everywhere. Kris Riise commented: “Neil has been a huge contributor to the UK real estate market, and we are thrilled to have his experience and expertise heading up our board and helping our current and new UK customers get rid of keys.”

Neil Sinclair is a 60-year property industry veteran and whilst running Palace Capital was a non-executive director at Chestertons and until recently was a Trustee of Variety the Children’s Charity.

PROPTECH-X in association with Estate Agent Networking & NewsNow publications.

Andrew Stanton is the founder and CEO of Proptech-PR, a consultancy for Founders of Proptechs looking to grow and exit, using his influence from decades of industry experience. Separately he is a consultant to some of the biggest names in global real estate, advising on sales and acquisitions, market positioning, and operations. He is also the founder and editor of Proptech-X Proptech & Property News, where his insights, connections and detailed analysis and commentary on proptech and real estate are second to none.