UK Housing Policy General Election Hot Topic

Housing policy in the UK, does not exist, rhetoric around what it should be abounds. In the last seven days I have seen Lisa Nandy Shadow Leveller Up for housing flounder on television unable to articulate what Labour’s housing plan would be.

This was compounded by Shabana Mahmood’s inability to explain to Kuenssberg, how Labour’s housing programme would work. Given she is the National Campaign Co-ordinator of United Kingdom Shadow Cabinet she looked very much like a bunny in the headlights last Sunday.

On the flipside, Multi-millionaire Rishi Sunak, a man of the people, maybe his own people, whilst Chancellor of the Exchequer super charged the market with his SDLT giveaway, catapulting prices and demand through the roof. Now as PM he is seeing the inevitable dropping of sale prices and the cost of mortgages rocketing, with another Bank of England rate rise due in a few weeks.

Gove the great leveller has also done zero to sort out housing, at a local level planning is moribund, with a skeleton staff Nationally dealing slowly with applications.

If and there is no certainty Labour are elected, with a majority, I feel that their naïve approach to the dealing with the super complex ecosystem of housing, where renters need landlords, with 4.5M tenancies in the PRS. Where national home builders need to make profit or they do no build, and where if interest rates peak at 5.25% by the autumn, meaning a fixed rate will be 7.5%, this is a huge leap from the 1.2% fixed rates enjoyed by first time buyers 23 months ago.

In my life I have been a tenant, landlord home owner and sold around 18,000 properties through various markets over a three decade span. I have seen the folly of the Late Nigel Dawson another Chancellor supercharging the housing market of 1988, with 2M completions in a year. Then a 38% drop in values and an atomic winter for four years when the market flatlined.

I have seen Margaret Thatcher and her great idea, sell off the council housing at discounted rates to tenants, robbing the UK of housing stock for generations.

Now I stare into another housing policy abyss, with the threat of a housing plan that undermines the usual laissez faire nature of the housing market. It looks an awful lot a mixture of Xenophobia, pandering to the younger voters, the first time buyers, and smashing the hell out of landlords, who are leaving the industry in droves, pushing up rents as scarcity ensues.

The neatest description of some of Labour’s deep thinking on housing were reported by Toby Helm in the Guardian a few days ago,

‘Labour will announce concrete plans to restore targets for housebuilding that were scrapped recently by the Tories, and pledges to hand more power to local authorities, so that 300,000 new houses can be built every year.

Starmer says first-time buyers will be given priority on any new houses built in their areas, and that overseas buyers would be prevented from purchasing them.

He wants Labour to become the party of homeowners. “The dream of home ownership has been killed by the prime minister because he has taken those targets away. I want Labour to be the party of home ownership.”

In response no doubt the Conservatives will dream up a replacement of the middle class Help to Buy band wagon which gave free cash typically 20% of the purchase price to New Home buyers.

My thoughts are this, depending on where you live and how you pay to live there, shapes your world view. If you are a tenant facing rising rents, or a buyer facing a 37% rise in your mortgage payments in the last year, you are in the thick of it.

If you are mortgage free, and equity rich, you sit in a different position, if you are a private landlord, you may have a portfolio where you are re-mortgaging your buy to lets at over 7%, again market forces rents will need to rise to cover this, or you exit the market.

If you live in China and want to buy in the capital, and the government of the day raises SDLT again or even imposes a quota system, this will impact on London housing ecosystem. Will UK residents then not be allowed to buy second homes in other countries.

Labour is talking a lot about rent caps, this worries me more than anything, a landlord private or a corporate, borrowers cash to acquire housing stock to rent out, if the rents are set but the Russian war, CALC, inflation etc means the cost of borrowing rises, you go out of business as the artificially low set rents do not cover the cost of the operations. This leads to rental stock being sold, which leads to higher rents.

What next for Proptech Lettings Player Goodlord?

Recently the second co-founder of Goodlord, Thomas Munday left the company Goodlord, the other co-founder Richard White having stepped down in that role six years ago. So now we have a company without its two co-founders, which makes me wonder what is going on.

For those unfamiliar with what they do, according to their website ‘Goodlord is a cloud-based platform trusted by hundreds of estate agencies across the UK. We make renting easy through automated digital transactions, cutting agency time and spend by 50-75%. This enables agencies to focus on growing their business and providing a better service.

Goodlord creates a bespoke one-stop-shop by providing access to a dynamic suite of specialised services, including insurance, e-signing, referencing, e-payments, and more. (Working with) Ambitious, dynamic agencies who aspire to offer a better, fairer service to landlords and tenants.’

It also has for a Proptech company a huge amount of humans on its payroll, having a wage bill of around £10M in 2021, according to its annual accounts, its 2022 accounts are presently overdue so we have no up to date intel. What we do know is that it had burnt through £28M, and has raised £58M in a series of funding rounds.

The big question, and it is being asked by all investors who have been supporting or are supporting big Proptech beasts is, will we ever see an increasing profit profile or an exit for this company that we have supported.

Since the failure of Silicon Valley Bank, which ironically failed not because it supported a large swathe of tech companies, all the money men are now rightly laser focused on seeing a return.

This being the case how can Goodlord move forward without its Founders?

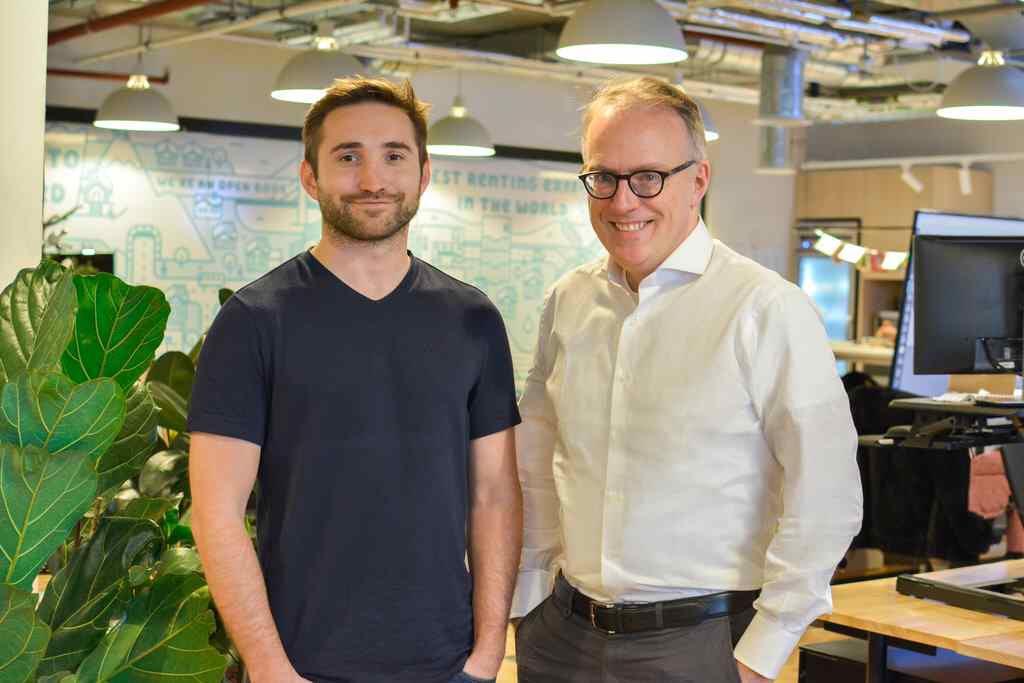

It has William Reeve as CEO, pictured right, (Tom Munday left) an exceptional talent with a reputation of getting businesses to exit.

But key is to be profitable or have the flight path to be profitable in the near term, is Goodlord such a company? No doubt in the coming months we will see what happens.

What is certain is that with a diminishing pool of investors unwilling to ‘go again’ for SME’s in the Proptech sector as a whole, who they have until now backed to the hilt, I am seeing in my day job a large line of vulnerable Proptechs here in the UK and globally pondering their futures with a greatly reduced line of funding. Together with significantly trimmed market capitalisations.

Proptech and Property News in association with Estate Agent Networking.

Andrew Stanton is the founder and CEO of Proptech-PR, a consultancy for Founders of Proptechs looking to grow and exit, using his influence from decades of industry experience. Separately he is a consultant to some of the biggest names in global real estate, advising on sales and acquisitions, market positioning, and operations. He is also the founder and editor of Proptech-X Proptech & Property News, where his insights, connections and detailed analysis and commentary on proptech and real estate are second to none.