Valuing New Build Property and Understanding the New Build Premium

Michael Joyner, Chief Data Scientist at Bricks & Logic a client of Proptech-PR, discusses how to accurately value residential properties and assess the new build premium. Focusing on challenges related to data scarcity and unique developments

‘As the real estate landscape continues to evolve, understanding the dynamics of property values is becoming increasingly crucial. One area of particular interest lies in the relationship between existing housing stock and newly constructed properties—the phenomenon known as “the new build premium.” In today’s market, where the rise of build-to-rent developments has garnered significant attention, accurately assessing this premium has become more pronounced than ever.

While performing this analysis with abundant direct comparable sales and rental data points for planned developments may be relatively straightforward, it poses a challenge when “creating the market.” This situation arises when your development is the first of its kind in the immediate vicinity or when the last development was built several years ago. In this article, we will explore various types of analysis that can assist in addressing this issue and how Bricks&Logic can provide valuable assistance in accurately assessing even the most data-sparse development opportunities.

Enhancing the Data

Where data is sparse, we need to make the best possible use of it by applying techniques that enrich and make it more relevant to our analysis. This involves updating older data points and finding robust and justifiable methods to equate properties with different characteristics to those we are comparing them against.

Making Data Current

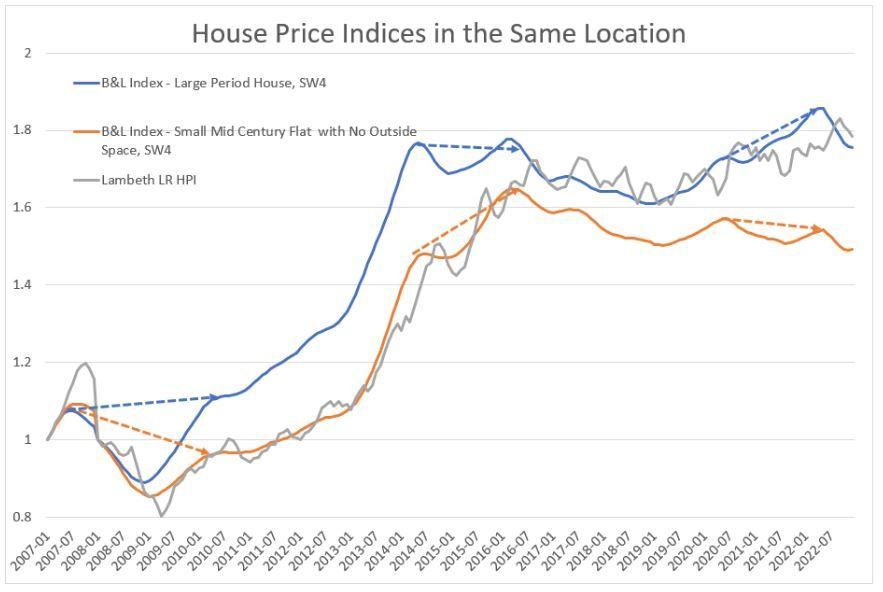

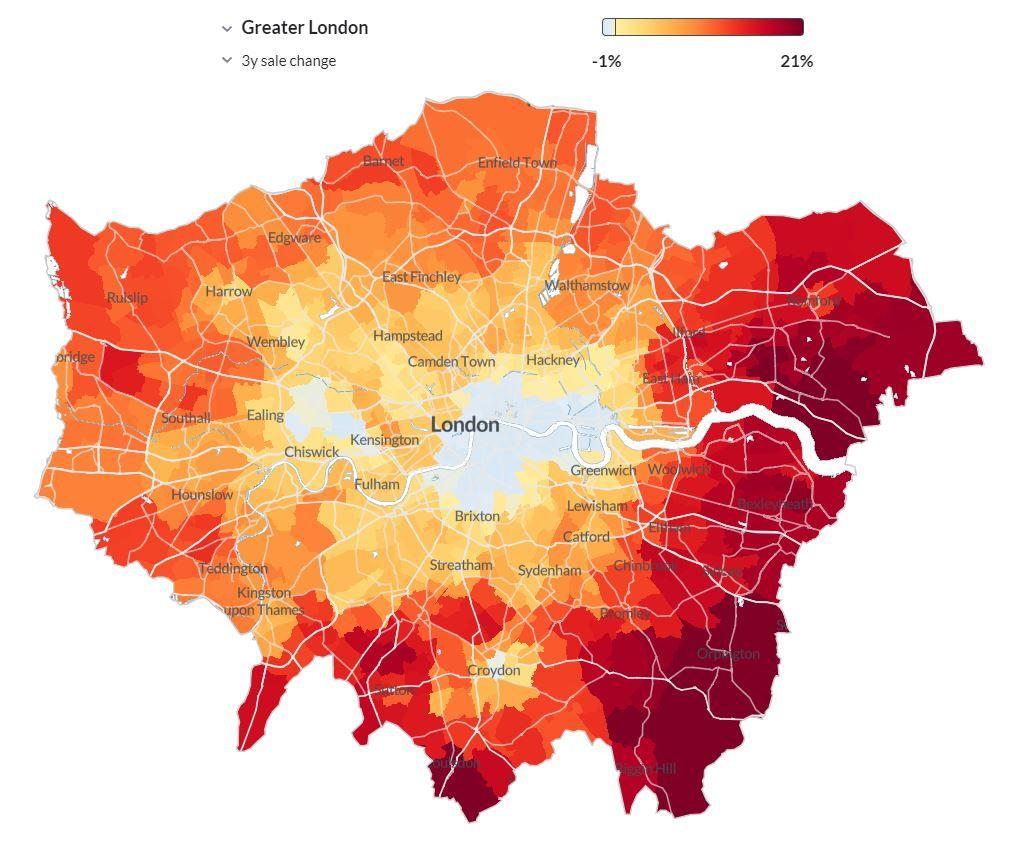

Using simple house price indexes for regions can be very risky. The UK market is not just a few regional markets but thousands of small ones that not only vary by hyper local locations but also property types. Coming out of the last financial crash we saw expensive prime properties perform much better than their neighbours.

Between 2012 and 2017 we saw this trend completely reverse as money was cheap for landlords to invest in buy-to-lets and the help to buy scheme provided support to those smaller properties targeted by first time buyers. Finally, following Covid we saw the ‘race for space‘ and those larger properties with outside space perform far better than their smaller internal only counterparts.

To understand all these effects Bricks&Logic have created a property level index that takes into account the attributes as well as location of a property to give an accurate picture of its house value performance over time that is unique to itself. Below shows an example of how two properties only a few hundred metres apart can act very differently. We also show how one region can have a huge disparity in house price performance. To understand more about how we do this please read our article on the Bricks&Logic property level index.

Understanding How Size Affects Price

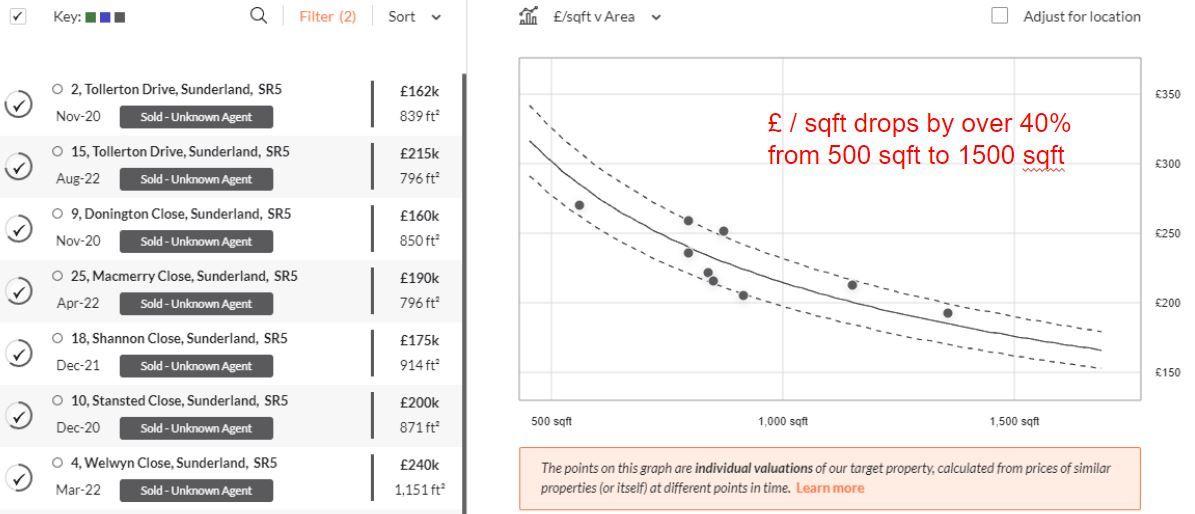

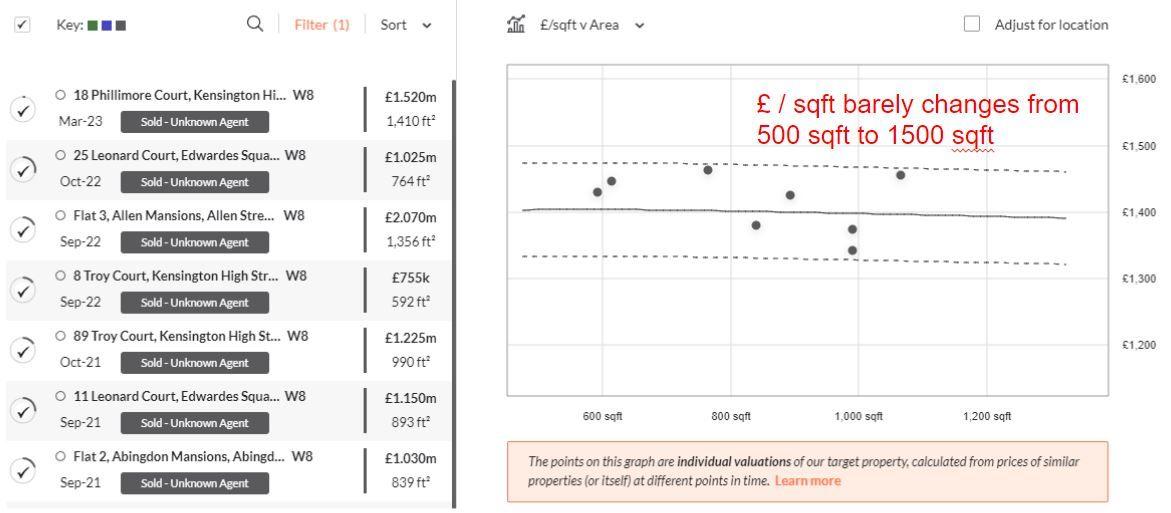

Aside from location the size of a property is the next most significant factor determining its value. A common measure used to help determine the value of a property compared to a neighbouring one is the £/sq ft. However this can be an overly simplistic measure. The rate of £/sqft for a property can vary depending on its size, with larger properties typically commanding a lower rate.

But, the rate of £/sqft can also vary depending on the area in which the property is located. In cheaper areas, the rate of £/sqft tends to decrease at a faster rate as the property size increases. In contrast, in more expensive areas, the rate of £/sqft tends to decrease at a slower rate as the property size increases. This means that larger properties in more expensive areas are likely to have a higher value per square foot than larger properties in cheaper areas. See the below examples of just how different the rate at which £/sq ft changes depending on the value of the property.

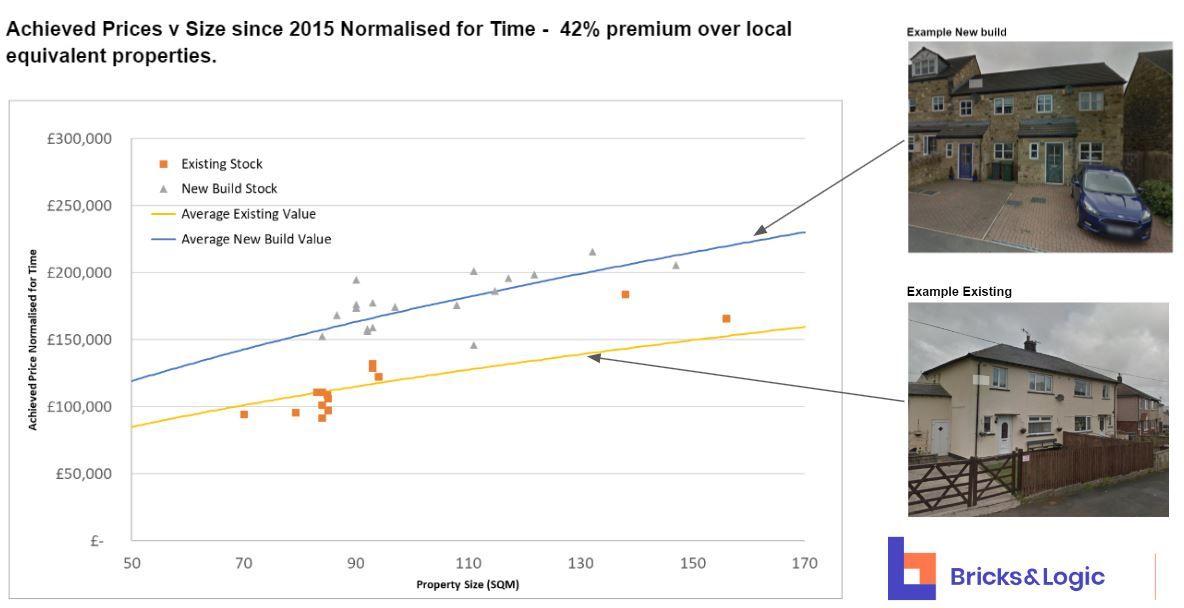

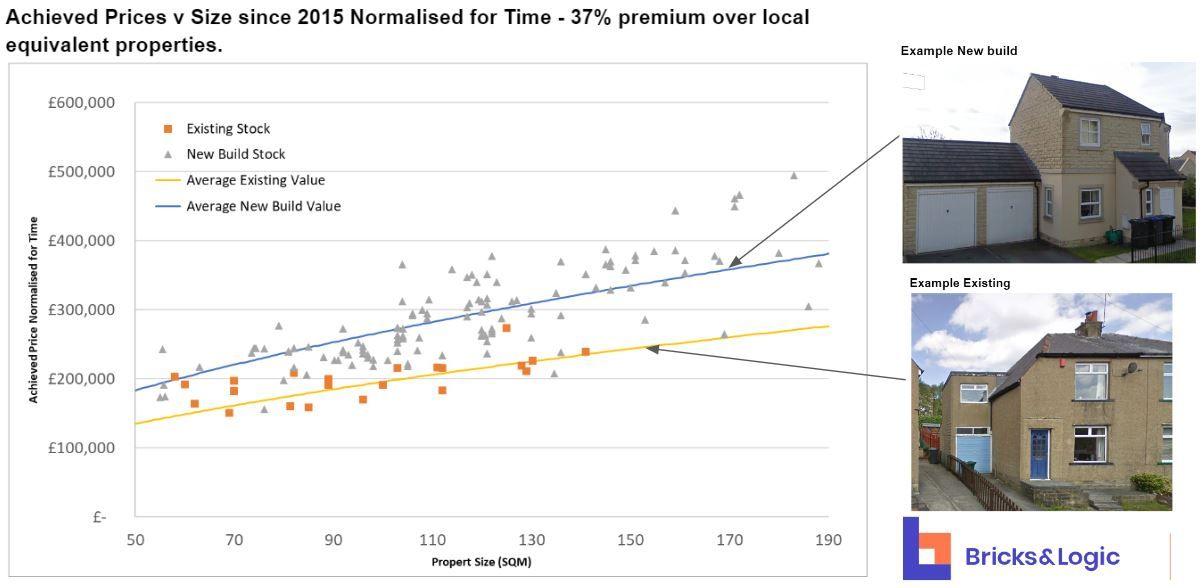

New Build Premium how to calculate it

By having a property specific understanding of how prices have moved over time and how the average £/sq ft changes depending on the location and value of a property we can equate the equivalent achieved price today of a set of existing properties relative to new build ones. By analysing the new build premium achieved by developments in the area we can then apply this to the specific existing properties in a given location to get an accurate estimate of expected new build value even without equivalent new build comparables.

Using the Bricks&Logic Yield Model

At Bricks&Logic we have created a highly accurate yield model that takes into account the location, type, size and value of a property to give an indication of the expected rental value a property can achieve. This means that even without comparable new build rents in the area you can get a good understanding of the expected value that is backed by a comprehensive models that see use the yields of surrounding areas for similar property types. By combining this with the new build premium analysis, with just a few clicks of a button a full value and expected income of a new development can be calculated.

Conclusion

Accurately assessing the new build premium and valuing residential properties requires a nuanced approach that goes beyond simplistic metrics like £/sqft. When dealing with data-sparse situations or creating markets for unique developments, it becomes essential to enhance and enrich the available data. Bricks&Logic’s data analytics solutions offer enhanced insights by making data current, considering property attributes, and analysing market dynamics. By combining this data and analytics together, Bricks&Logic enables accurate estimations of new build value and expected rental income’.

We are in the process of building out specific tools that will help developers move beyond just simple comparables when providing evidence for investment decisions. If you would like to find out more or about any of the other services that we provide then please contact us at contact@bricksandlogic.com

Author: Michael Joyner, Chief Data Scientist, Bricks&Logic

Sign up for free to access our full analysis including property characteristics and sale and rental estimates for over 27 million England & Wales properties.Start now

Did Rishi Sunak make a fatal error in SDLT taxation policy causing a potential housing crash.

Whilst Chancellor for the Exchequer did Rishi Sunak make a fatal error in SDLT taxation policy causing a potential housing crash. With Brexit, Covid, Boris, and three PM’s in the space of a few months, it has been hard to see what has been thought out government policy, and what is just reactionary legislation to act as a sticking plaster. But as we suffer our thirteenth and probably not our last Bank of England rate rise, it is time to ask who is to blame.

For my money, the incumbent PM Rishi Sunak, whilst in his previous role as Chancellor of the Exchequer is guilty as charged, not only has he allowed about £26BN of tax payers money to go walkabout to criminals who abused Covid funding. Rishi stoked the fires of hyper-house-inflation with typically a 20% rise in house value in 24-months.

Now we as a nation are dealing with the fallout of this scandalous ill thought out SDLT giveaway, that has meant for many their mortgage repayments are set to increase by 50% just a the time the CALC still rages. Fiscal competency should be the compass of any Chancellor, this one just went with a populist cure all that was always going to funnel activity and inflate prices.

Proptech and Property News in association with Estate Agent Networking.

Andrew Stanton is the founder and CEO of Proptech-PR, a consultancy for Founders of Proptechs looking to grow and exit, using his influence from decades of industry experience. Separately he is a consultant to some of the biggest names in global real estate, advising on sales and acquisitions, market positioning, and operations. He is also the founder and editor of Proptech-X Proptech & Property News, where his insights, connections and detailed analysis and commentary on proptech and real estate are second to none.