Bricks & Logic – winners and losers in property since economic turmoil of Sept 2022?

Michael Joyner, Chief Data Scientist at Bricks&Logic has all the answers to what the housing market has been up to since the election of Liz Truss back in September 2022.

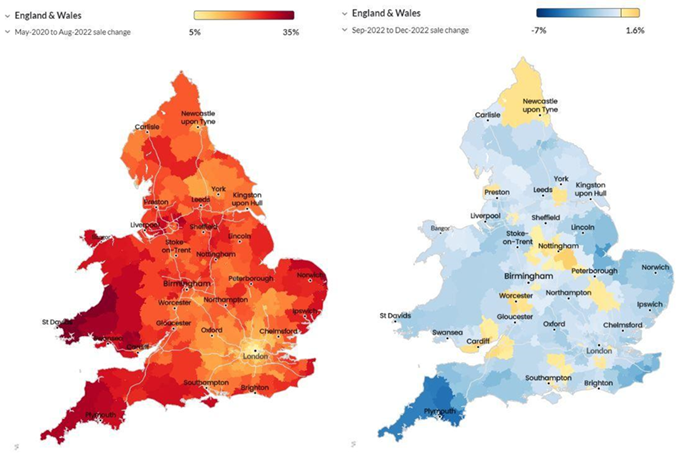

Michael Joyner, ”Prior to the summer of 2022, the UK had enjoyed a robust housing market, with the average home price surging by nearly 20% between May 2020 and August 2022. This growth was fuelled by a number of factors including: Continued record low interest rates making mortgages very affordable, Increased savings as people unable to spend during lockdowns, Stamp duty holiday, Change in working dynamics with an increase in working from home causing a “race for space”

‘On September 23, 2022, the then-Chancellor of the Exchequer, Kwasi Kwarteng, announced a mini budget designed to address the UK’s cost of living crisis. This package included numerous tax cuts and spending increases. Unfortunately, the global markets reacted negatively to the surplus borrowing needed to execute these measures, leading to a rise in the UK’s borrowing costs. This sparked a chain reaction and as mortgage lenders align their interest rates closely to the Treasury bond rates, a steep increase in the average residential mortgage cost followed.

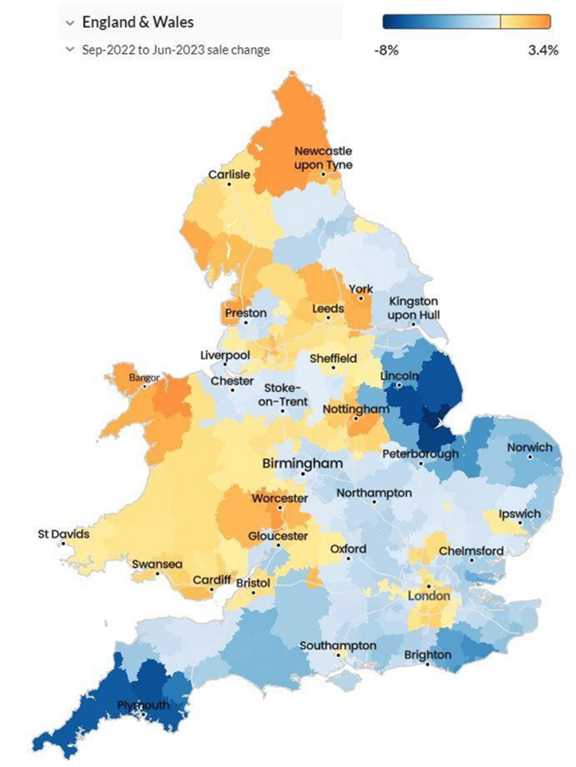

During this period, numerous media outlets predicted a house price crash. In this article, we aim to assess the market’s movements since this event, delving into the performance of various property types and locations to identify those that have fared the best and the worst’.

The immediate aftermath – rural properties retreat

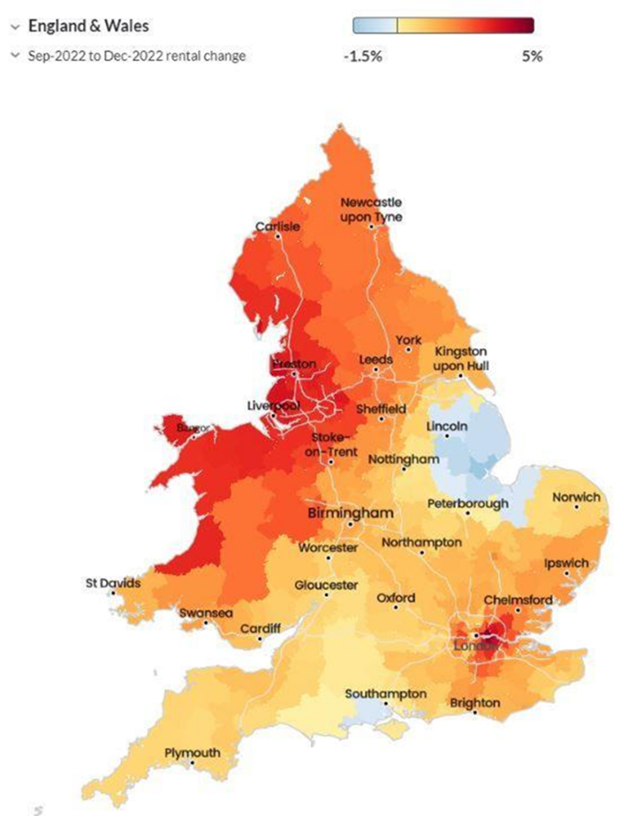

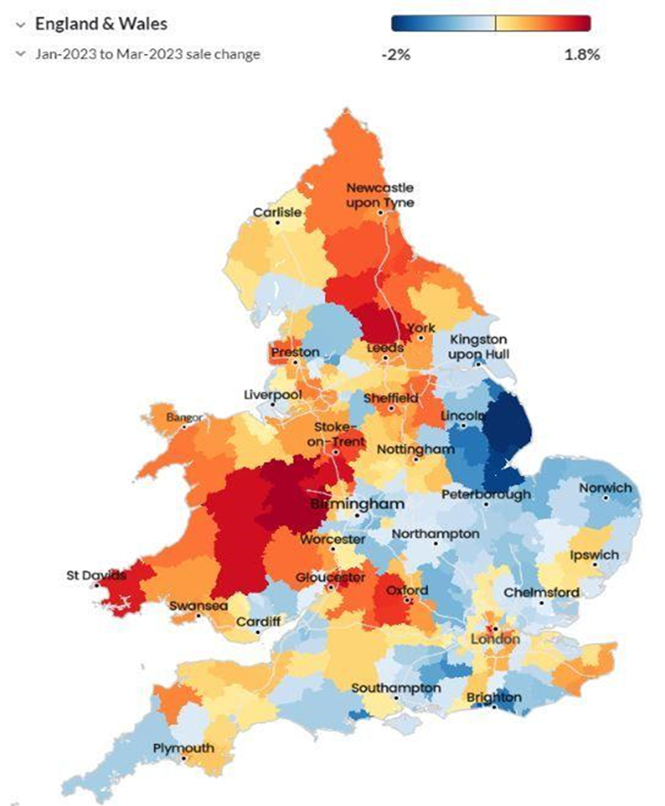

‘The two years after covid saw an incredibly strong housing market, with those coastal areas in the South of England and Wales performing particularly well. For the final quarter of 2022 it was these areas that saw the biggest reversals in their house price performance with Cornwall and Devon performing particularly poorly seeing prices drop by almost 7% over these three months. Conversely to this it was the metropolitan centres that actually remained relatively robust as perhaps more people were returning to the office and demand for rental properties was still surging over the same period’.

Map of house price changes after covid until the mini budget, then in the following three months

Map of house price changes after covid until the mini budget, then in the following three months

Map of rental price changes in the three months after the mini budget

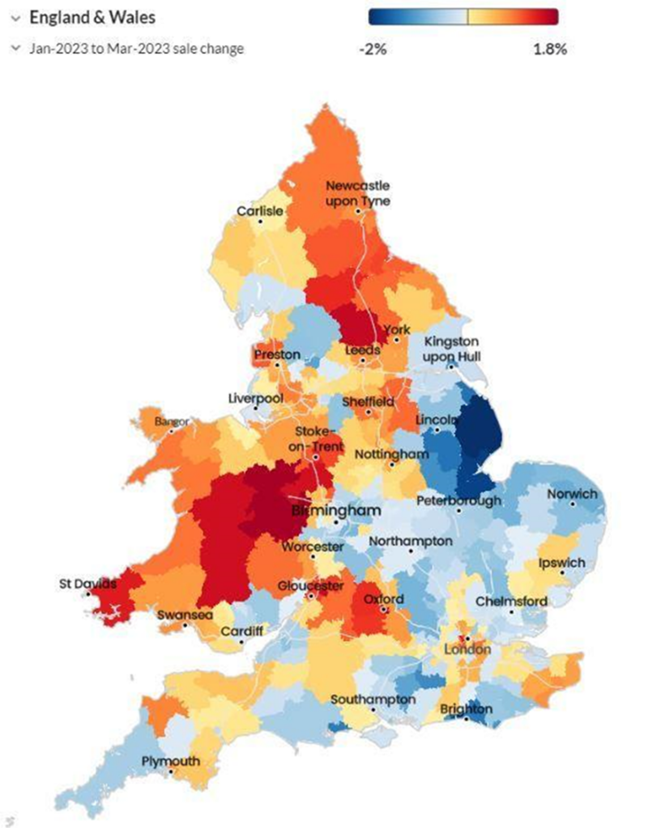

Early 2023 – the market stabilises

‘Following the economic turmoil ignited by the mini budget, Liz Truss dismissed Kwasi Kwarteng and subsequently resigned herself. Rishi Sunak was elected by the Conservative membership to lead the party, and therefore ascended to the role of Prime Minister. He then appointed Jeremy Hunt as Chancellor. Almost immediately, the new leadership overturned the majority of the policies introduced in the mini budget with a clear aim to restore market confidence.

This strategy seemed to achieve its intended effect, lowering the cost of borrowing for the UK and thereby stabilising property prices on the whole. However, a subtle regional disparity began to surface: properties in the North saw modest increases, outpacing those in the South, which continued to depreciate, albeit at a slower pace’.

UK cost of borrowing between August 2022 and March 2023

Map of house price changes during Q1 2023

April – July 2023: rising Interest Rates Fail to Shake Stable House Prices

Michael Joyner also feels that, ‘Over the past three months, inflation has remained persistently high, prompting the Bank of England to increase interest rates as a measure to address the issue. Despite these efforts, there are no signs of the earlier-year recovery reversing, as house prices continue to exhibit resilience. A recent article by the BBC highlights how banks are employing proactive measures, leveraging machine learning to anticipate potential mortgage defaults and offer assistance whenever feasible. With homeowners cutting back on non-essential expenses to accommodate higher mortgage costs, the number of defaults (which typically trigger market crashes) is being kept to a minimum’.

UK cost of borrowing in Q2 2023

Map of house price changes during Q2 2023

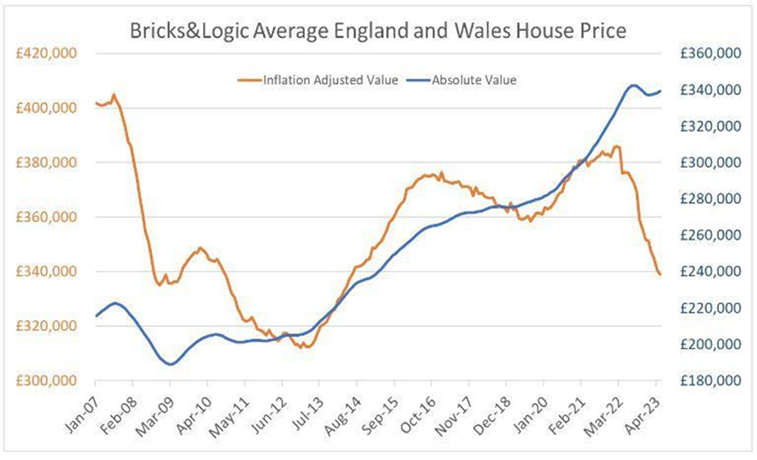

Inflation adjusted house price growth

‘We know inflation has fuelled the bank of England to raise interest rates, which in turn has seen some small house price decreases but not caused the “crash” as some have expected. It is worth noting that we have been talking about house prices in absolute terms. If we adjust prices for inflation (ONS Retail Price Index) prices have dropped by around 10% in the last twelve months’.

Inflation adjusted house prices between Jan 2007 and May 2023

Small trends big changes

Summing it all up, Michael Joyner states that, ‘The aftermath of the COVID-19 pandemic brought significant shifts in the housing market, particularly in relation to the performance of different property types and locations. Following the initial impact of the pandemic, the housing market experienced a strong recovery, with coastal areas in the South of England and Wales emerging as particularly desirable locations for homebuyers. These regions saw substantial increases in house prices during this period.

However, as the mini budget measures were implemented in September 2022, a reversal in market dynamics occurred. The introduction of tax cuts and increased government spending led to concerns among global markets, resulting in higher borrowing costs for the UK. This had an immediate effect on the housing market, causing a retreat in prices, particularly those areas that had seen the strongest growth over the last couple of years.

Fortunately for homeowners this retreat appeared to be short lived as interventions by the government and the use of technology in banks appeared to have boosted confidence in bolstering the housing market.However, it’s important to consider the impact of inflation when assessing the true value of housing. When adjusting prices for inflation, it becomes apparent that house prices the picture of stability is not quite as clear as first thought.

The dynamics of the housing market are complex and multifaceted, influenced by a range of economic, social, and political factors. Understanding the performance of different property types and locations provides valuable insights into the broader trends shaping the housing market.

To find more about the suite of services that Bricks&Logic provides for all types of property practitioners, please message us at contact@bricksandlogic.com

Inventorybase asks why are there so many empty homes in the UK and what should be done about it?

The following article was previously published by Inventorybase Founders Steve Rad and James Taylor, it is no industry secret that a well as being our longest serving client in my day job at Proptech-PR, we fully support this company as it has a great management team including folk like Operations Director Siȃn Hemming Metcalfe, all of whom have huge hearts and really care not just about their clients, but about people who often live in properties that are not fit for purpose or who can not even get a roof over their head.

This high connectivity to ‘what needs sorting’ out is why Steve and James have over the years designed a suite of services that really is powering a different way to look after people and the property asset they live, if you get time it is well worth catching up with them both, just click on this link, but until then here is what they are thinking about right now.

The UK’s empty homes in numbers

‘As has been highlighted by researchers, the number of empty lets in England is astonishing. Almost a quarter of a million properties lie vacant across the United Kingdom. And whilst representing a loss of revenue for PRS landlords, empty properties won’t generate rental income. After all, there’s an urgent need to house families and people who find themselves in need of habitable accommodation.

The aforementioned figure of 248,633 vacant properties could contribute significantly towards housing the homeless population (271,000 people) in England when you consider that multiple family members would live within one home.

Why are there so many empty properties?

According to RICS, the volume of empty properties in the UK can be partially explained by factors such as probate, inheritance and elderly owners moving into residential care. Considered normal market processes, this is to be expected. However, RICS notes other causes of vacant properties in England that can be seen when examining the three types of long-term empty lettings.

Highlighting the analysis undertaken by the charity Empty Homes (EH) in 2018, the first point to make note of is that 37 out of 53 English local authorities where 1.2% of properties were classed as (long-term) empty properties, are located in the north of the country. This points to a geographical divide when it comes to uninhabited private rented sector housing, possibly widened by the cost of living crisis.

Secondly, Empty Homes state that it has seen a link between communities with “high levels of empty homes and where industrial decline over recent decades has caused substantial job losses”. Whilst housing is still sorely needed in these areas, there is a disparity between what people can afford and the rental market prices.

Finally, there is a willingness among people to relocate across England in order to find good-quality affordable housing, even if that housing is in low-demand areas. This points to a national housing crisis where the supply of habitable homes is causing a lettings crisis despite properties already existing.

Therefore, every property is an asset that could be put to better use than standing empty, with any sound initiatives having the potential to modernise the private rented sector for the twenty-first century.

Another reason that Inventory Base has previously covered is the departure of swathes of private landlords from the PRS, due in part to legislation that some landlords might view as restrictive. Before their properties are sold, they could sit vacant on the market for more than six months, therefore, qualifying as empty properties.

Discover more on this subject by reading our articles Why UK landlords are quitting the private rented sector and Renters’ Reform Bill: What You Need to Know. Returning vacant lettings to be inhabited is a vital strategy to offset this loss of rental stock in the private rented sector.

What are the reactions to 250,000 empty properties?

Clearly, this situation is far from sustainable moving forward, especially given the cost of living crisis and rising mortgage interest rates. People require homes whilst landlords, and lettings agents, in turn, need tenant income to continue operating.

To rectify this situation, Propertymark has written to the Secretary of State for Levelling Up, Housing and Communities, to ask the Government to restart the Empty Homes Community Grant Programme. Ending in 2015, an applicants’ guide from January 2012 stated that this scheme allocated funding to tackle long-term empty properties, which would otherwise not find their way back into use without some form of financial intervention.

One part of the UK Government’s strategy to tackle empty lettings and address housing issues was the allocation of £100m for the 2011-2015 Affordable Homes Programme. It sought to deliver 3,300 affordable homes across this four-year period. Yet, this financial assistance has not been extended.

Driving Propertymark to take action, it has requested that PRS supply issues are reduced to ensure that avenues become available for people and local authorities to buy, lease or refurbish empty homes as another route to providing affordable housing. The widely-respected UK property agents’ membership body believes that a number of long-term incentives, like discounts or exemptions to property tax, will go some way to incentivising English councils and property owners to bring properties back into use.

Propertymark advocates solutions such as removing VAT on home and energy efficiency improvements, along with discounts or exemptions to Council Tax and Stamp Duty when empty properties are bought and used.

What are the possible solutions?

Looking to the future, there have been several remedies suggested apart from Propertymark’s drive to return to the Empty Homes Community Grant Programme. So what can be done to return the UK’s empty lets back into homes?

Look to the Welsh Government

Inspiration could come from across the Welsh border. In January 2023, Property Industry Eye reported that the Welsh Government “could see up to 2,000 long-term empty properties brought back into use”. Julie James, the Welsh Climate Change Minister announced that £50m would be used to bring more empty properties in Wales back into use.

With more than 22,000 properties sitting empty long term in the country, James aims to increase how many properties are available to rent. Noting that otherwise, vacant lettings mean a “wasted housing resource” that could in effect become a blight on the communities they are in. The principle of issuing a grant on properties that have been empty for at least a year could theoretically be replicated in England.

It is also interesting to note Propertymark’s view that with 200,000 or so empty homes in the UK, creating homes from empty properties for people to live in saves a lot of materials compared to building new homes, bringing a sustainability slant to the debate.

England’s approach to using empty homes appears rather puzzling, especially considering the UK Government’s ambitious goal of constructing 300,000 new homes annually by the middle of this decade. Propertymark has highlighted this issue, raising concerns about the inadequacy of the Government’s efforts in managing the existing underused housing stock.

Retrofitting empty properties

Retrofitting an empty property is another approach that has merit. Introducing new materials, products and technologies into an existing building to reduce the energy needed to occupy that building has the potential to return more housing stock to the private rented sector.

Examples outlined by the Government include insulating roofs, walls and floors; replacement windows; improved ventilation design; airtightness works and more efficient heating and hot water systems. Architect Paul Testa states that “renewables are also often installed during retrofit works” which is significant for many. A higher standard of property is also claimed to attract responsible tenants and help a home stand out from competing properties.

The Big Issue advocates this solution, claiming that the UK is “trapped in a housing crisis” and that fixing the issue doesn’t just come from building thousands of new affordable homes, but also bringing empty homes back into use.

Among the many benefits of retrofitting, the most attractive given the current focus on energy prices is lower energy costs for tenants, thus providing a warmer and more energy-efficient home. If enacted across all of the UK’s empty homes, it would contribute towards lowering the nation’s carbon footprint, too.

Martese Carton, the director of mortgage distribution at Leeds Building Society, believes that whilst providing new homes is essential, the society’s research demonstrates that it is not the only path to a solution and that there is a “growing sense that these empty properties could provide some of the solutions to the housing crisis the country faces”.

Occupying once-empty homes benefits everyone

All of these viewpoints differ in their methods, with some saying retrofit, and others asking for more new builds. However, the consensus is that solving the UK empty homes crisis will have significant benefits for the entire country, not just among private landlords, letting agents and those looking to rent a home.

Another noteworthy advantage, which holds particular significance in today’s world, is that repurposing and using these empty homes could aid the Government in achieving its net-zero target while also providing a refuge for families and people who are struggling to secure permanent, safe housing’.

PROPTECH-X in association with Estate Agent Networking & NewsNow publications.

Andrew Stanton is the founder and CEO of Proptech-PR, a consultancy for Founders of Proptechs looking to grow and exit, using his influence from decades of industry experience. Separately he is a consultant to some of the biggest names in global real estate, advising on sales and acquisitions, market positioning, and operations. He is also the founder and editor of Proptech-X Proptech & Property News, where his insights, connections and detailed analysis and commentary on proptech and real estate are second to none.