Renter’s Reform: The biggest upheaval in private renting since the 2004 Housing Act

The Renter’s Reform white paper has finally been published and it now looks like things will move quite fast as the white paper appears to essentially be the first draft of the Renter’s Reform Bill mentioned in the recent Queen’s Speech. It is likely to be the biggest upheaval in private renting in England since the introduction of the Housing Act 2004.

David Smith, Real Estate Partner at JMW Solicitors, gives his commentary on the Government’s reform plans:

“Clearly some of these reforms are huge, such as an end to s21, but others are likely to end up being a bit of a damp squib. The elephant in the room however is that most of this stuff will only apply to Assured Shorthold Tenancies. There are long-standing ways to avoid the AST regime and it is likely that some landlords will look to dust these off to continue operating as they are.

The long-awaited abolition of section 21. However, the White Paper seems to be going further than this and simply abolishing all fixed term tenancies altogether, echoing Private Tenancies in Scotland. All tenancies will be essentially periodic from the start, leaving tenants reasonably free to give notice and exit when they wish. Landlords will not have the same luxury and will only be able to evict tenants with cause. Those causes are to be added to, to allow for property sale and moving back in. The detail of the actual legislation will be important here.

Blanket bans on renting to children and to those on benefits. These are pretty unsurprising. I have long said that refusal to rent to people on benefits as a blanket policy was unwise and that every tenant should be looked at on their own terms. More than likely this will lead to private landlords adopting the same approach as some social landlords and simply telling tenants that their income (less benefits) is too low and that they cannot afford the property. It is likely to lead to a surge in efforts to “pre-qualify” tenants to avoid wasting time with applicants who are unlikely to meet criteria. This however has data protection implications.

Rent review changes. This is unclear but it seems likely that all rent review will have to be by way of the statutory s13 mechanism with a longer notice period and the white paper says that increases will only be allowed once annually but this is part of s13 already and few landlords use increase clauses that push rents up more often.

Allowing pets. This really seems like a bit of a crowd-pleaser as the desire for pets by tenants does not seem to be all that large, albeit that it has a vocal lobby. In fact, this is almost certainly going to have to be riven with exceptions which is likely to make it unworkable in practice. It appears that one of the main barriers to pets which was caused by the Tenant Fees Act is also to be reduced by allowing landlords to require pet-owning tenants to buy pet insurance.

A private-renter’s Ombudsman. Inevitably as a solicitor I am bound to say that I think it would be far better to make the existing court system more accessible. However, there has already been a huge growth in this form of privatised justice in the sector and it is clearly going to continue. There appears to be a wider commitment to increasing the use of Rent Repayment Orders by tenants.

Decent homes. It is illogical not to apply the Decent Homes Standard to the private sector. Even more bizarrely the English Housing Survey does apply the standard and measures PRS property based on it. However, it is a pretty low bar and having yet another standard alongside the existing structures does not make much sense, especially if it is not going to achieve much.

The portal. The DLUHC seems determined to say this is not a landlord register. But if it is compulsory then it is hard to see how it is anything else, however it is dressed up. However it now looks more like an advice portal for landlords but with some information from the register of rogue landlords and agents included.

Recovering possession. There is to be new powers to recover possession from ant-social tenants and grounds on rent arrears are to be improved. Bailiff resources are to be improved and there is to be a drive to list initial hearings sooner in ASB cases. But the reality is that the legislation is not really the problem here. It is the total lack of funding for the court system that is the real bar to obtaining possession.

More enforcement. It will be interesting to see the upgrades to council powers. I suspect that fines on civil penalties will be increased but the detail will be important. However, again the problem is more one of lack of funding and a shortage of experienced EHOs rather than a lack of powers. It appears that this will be started by running pilot schemes. Ironically, this is likely to increase, at least temporarily, what has been referred to as the “postcode lottery” on enforcement.

Deposits. There remains a commitment to develop some form of deposit passport to avoid tenants having to have to pay a second deposit when they move home with the first one being returned later. However, this is practically very difficult and I suspect it will continue to be more of a commitment than action.”

Most Homeowners Overly Optimistic About Property Value, According to Figures

PRESS RELEASE: Homeowners in England and Wales overvalue their properties by an average of eight percent, according to new figures. The research, by Quick Move Now, compared homeowner valuations with formal independent estate agent valuations.

Danny Luke, Quick Move Now’s managing director, explained: “When we first started comparing the figures in 2019 homeowners were overvaluing their properties by an average of eleven percent. The current figure of eight percent indicates that homeowners are becoming more accurate with their assessment of their home’s value.

“Property websites such as Rightmove and Zoopla are making it much easier for homeowners to gather information about the local property market and what their homes might be worth. Some sites allow the public to search for recent sold prices in the area, whilst others go a step further by using recent sold data and general property market trends to offer a basic property valuation tool.

“This access to property data makes it much easier for homeowners to be clued up on how much their home could be worth, but our figures show that – even armed with that data – homeowner estimates can be pretty far off their property’s actual value. Overpricing your property by eight percent when putting it on the market could have a significant impact on how long it takes to sell. Previous data has suggested that over-pricing your property can result in it sitting on the market for twice as long as an accurately priced property. It can be very difficult to view your own home objectively, so it’s always best to get a local estate agent to visit your property for an accurate and up to date valuation.”

Quick Move Now also looked at regional variations in how accurately homeowners value their own properties. Residents in Harrow, Romford and Telford provided the most accurate property valuations, with homeowners over-valuing their properties by an average of six percent. At the other end of the scale, those living in Llandrindod Wells gave the least accurate valuations, overvaluing by an average of 20 percent. All areas tended to overvalue properties rather than undervalue them.

Danny added: “Headlines over the last couple of years have been filled with exponential property price growth and it’s easy for homeowners to get caught up in the hype of that.

“Those living in urban areas, where there are more properties of a similar design in a small geographical area, are likely to have a larger amount of comparable information that will give them a more accurate idea of their property’s value. Those in rural areas will find it more challenging as properties tend to be more spread out and therefore price comparison is increasingly tricky.

“Whilst it is handy to be able to go online and get a rough idea of how much your property might be worth, it is always best to ask a local independent estate agent for a formal valuation. Ultimately, any property is only worth what someone is willing to pay for it and a local estate agent is likely to have knowledge about the local market that an online valuation tool simply can’t compete with. That is especially true in the current market where things are changing very quickly from one week to the next. Now that the ‘cost of living’ crisis is really starting to hit, we are definitely beginning to see a cooling of the market. The first two weeks of marketing your property are the most important in terms of attracting a buyer, so it’s vital that you price your property correctly from the start.”

Property Market: Boom or bust, does it matter? There is a bigger threat to the industry

Everyone knows that asking prices are going skyward and agents have very little inventory, vendors are getting greedier as they need higher amounts to cover the cost of their next move, and despite a base rate of 1.25%, the housing market is in rude health.

But if you scratch under the surface and look at the figures such as the just released by the Gov.UK analysis the amount of completed sales is dropping:

“The UK Property Transactions Statistics showed that in April 2022, on a seasonally adjusted basis, the estimated number of transactions of residential properties with a value of £40,000 or greater was 106,780. This is 12.1% lower than a year ago (April 2021). Between March and April 2022, UK transactions decreased by 3.9% on a seasonally adjusted basis.’

Now at some point, rampant house inflation could be dampened by the increasing cost of borrowing. But if wage inflation, spearheaded by bodies such as our friends who keep the railways running and their large pay increase demands becomes a reality, will anyone care.

In terms of industry sentiment and chatter, many are very bullish about their indexes, especially their end-of-year performance for 2021, but what will the end of 2022 look like? It is great that property sells in days if correctly priced, but if you do not have enough stock how do you cover your overheads.

What we are seeing is that many of the big fish are quietly buying up large tranches of agencies with a lettings focus, and utilising software to push efficiencies across their enlarged network. And I see nothing that will stop this combine-harvesting approach from stopping anytime soon.

Estate agency in the UK may well be a national cottage industry, made up majoritively of a huge rump of one and two-branch concerns run by highly experienced owners, but the scope for keeping these businesses at a level of high profitability is becoming far harder. Not so much due to competition, but more because the general public has been conditioned to want more for less, and to want things done now rather than next week.

This new generation which I term the smart/lazy generation buys and sells things in a digital way, they order goods and services in an almost zombie-like digital way with a few clicks on their mobile.

Their parents might feel that dealing with James the local owner of an agency who has been in business selling and letting property for 30 years is the person to deal with. But the next generation uses their digital side to ‘find’ the best agent for them, negating the old ways of doing business.

“If an analogue agent feels they can continue in a business-as-usual way, ask yourself why when 90% of agencies still have their agency doors locked are you still doing business.”

Andrew Stanton

And there are two points here, if an analogue agent feels they can continue in a business-as-usual way, ask yourself why when 90% of agencies still have their agency doors locked are you still doing business.

The second point is that the general public, or the younger smart/lazy generation, never sleep. They are being consumers and communicating with everyone 24/7, it is just what they do.

If agents do not have a method of digitally delighting them, a strategy where they can engage and do property stuff, then focusing on the problem of where to get the next property or letting listing from will pale into insignificance faced with the paradigm shift in consumer behaviour.

Agency is a people business, but if you no longer can talk to them in the communication channel of their choice, at their favourite time, they will seek out agents who do and will. Amazon is a marketplace that never sleeps, very soon property will follow suit.

Proptech fu3e. secures £3.5 million investment from Gresham House Ventures

Gresham House Ventures, a growth equity investor specialising in software and digitally-driven businesses in the consumer, healthcare, and service sectors, has made a £3.5mn investment in fu3e., an adaptive management reporting software platform for the real estate sector.

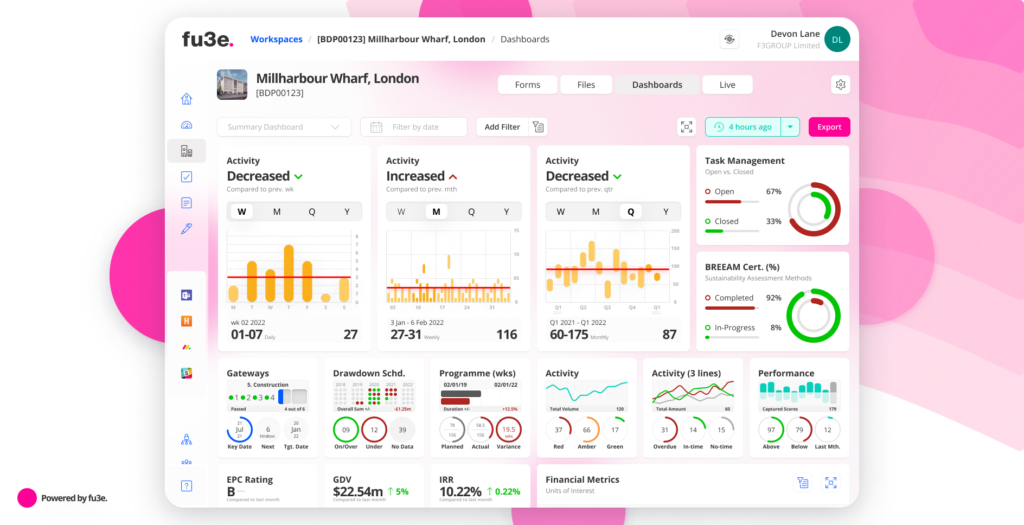

The fu3e. platform combines two leading digital products aimed at managing development risks and digitising management processes and is designed to sit above and integrate with existing management reporting software solutions.

The platform is designed for real estate funds, assets owners, developers and professional consultants providing users with real-time data enabling them to operate with insight, manage risk effectively and make informed decisions quickly and at scale.

Gresham House Ventures’ investment will be used to accelerate product development and sales and marketing growth, as the real estate sector sees increasing adoption of software solutions.

For those who may not be aware, fu3e. is an adaptive management reporting software designed by real estate and property executives. fu3e. is the umbrella above existing management software, used by real estate funds, asset owners, developers, and professional consultants.

fu3e. was created by F3GROUP, the UK’s leading boutique real estate development, risk, and capital management consultancy. With a 40-year track record in property and real estate development management ownership, fu3e. was built by executives, for executives, to combat the challenges created by siloed systems and manual reporting.

There are two products, Business Impacts – to manage development risks and Digital PMO – to digitise management process; each one delivers management reporting and processing with incredible efficiency.

Gavin Gleave, CEO of fu3e., comments:

“We are excited to have secured this investment from one of the UK’s leading growth capital investors in the enterprise software space. Gresham House Ventures’ funding and experience in this area will be a major boost and will enable fu3e. to further expand its market share and build awareness in the wider real estate industry, as the sector’s adoption of software-based solutions continues to accelerate.”

James Hendry, Associate Director at Gresham House Ventures, comments:

“fu3e. has delivered impressive growth to date and we believe the business is well-positioned to emerge as a market leader, as the real estate sector increasingly embraces the potential of software to improve existing processes. The platform already has a strong customer base, and our investment will support further product development and sales and marketing growth at this critical time for fu3e.

“We were immediately impressed by the fu3e. platform which has clearly benefited from the management team’s background in the industry to address a significant issue which they had experienced first-hand.

“We believe the quality of the management team at fu3e. combined with our software scaling expertise will make this a highly effective partnership, and we look forward to working closely with the business over the coming years as it continues its positive trajectory.”

Gresham House Ventures specialises in scaling businesses with business models driven by technology, customer insight or service excellence. Gresham House Ventures aims to work with ambitious management teams who want the support of a flexible long-term investor who brings capital, insight, and expertise.

Andrew Stanton is the founder and CEO of Proptech-PR, a consultancy for Founders of Proptechs looking to grow and exit, using his influence from decades of industry experience. Separately he is a consultant to some of the biggest names in global real estate, advising on sales and acquisitions, market positioning, and operations. He is also the founder and editor of Proptech-X Proptech & Property News, where his insights, connections and detailed analysis and commentary on proptech and real estate are second to none.