Valuing New Build Property and Understanding the New Build Premium

This thought piece by Michael Joyner, Chief Data Scientist at Bricks&Logic focuses on the processes involved in accurately valuing residential properties and assessing the new build premium, focusing on challenges related to data scarcity and unique developments

Introduction ‘As the real estate landscape continues to evolve, understanding the dynamics of property values is becoming increasingly crucial. One area of particular interest lies in the relationship between existing housing stock and newly constructed properties—the phenomenon known as “the new build premium.” In today’s market, where the rise of build-to-rent developments has garnered significant attention, accurately assessing this premium has become more pronounced than ever.’

‘While performing this analysis with abundant direct comparable sales and rental data points for planned developments may be relatively straightforward, it poses a challenge when “creating the market.” This situation arises when your development is the first of its kind in the immediate vicinity or when the last development was built several years ago. In this article, we will explore various types of analysis that can assist in addressing this issue and how Bricks&Logic can provide valuable assistance in accurately assessing even the most data-sparse development opportunities.’

Enhancing the Data ‘Where data is sparse, we need to make the best possible use of it by applying techniques that enrich and make it more relevant to our analysis. This involves updating older data points and finding robust and justifiable methods to equate properties with different characteristics to those we are comparing them against.’

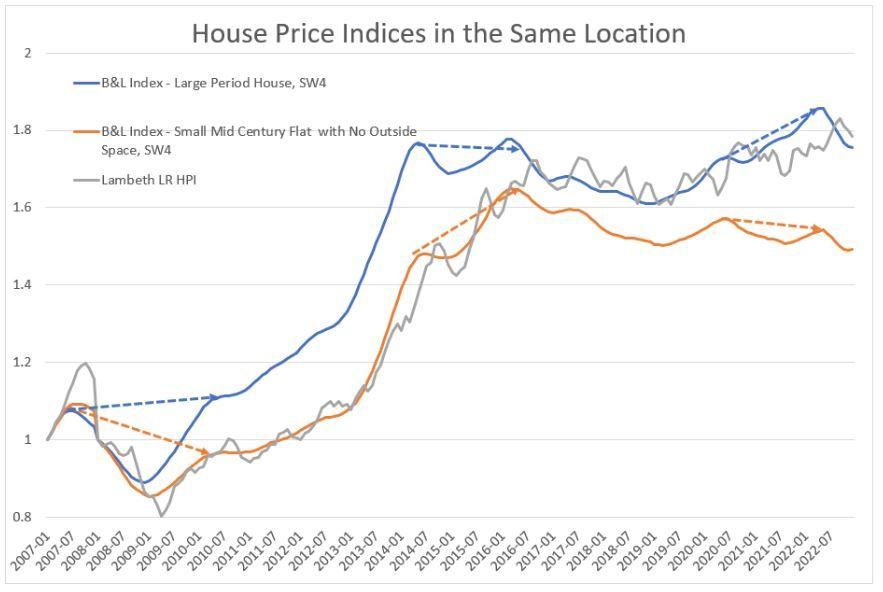

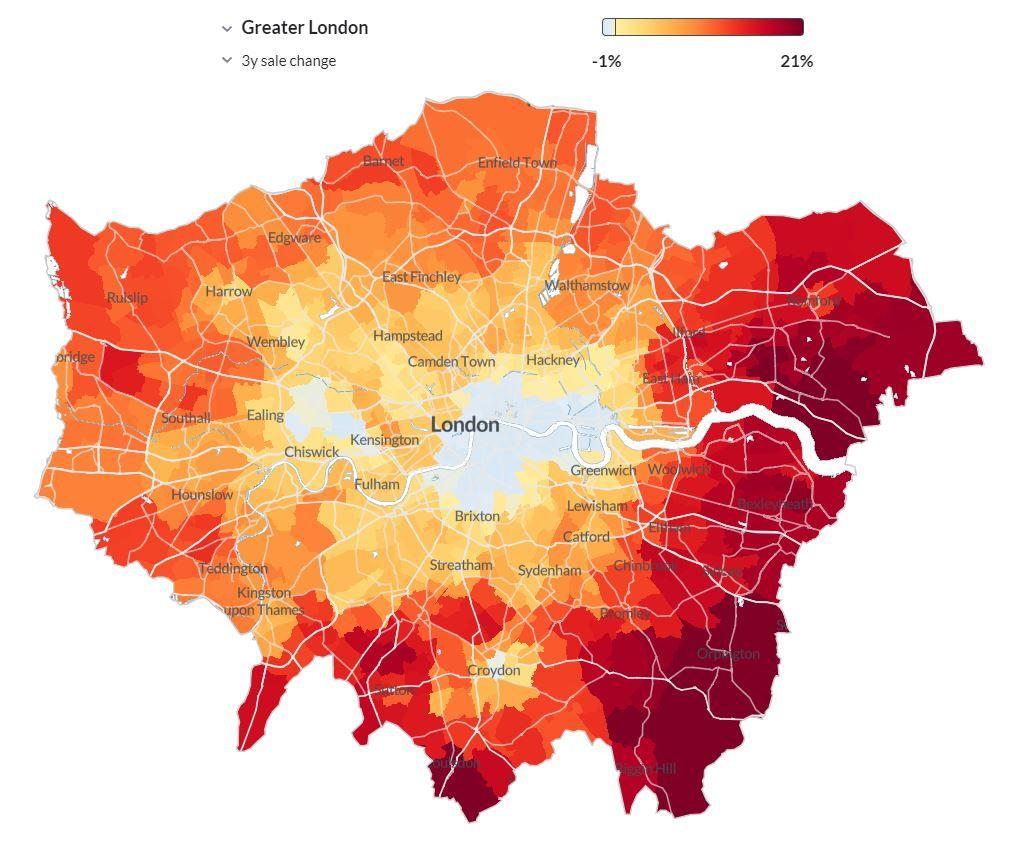

Make the Data Current ‘Using simple house price indexes for regions can be very risky. The UK market is not just a few regional markets but thousands of small ones that not only vary by hyper local locations but also property types. Coming out of the last financial crash we saw expensive prime properties perform much better than their neighbours. Between 2012 and 2017 we saw this trend completely reverse as money was cheap for landlords to invest in buy-to-lets and the help to buy scheme provided support to those smaller properties targeted by first time buyers.’

‘Following Covid we saw the ‘race for space‘ and those larger properties with outside space perform far better than their smaller internal only counterparts. To understand all these effects Bricks&Logic have created a property level index that takes into account the attributes as well as location of a property to give an accurate picture of its house value performance over time that is unique to itself. Below shows an example of how two properties only a few hundred metres apart can act very differently. We also show how one region can have a huge disparity in house price performance.’

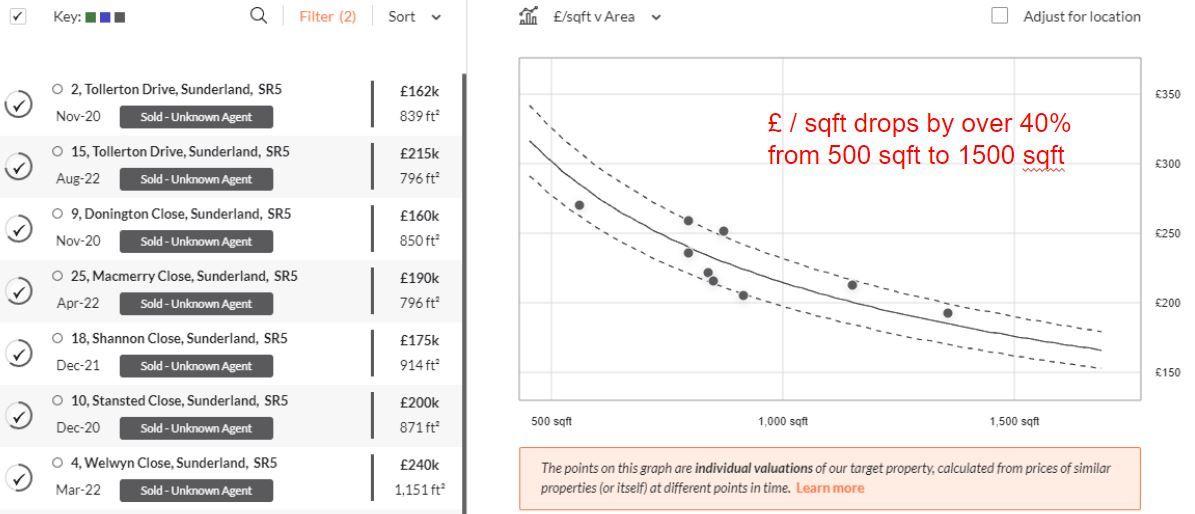

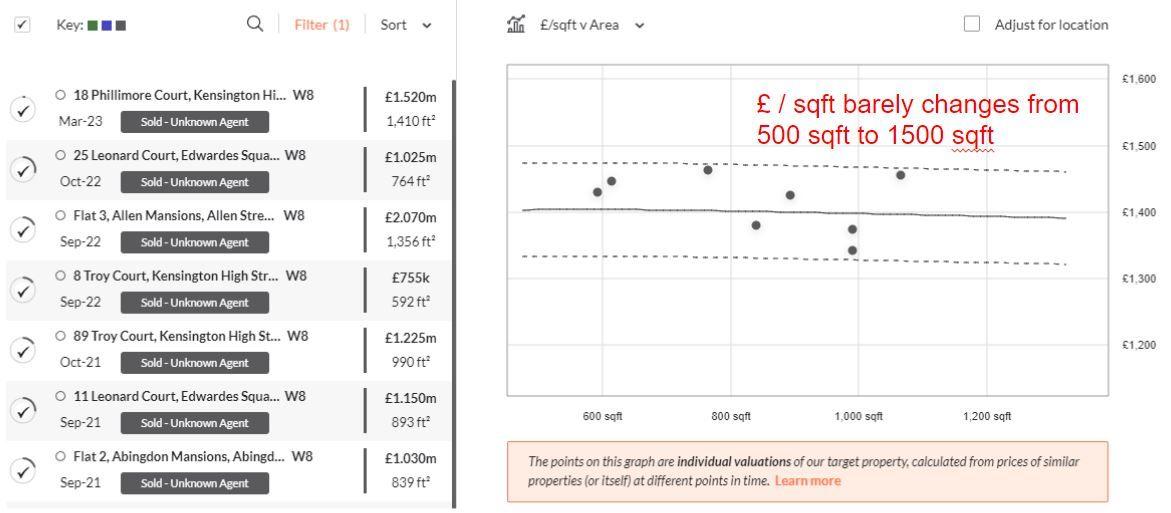

Understanding How Size Affects Price ‘Aside from location the size of a property is the next most significant factor determining its value. A common measure used to help determine the value of a property compared to a neighbouring one is the £/sq ft. However this can be an overly simplistic measure. The rate of £/sqft for a property can vary depending on its size, with larger properties typically commanding a lower rate. However, the rate of £/sqft can also vary depending on the area in which the property is located. In cheaper areas, the rate of £/sqft tends to decrease at a faster rate as the property size increases. In contrast, in more expensive areas, the rate of £/sqft tends to decrease at a slower rate as the property size increases. This means that larger properties in more expensive areas are likely to have a higher value per square foot than larger properties in cheaper areas. See the below examples of just how different the rate at which £/sq ft changes depending on the value of the property.’

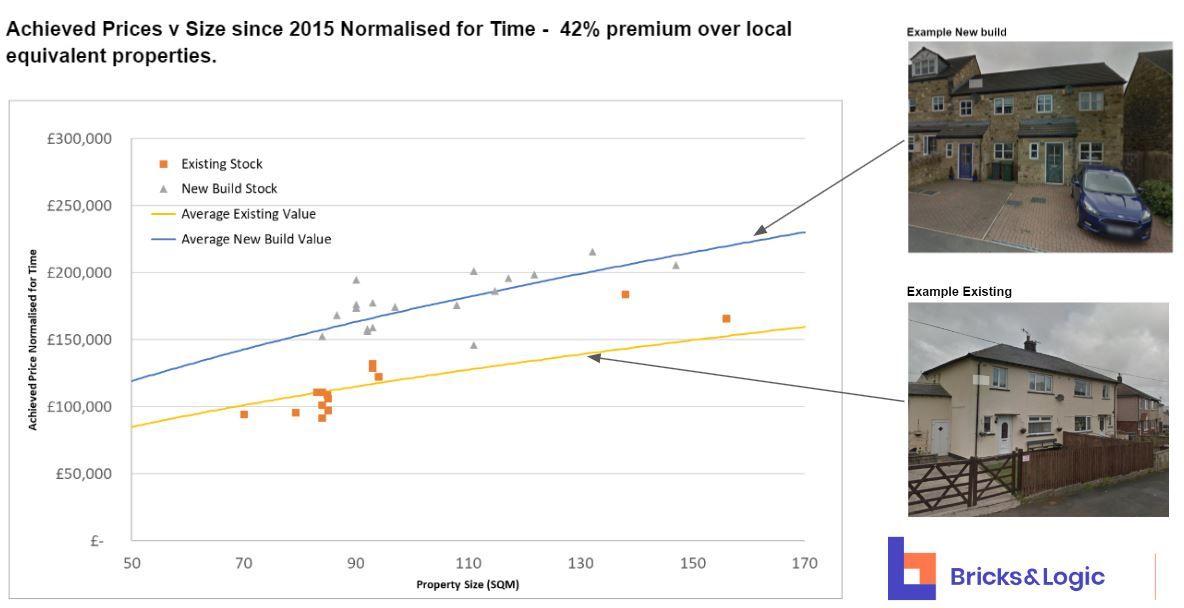

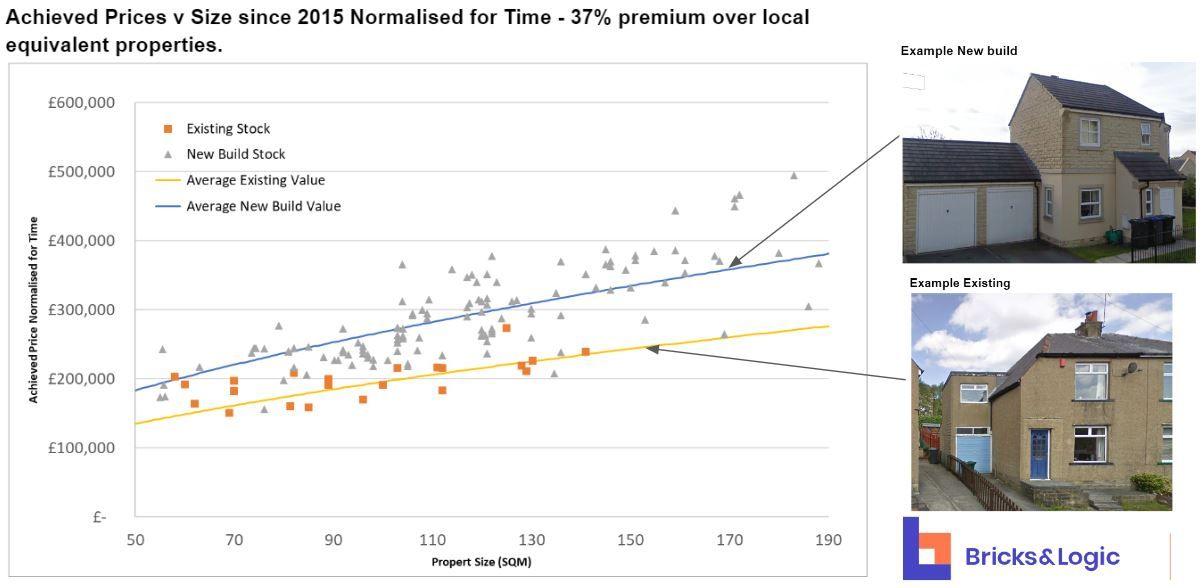

Calculating the New Build Premium ‘By having a property specific understanding of how prices have moved over time and how the average £/sq ft changes depending on the location and value of a property we can equate the equivalent achieved price today of a set of existing properties relative to new build ones. By analysing the new build premium achieved by developments in the area we can then apply this to the specific existing properties in a given location to get an accurate estimate of expected new build value even without equivalent new build comparables.’

Utilising the Bricks&Logic Yield Model ‘At Bricks&Logic we have created a highly accurate yield model that takes into account the location, type, size and value of a property to give an indication of the expected rental value a property can achieve. This means that even without comparable new build rents in the area you can get a good understanding of the expected value that is backed by a comprehensive models that see use the yields of surrounding areas for similar property types. By combining this with the new build premium analysis, with just a few clicks of a button a full value and expected income of a new development can be calculated.’

Conclusion Michael Joyner, Chief Data Scientist, at Bricks&Logic feels that, ‘accurately assessing the new build premium and valuing residential properties requires a nuanced approach that goes beyond simplistic metrics like £/sqft. When dealing with data-sparse situations or creating markets for unique developments, it becomes essential to enhance and enrich the available data. Bricks&Logic’s data analytics solutions offer enhanced insights by making data current, considering property attributes, and analysing market dynamics. By combining this data and analytics together, Bricks&Logic enables accurate estimations of new build value and expected rental income.

We are in the process of building out specific tools that will help developers move beyond just simple comparables when providing evidence for investment decisions. If you would like to find out more or about any of the other services that we provide then please contact us at contact@bricksandlogic.com

Registration is open for CREtech London 2024, Europe’s leading event that is Reimagining the Built World, and we would love to have you join us again.

I am running this advert for Michael Beckerman CEO of CREtech – (no cash has changed hands) – as I like to support conferences and iniatives that speed the commercial real estate plough and get that digital dial turned up to full throttle. And because I do actually attend these CREtech events with Zara and get a lot of value, new knowledge, and to catch up with old friends and make new ones. And over the two days know there wil be tonnes of networking opportunities and the odd party or two. Remember to take advantage of the Early Bird option too.

Passes are on sale right now at the absolute lowest price point until 31st January with our Super Early Bird sale (savings of £500). As a thank you for your loyalty to CREtech events, please enjoy an additional 15% off with code ThankYou15 (expires next Friday, 15 December). Use this LINK to book.

This year at CREtech London we are elevating your attendee experience by offering the following:

• Best-in-Class Speaker Lineup: Curated by our new Head of Content, Emily Wright, you’ll hear from C-Suite speakers you won’t find at any other real estate tech event including, David Camp, Chief Executive, Stanhope PLC, Oliver Tyler, Director, Wilkinson Eyre, Hanif Kara OBE, Engineer, AKT II, Smith Mordak, Chief Executive, UKGBC, Ed Parsons, Geospatial Technologist, Google, Roger Madelin CBE, Joint Head of Canada Water, British Land, Martyn Evans, Creative Director, Landsec U+I, Simon Henzell-Thomas, Global Director Climate and Nature, Ingka Group (IKEA) and more to be announced.

• Extraordinary Content: Attend our sessions to learn all about AI, real estate-led climate innovation, lessons in resilience and adaptation, repositioning in a tough market, occupier demand, smart design, and urban master planning from the leading Built World innovators to get actionable insights you need to position yourself and your company in a complex, ever-evolving market.

• Breakout Curated Conversations: New in 2024, delegates at CREtech London can participate in breakout sessions, “CREtech Conversations”, to engage in curated and meaningful discussions on AI, Climate, Affordable Housing and more with like-minded attendees. Participate in the dialogue and build new relationships.

• Peer-to-Peer Networking: With our AI-driven matchmaking app, it has never been easier to book 1:1 meetings with like-minded individuals to foster new relationships, build deal flow, find your next investor, and more. No other show offers more opportunities to connect with real estate decision-makers, investors and leading solutions providers.

• NEW Connected Experience: Curated by Lee Odess of the Access Control Brief, this immersive showcase will feature the top technology hardware and software providers for smart buildings who specialize in access control, smart locks, and other technology categories that impact the built environment.

• Technology Discovery: From smart building hardware to analytics and AI, our show floor is packed full of the most innovative tech providers serving the Built World. Plus, our matchmaking app helps to curate meetings with solutions providers you want to hear from.

• And MORE to be announced including Sustainable Buildings Tours, a Meet the Buyers Program, Smart Building Awards, Parties and more.

Passes are on sale right now at the absolute lowest price point until 31st January with our Super Early Bird sale (savings of £500). As a thank you for your loyalty to CREtech events, please enjoy an additional 15% off with code ThankYou15 (expires next Friday, 15 December). Use this LINK to book.

Andrew Stanton’s PROPTECH-X ‘Proptech & Property News’ in association with Estate Agent Networking & News Now publications. #proptech #property #realestate #digitaltransformation #startups

Andrew Stanton Founder & Editor of 'PROPTECH-X' where his insights, connections, analysis and commentary on proptech and real estate are based on writing 1.3M words annually. Plus meeting 1,000 Proptech founders, critiquing 400 decks and having had 130 clients as CEO of 'PROPTECH-PR', a consultancy for Proptech founders seeking growth and exit strategies. He also acts as an advisory for major global real estate companies on sales, acquisitions, market positioning & operations. With 200K followers & readers, he is the 'Proptech Realestate Influencer.'