Ascendix provides market map of current property technology industry

Things you need to know about the expanding proptech marketplace

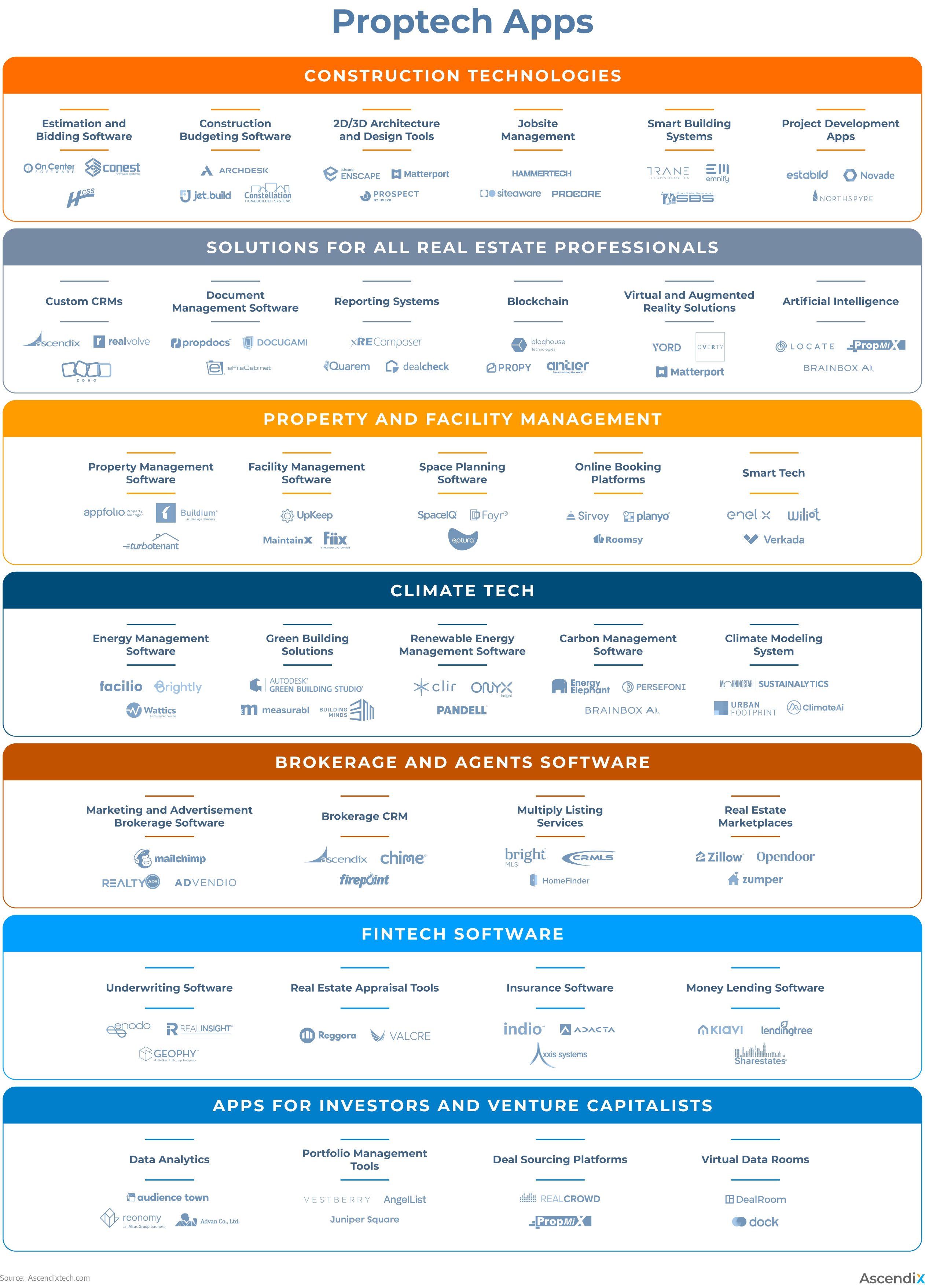

Over the last few years, the proptech market map has turned into a whole universe with a huge number of proptech companies that reportedly equals 10,000. To navigate this complex field with different domains and technological trends of different strategic orientations, now one certainly needs a map.

In this article, we would like to measure the pulse of the current state of the real estate tech market map and define the most successful proptech companies and areas that attract the heaviest investment. Moreover, we will answer the most frequent questions regarding the highest value proptech unicorns and the state of the European proptech market.

What’s in the Proptech Market Map?

The real estate tech market consists of different market players, each focusing on different aspects of proptech. Maybe that’s the reason why at the moment, there is no single view on what the real estate tech market map should look like. However, the first beginnings are starting to crystallize with the help of innovative proptech companies and communities all over the world.

This year, we’ve presented our very own overview of the proptech market in the form of a full-fledged map of the proptech network. Check our proptech market map introducing companies from both commercial and residential real estate markets below.

Building a start-up is a 24/7 mindset, but for 90 minutes a week, my focus is elsewhere

Owen Redman co-founder of Roome – is looking to save Universities over £9M annually by connecting the dots in a fragmented student accommodation market. Putting these institutions back in the driving seat and ensuring undergraduates have a centralized service for all off-campus accommodation problems, which empowers wellbeing and gets them living with people they like so they complete their courses.

But what struck me was a post on social media Owen made – because it sums up the plight of every property technology founder I have ever met, (over 1,300 of them in the last eight years – 140 as clients) – the fact that they permanently exist in in two worlds, and there is never any respite. In fact I think it is actually poetry so I have reproduced it in a free verse poem format.

Here then are Owen’s brilliant words –

‘Roome is always on my mind.

First thing in the morning. Last thing at night.

At the gym. Watching a film. Even on a date with my fiancé (sorry, Tash, I’m working on being more present here!).

But when I step onto the football pitch, it’s different.

For those 90 minutes, my only focus is the game.

A finite challenge. A clear goal. A team working together.

And every Saturday, I come home feeling refreshed.

Not just because I love football as much as I did as a child, but because stepping away from Roome, even for a little while, gives me clarity when I return.

A couple of weeks ago, we won a cup final. A great day, a great win, but more than that, a reminder of how important it is to find balance.

What’s the one thing that completely takes your mind off work?’

This ‘proptech poem’ I am sure so resonates with all proptech founders and of course people heading up their own businesses, the highs and lows, the worries the achievements etc, always with the dead hand of time chasing us. Plus of course now with an ever increasing digitally connected world, our brains are over stimulated and bombarded with so much new data hourly.

The concept of running around with your team, being part of that with no connection to the world or the stresses of the business – even for 90 minutes, is as Owen says a vitally important part of balancing the day job.

And it not only wise words that Owen Redman and James Buck the other co-founder of Roome have going for them, but they really are also a dynamic powerhouse of talent looking to solve the loneliness of the University adventure if accommodation is not done right – a lost opportunity for the student, and a bigger financial one for the University.

Gareth Samples CEO of The Property Franchise Group gives analysis on interest rates

No change in the Bank of England base rate in March

Owen Amos Live Editor of BBC News, ‘At 12:00 GMT, we got the decision we were expecting – the Bank of England held interest rates at 4.5%.

The nine-person Monetary Policy Committee, which sets the rate, voted 8-1 in favour of holding – with one member voting to cut.

That decisive vote is being seen by some as a sign that rates will remain at 4.5% for longer than expected. But – as with all economic forecasts – no-one can be certain.

The MPC said “global trade policy uncertainty has intensified” in recent weeks, citing US tariffs and other countries’ responses.

Yet while Bank of England Governor Andrew Bailey acknowledged that uncertainty, he also said: “We still think that interest rates are on a gradually declining path.”

Gareth Samples, CEO of The Property Franchise Group, comments: “The Bank of England’s decision to keep the base rate unchanged comes as no surprise, given the delicate balance between controlling inflation and supporting economic growth. While further rate cuts are anticipated later in the year, it’s clear that the Monetary Policy Committee is taking a measured approach.

“Encouragingly, we are seeing a steady recovery in market activity. Sales volumes have returned to pre-pandemic levels, mortgage approvals are on track with long-term trends, and first-time buyer numbers have rebounded significantly, spurred on by improving affordability and the impending stamp duty changes.

“Mortgage rates have also eased, with some competitive fixed-rate deals now available below 4% for those with a strong deposit. This is providing buyers with greater confidence to move forward with transactions, which in turn is supporting moderate house price growth.

“While external pressures such as geopolitical uncertainty and inflationary risks remain, the fundamentals of the housing market remain robust. Moderate GDP growth is still expected to underpin sustained sales activity, and with buyer confidence improving, we anticipate a stable and positive year for the property market in 2025.”

Andrew Stanton Founder & Editor of 'PROPTECH-X' where his insights, connections, analysis and commentary on proptech and real estate are based on writing 1.3M words annually. Plus meeting 1,000 Proptech founders, critiquing 400 decks and having had 130 clients as CEO of 'PROPTECH-PR', a consultancy for Proptech founders seeking growth and exit strategies. He also acts as an advisory for major global real estate companies on sales, acquisitions, market positioning & operations. With 200K followers & readers, he is the 'Proptech Realestate Influencer.'