Table of Contents Hide

An uncertain 2025: making the property market work in your favour

Property experts across the country are predicting that 2025 will be a buyer’s market, offering potential new property owners more negotiating power and putting sales on the increase.

According to recent analysis by Savills, ‘property sales activity is likely to remain strong until March. We expect buyers will seek to beat the reversion to higher stamp duty rates in April by bringing purchases forward, creating a peak in sales during Q1. Longer term, the market will continue to be sensitive to interest rates. Our forecast for 4% price growth in 2025 relies on mortgage rates falling in line with expectations. Mortgage interest rates and underlying swap rates have remained relatively stable since the autumn. But some lenders started the year by cutting their interest rates to compete for buyers more aggressively.’

What does this mean for agents? Sales will be agreed but with a relative glut of properties, there will be a lower demand – and purchasers will be more picky leveraging their position to get the best property at the best price. According to The Independent, “the number of available properties per estate agent is at a decade high.” So, agents need to find the best way to increase market share when conditions are not so favourable for vendors, making sure they can engage buyers and close sales.

Cut Above the Competition: Solid Design The first impression is critical in today’s digital world. Buyers are scrolling through listings online, and you only have a few seconds to capture their interest. A well-designed listing is essential for standing out. Poor website design or difficult-to-use interfaces can drive potential buyers away.

Virtual Tours: Make Properties Shine Virtual tours are rapidly becoming an essential feature in property listings, offering agents a way to be fully transparent by ensuring no details are hidden. They provide prospective buyers with the ability to explore a property remotely, allowing them to experience the space before committing to an in-person viewing.

Construction Apps are the new bricks and mortar

This month the leader in the field Ascendix, focuses on why having a construction App promises to solve delays, miscommunication, and cost overruns. A construction application makes it easier to coordinate teams, share information, and avoid costly mistakes. The result — projects stay on track from start to finish, as 18% of a build cost is actually the errors in the implementation from design to build, which traditionally has been until now a paper heavy ticket system.

Here Ascendix CEO & Co-founder Wes Snow‘s team unravels how these apps are developed, and why they are changing the construction industry.

Building a construction app improves project management, helps teams on job sites and in the office communicate more effectively, and makes cost estimation more precise.

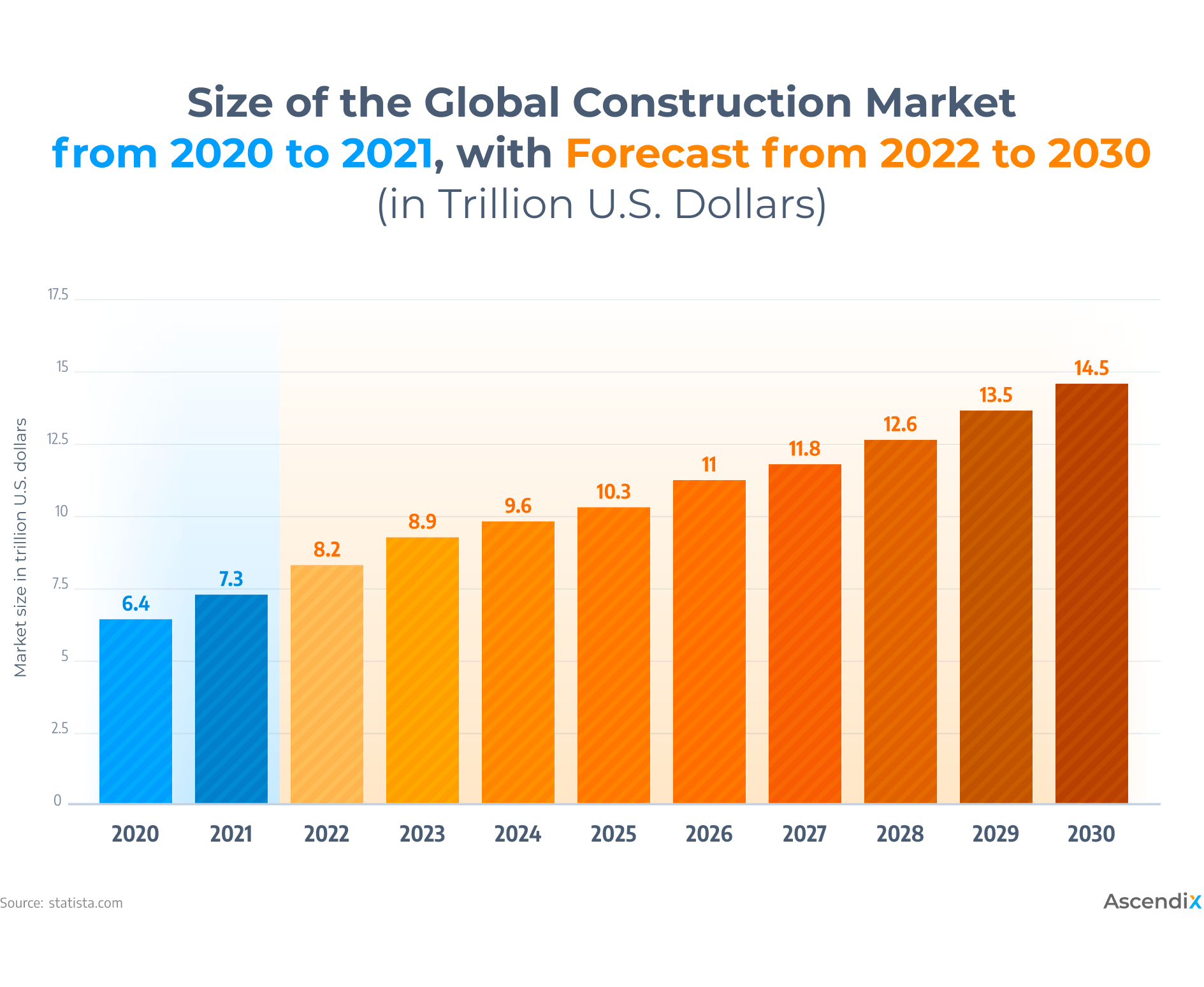

With the global construction management software market projected to reach $2.71 billion by 2027 (source). This growth shows that more companies are turning to construction apps to work faster, improve safety, and manage tasks better.

Construction market size

In construction, inefficiencies like material waste and miscommunication account for 35% of costs. Let’s see how construction apps are helping businesses:

| Role | Benefits |

|---|---|

| Project Managers | Gain full visibility into schedules, budgets, and resources, reducing project delays. |

| Field Workers | Access tools like blueprints, checklists, and progress updates on mobile devices in real time. |

| Construction Companies | Save money by cutting waste, improving communication, and avoiding rework caused by errors. |

| Safety Officers | Perform quicker site inspections, log incidents digitally, and track safety compliance seamlessly. |

| Clients/Stakeholders | Stay informed about project milestones, budgets, and timelines for better transparency. |

“Construction projects are becoming increasingly complex, and sticking to outdated methods can lead to costly setbacks. Firms that invest in construction apps can modernize their operations, reduce costs, and improve safety. ”

Why Choose a Custom Construction App Over Ready-Made Solutions?

While ready-made solutions offer excellent features for general construction management, building a custom app is often the better choice in specific situations. Let’s explore these in detail:

1. Launching a Product for Other Businesses

If your company wants to create software to sell to other construction businesses, a custom app helps your product stand out. You can add features that solve specific problems, like managing subcontractors, creating detailed reports, or following unique rules and regulations. A custom app also lets you use your branding and build something that can grow with your customers’ needs.

Things to think about if you do not want to be a renter for life!

The team behind tlyfe the lifecycle tenant app, not only know a great deal about providing technology that aids tenants to get to the front of the queue when looking to rent their next home, they also know a huge amount about the aspirations of tenants and the roadmap from renting a property to owning a home. They start by explaining that moving forward all depends on building a correct foundation, and finances are key, starting with balancing your finances.

Your credit history Your credit history plays a significant role in building good credit. It takes time to build a positive credit history, and the length of time it takes to build good credit can vary depending on how long you’ve been using credit. Typically, it takes around six months to a year of using credit responsibly to build a good credit history. During this time, you should make all your payments on time, keep your balances low, and avoid applying for too much credit at once.

Your credit history Your credit history plays a significant role in building good credit. It takes time to build a positive credit history, and the length of time it takes to build good credit can vary depending on how long you’ve been using credit. Typically, it takes around six months to a year of using credit responsibly to build a good credit history. During this time, you should make all your payments on time, keep your balances low, and avoid applying for too much credit at once.

Your credit utilization ratio Your credit utilization ratio is the amount of credit you’re using compared to the amount of credit you have available. This ratio plays a significant role in your credit score. To build good credit, you should aim to keep your credit utilization ratio below 30%. If you’re starting from scratch, it may take a few months to establish a credit utilization ratio that won’t negatively impact your credit score. However, if you have existing credit cards, you can make changes to your spending habits and start reducing your credit utilization ratio immediately.

Your credit score Your credit score is a measure of your creditworthiness. It takes into account your credit history, credit utilization ratio, and other factors. A good credit score is typically above 700. It can take a few years to build a good credit score from scratch. However, if you have a bad credit score, you can take steps to improve it. Improving your credit score can take anywhere from a few months to a year or more, depending on how much work needs to be done.

Andrew Stanton Founder & Editor of 'PROPTECH-X' where his insights, connections, analysis and commentary on proptech and real estate are based on writing 1.3M words annually. Plus meeting 1,000 Proptech founders, critiquing 400 decks and having had 130 clients as CEO of 'PROPTECH-PR', a consultancy for Proptech founders seeking growth and exit strategies. He also acts as an advisory for major global real estate companies on sales, acquisitions, market positioning & operations. With 200K followers & readers, he is the 'Proptech Realestate Influencer.'

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew StantonSeptember 25, 2025

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton

- Andrew Stanton