Universities Losing Millions Due to Accommodation Challenges: A Proptech Solution

Owen Redman co-founder of Roome shares some thoughts on the plight of students and seats of learning across the UK, and how they both can be helped,

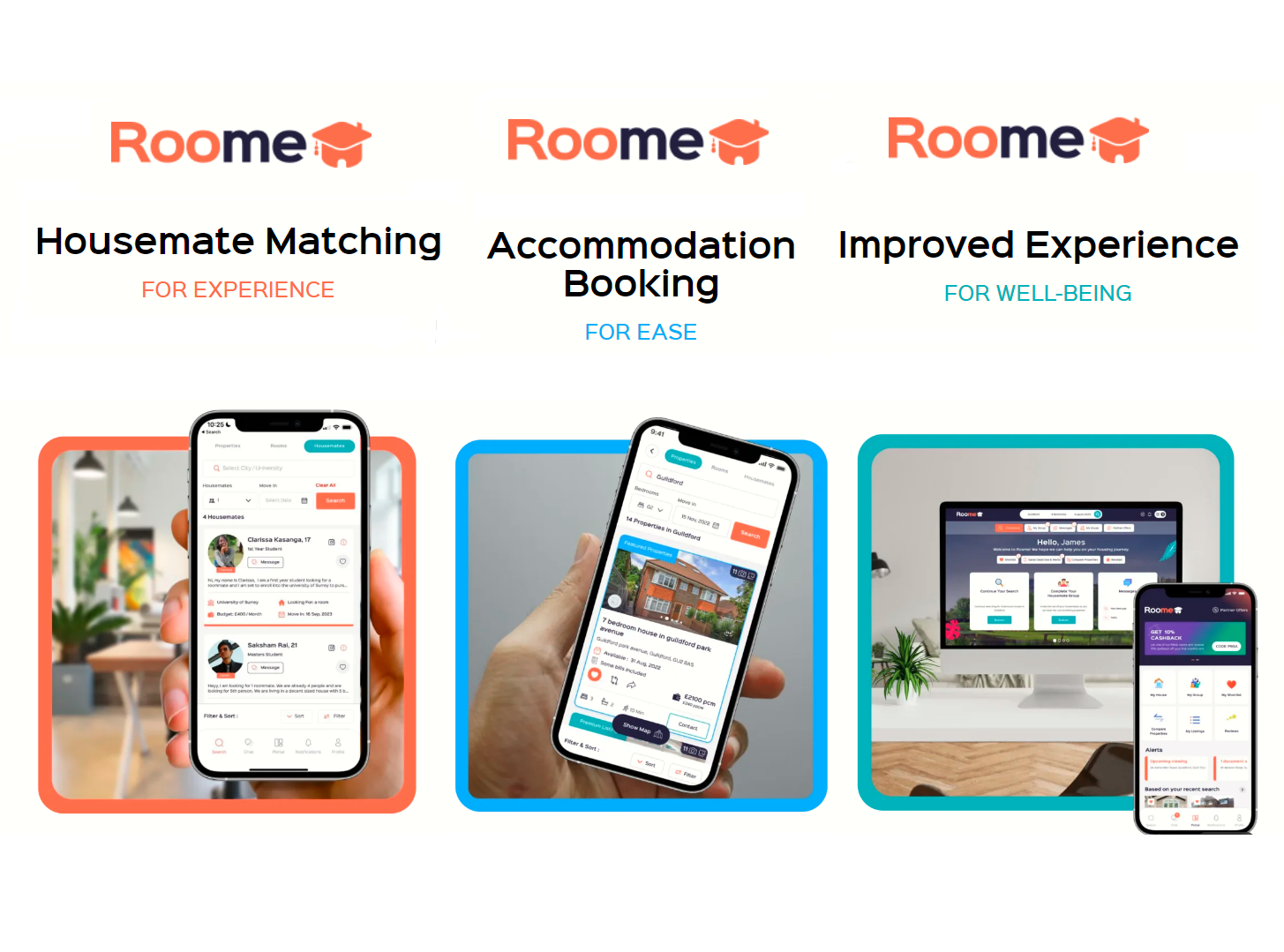

‘Universities across the UK are facing significant financial losses every year, driven in part by the accommodation crisis impacting their students. A staggering number of students drop out of university annually, with 6.4% leaving their course. These issues span affordability, conflicts with housemates, inconvenient locations, and the lack of suitable accommodation options. From our research, university staff responsible for student exit interviews report that between 80-90% of dropouts are directly related to these housing challenges. Given that student retention is crucial for institutional stability, this represents a massive concern.

The Cost of Housing-Related Dropouts

To put the impact into numbers, consider the average student population across UK institutions, which totals approximately 2.66 million students as of the latest data. If we take the 6.4% dropout rate, compounded by the fact that 85% of these students are leaving due to housing-related issues, the financial implications are immense. Let’s say a dropout represents a loss of £9,250 in tuition fees alone, not including government funding and additional income from services like accommodation, food, and other on-campus activities.

For example, if 6.4% of a university’s 20,000 students drop out annually, that equates to 1,280 students. If 85% of these dropouts are due to housing issues, that’s 1,088 students leaving. With each student representing £9,250 in lost tuition fees, this amounts to £10.07 million annually. The true financial loss is likely higher when factoring in other streams of income tied to student presence.

The International Student Challenge

Universities are not just losing money on domestic students, but also missing out on the lucrative international student market. International students pay significantly higher tuition fees, averaging £22,000 annually, and play a key role in boosting university income streams. However, for universities seeking to attract these students, the lack of clear and accessible accommodation options creates a significant barrier.

Research shows that around 50% of prospective international students consider accommodation options as a major factor in their decision-making process. With increasing competition for global talent, universities must go beyond affordability and provide better options and clarity in housing, including access to detailed information on amenities, housing types, and potential roommates. The Private Built Student Accommodation (PBSA) market, which is expected to grow at a CAGR of 5% between 2022-2028, has shown tremendous appeal to international students, but access to this housing information is often limited or poorly integrated into university portals.

Leading proptech tlyfe helps both tenants & landlords

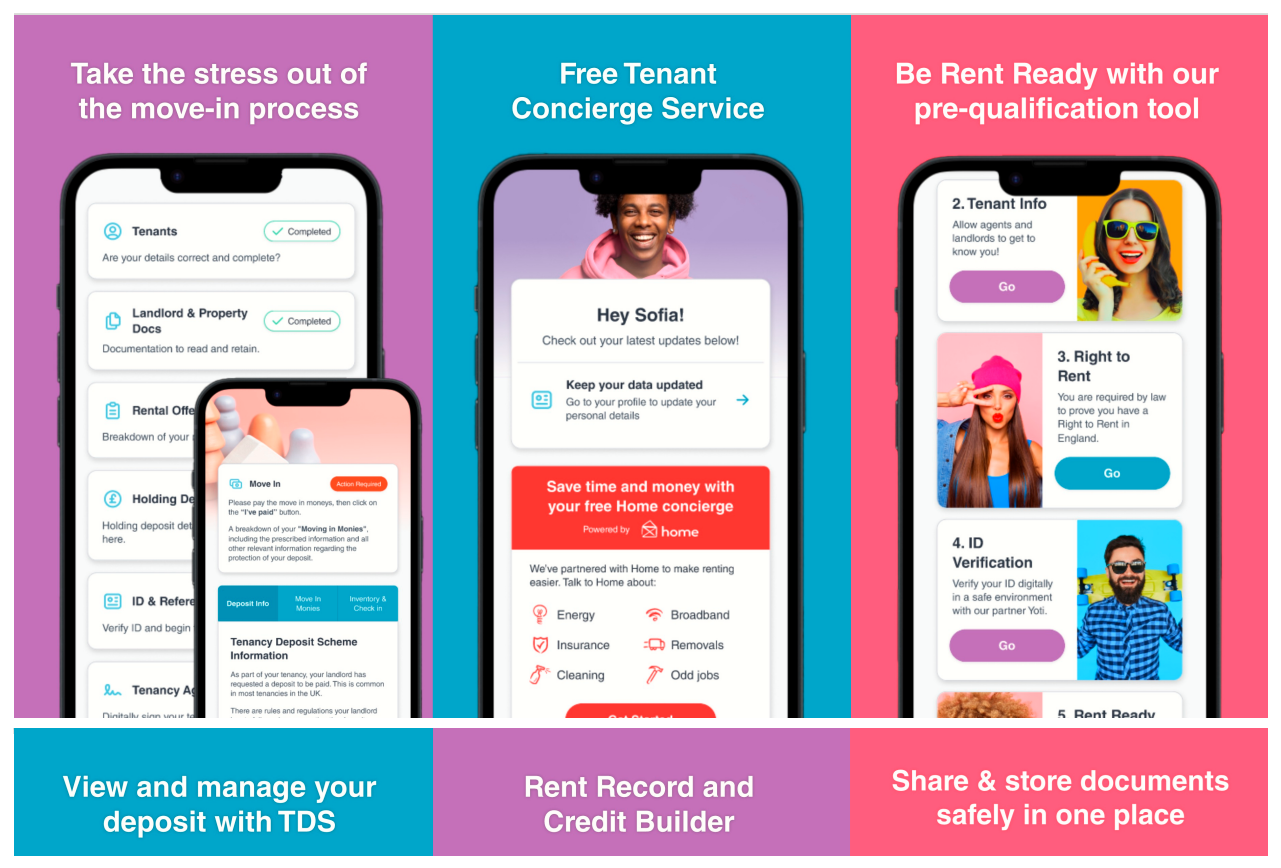

As the rental market evolves in response to impending change to legislation and increasing demand, both tenants and landlords are navigating a more competitive and complex environment. The upcoming Renters’ Rights Bill and the removal of Section 21 are set to bring significant changes, making it more crucial than ever for tenants to stand out and secure their preferred properties quickly and efficiently. This is where tlyfe’s Rent Ready service comes into play, offering a comprehensive solution that benefits both tenants and agents.

Navigating the New Rental Landscape – With the anticipated changes from the Renters’ Rights Bill, including the abolition of Section 21 “no-fault” evictions, landlords will be more cautious in selecting tenants. The ability to ensure a tenant is reliable, financially stable, and legally compliant will be paramount. tlyfe’s Rent Ready service addresses these needs by providing a streamlined, verified package of tenant information that significantly enhances the rental process.

The important bit, is that it allows a tenant to collate their own validated data should they so wish. It can’t be mandated (unless the agent pays for it) but it importantly allows a tenant, who may be frustrated at not even being able to secure a viewing due to there being too many applicants, access to own their own verified data and then are able to share it simply and securely from their tlyfe App to the agent.

The agent can then download it, but the if the applicant doesn’t like the property or indeed have missed out, the applicant can “unshare” their profile immediately. The facility puts the ownership of their own data back to the tenant applicant but also saves the agent time and costs whilst allowing the agent to immediately qualify their applicant.

What is Rent Ready? – tlyfe’s Rent Ready is an innovative feature within the tlyfe app designed to empower tenants by allowing them to vet themselves and present a verified, comprehensive profile to agents. This “speedy boarding” service for tenants includes seven critical components:

One – Affordability Calculator: This tool helps tenants determine their budget before starting their search, ensuring they are only applying for properties within their financial means.

Two – Right to Rent Checks: These checks verify that the tenant has the legal right to rent in the UK, eliminating potential delays and legal issues.

Three – ID Verification: A digital process that confirms the tenant’s identity, reducing the risk of fraud and speeding up the application process.

Four – Verified Digital References: This feature allows tenants to present credible references that have been digitally verified, enhancing their trustworthiness.

Five – Self-Certified Information: Tenants can include personal details about their rental preferences and circumstances, such as reasons for renting, household composition, and even pet ownership.

Six – Comprehensive Reference: A deep dive into the tenant’s background, supported by a rental warranty that can be purchased for added security.

Seven – Rental Guarantor: Future plans include allowing tenants to provide their own rental guarantor, further strengthening their application.

Managing Partner Clelia Warburg Peters raises multi-million first fund to digitally transform real estate sector

Era Ventures, a pioneering venture capital firm focused on investing in a broad range of business model innovations to catalyse positive change in the built world, today announced the launch of its inaugural $88/£65.5 million fund. It will will deploy capital across multiple stages and a full spectrum of sector-focused innovations, from enablement technologies that improve existing processes to truly disruptive platforms that reshape the industry.

The firm has identified seven core business models driving change, including but not limited to SaaS and AI, marketplaces, embedded fintech, and hardtech ventures leveraging new technologies to optimize physical assets, and will actively invest across all of these categories.

Founded by industry veteran Clelia Warburg Peters, (main picture) Era Ventures has already garnered support from a broad roster of leading institutional investors, including one of the country’s leading Ivy League Endowments, ICG Advisors, The Ashforth Company, BentallGreenOak (BGO), Continental General Insurance Company (CGIC), Pelwood Holdings, First American, Bain Capital Ventures, Fenwick & West LLP and others. It marks a notable achievement during a year when very few new venture funds of this size were raised.

“We are proud to have invested in and to support Era Ventures in its mission to drive transformational change in the real estate sector,” said Jeff Assaf, Chief Investment Officer at ICG Advisors, one of the leading multifamily offices in the country. “We’ve seen specialist venture funds consistently outperform in similarly complex sectors like financial services and healthcare, and Era’s approach positions it to drive fundamental disruption in a massive, yet technologically lagging, industry.”

Peters has been a leading investor in the PropTech space since its early days — first as a co-founder of MetaProp, one of the original, strategically backed PropTech funds, and then as a Venture Partner at Bain Capital Ventures, a leading generalist venture firm. She is an authority on innovation in the real estate category and is the first woman to raise an initial fund of this size in the category.

“I’ve seen firsthand the need for a new approach to physical world innovation that combines the creativity and quality of the generalist investing approach with the sector knowledge and relationships brought by specialist funds,” said Clelia Warburg Peters, founder and Managing Partner at Era Ventures. “Era Ventures is leveraging our unique blend of institutional backing, top-tier venture experience, and deep real estate expertise to bring both rigor and care to driving transformational change in the physical world.”

The fund’s launch comes at a critical juncture for the nearly $380 trillion global real estate industry, which has long resisted technological disruption. With productivity in construction rising just around 1% annually over recent decades and buildings consuming 30% of global energy, the need for innovation has never been more urgent.

Andrew Stanton Founder & Editor of 'PROPTECH-X' where his insights, connections, analysis and commentary on proptech and real estate are based on writing 1.3M words annually. Plus meeting 1,000 Proptech founders, critiquing 400 decks and having had 130 clients as CEO of 'PROPTECH-PR', a consultancy for Proptech founders seeking growth and exit strategies. He also acts as an advisory for major global real estate companies on sales, acquisitions, market positioning & operations. With 200K followers & readers, he is the 'Proptech Realestate Influencer.'