OpticWise – Why most building tech upgrades fail to deliver measurable returns?

Week 6: Why Most Tech Upgrades Fail to Improve NOI

Introduction

Welcome to Week 6 of our 52-week series exploring how CRE owners can unlock performance and profitability through digital infrastructure. I’m Bill Douglas, CEO of OpticWise and co-author of Peak Property Performance: Game-Changing AI and Digital Strategies for Commercial Real Estate. Today, we’re tackling a harsh truth: most building tech upgrades fail to deliver measurable returns. In fact, they often become sunk costs that drain resources and frustrate teams.

The Illusion of Progress

In recent years, the CRE industry has seen a flood of technology: Proptech, tenant apps, smart sensors, “AI-powered” building management systems. On paper, they promise efficiency and enhanced experience. But in practice, many owners see no meaningful increase in NOI or tenant satisfaction.

Why? Because they’ve invested in tools, not strategy. Tech is layered on top of old infrastructure, fragmented platforms, and vendor-controlled systems. Without a cohesive foundation, these upgrades can’t deliver integrated, scalable value.

PPP Insight: The ‘Connect’ Phase Comes First

In our book *Peak Property Performance*, we lay out the 5C™ Framework. The second step—**Connect**—is the digital backbone of the asset. Without owning and integrating your infrastructure first, every tech layer added is like painting over rust. Connectivity isn’t just about bandwidth. It’s about data flow, system interoperability, and owner control.

When upgrades happen without establishing that foundation, they may function in isolation but can’t contribute to holistic property intelligence or operational ROI.

A Familiar Scenario

A mid-sized office portfolio added a tenant experience app, only to find that less than 15% of tenants adopted it. Worse, the app provider owned the user data, and the building’s access control system didn’t integrate with the app’s workflow.

The result? Confused tenants, frustrated property managers, and a wasted budget. Only after completing an OpticWise PPP Digital Infrastructure + Data Ownership Audit did the owner understand the underlying issue: multiple vendors, no data interoperability, and no ownership of the connectivity layer. Fixing those gaps was the prerequisite to making any CRE tech truly work.

Why Owners Must Lead with Strategy, Not Tech

Building owners are often pitched solutions before identifying the actual problems. A new energy dashboard doesn’t help if your HVAC system isn’t connected to it. Smart lighting won’t move the needle if your occupancy sensors are inaccurate.

The issue isn’t technology—it’s misalignment. Tools are chosen before defining business goals. Digital infrastructure is treated as IT’s problem, rather than an owner-controlled asset.

Owners need to ask: “What’s the outcome we’re after—and what foundation must be in place for that outcome to be real?”

Andrew Stanton CEO Proptech-PR

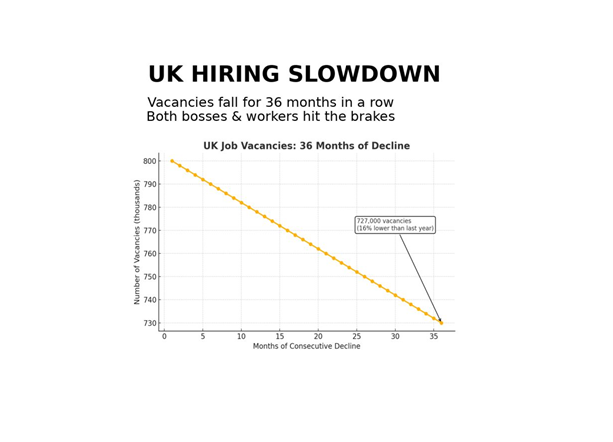

WEDI: vacancy rates and softening rental markets in key commercial hubs

The UK is Europe’s second most distressed market despite headline GDP growth

(Europe – Thursday 26 June 2025): Retail and Consumers Goods has emerged as the most distressed sector in Europe, with distress levels now the highest since the global financial crisis, according to the latest Weil European Distress Index (WEDI). The downturn is driven by a combination of tight credit conditions, cost inflation and weakened consumer demand – particularly in the UK, where discretionary spending is under severe strain.

This deepening retail distress has become a bellwether for a wider trend: corporate distress across Europe has accelerated more sharply than anticipated at the start of the year. Whilst the WEDI forecast published in January 2025 correctly pointed to a fragile and uneven recovery, the actual pace of deterioration has exceeded initial projections. Distress has risen across all major European economies, with seven out of ten industry groups now worse off than a year ago.

Geopolitical volatility, trade disruption and tighter fiscal policy continue to suppress confidence, limit liquidity and slow investment. At the same time, softer demand and squeezed household finances are impacting revenues. The combined effect is leaving businesses with less capacity to absorb shocks, with resilience becoming a critical concern.

Andrew Stanton CEO Proptech-PR

PROPTECH-X : Utopi scales growth with £5M of follow on investment

Follow-on funding is supporting new long-term income contracts, including with global real estate company Mapletree

[Press Release June 2025] Data solutions and property technology firm, Utopi, has secured a further £5m investment from the Scottish National Investment Bank (“The Bank”). The investment is supporting the Glasgow-based company to secure and resource several long-term income contracts.

Utopi’s technology collects data from multi-tenant buildings, tracking and measuring six different performance indicators: temperature, humidity, air quality, light, noise, and motion. The company’s in-house specialists then provide data-informed recommendations, tailored to the property, to reduce the building’s environmental footprint, create a healthier environment for residents, and improve the value of the building for investors and asset managers.

The Bank initially invested £5m in Utopi in 2023, which supported the business to grow from 12 employees to 55 and supported a 500% revenue growth in the first year of the investment.

The latest investment will help unlock the company’s next phase of growth, which includes an initial contract with global real estate company, Mapletree Investments Pte Ltd, to provide electric panel heaters and smart sensors for 1,500 student rooms within its UK student housing properties.

Jonathan Burridge, CEO and co-founder of Utopi, said: “The support and investment provided by the Scottish National Investment Bank have been transformative for Utopi. Their strategic guidance and alignment with our growth vision have enabled us to expand our team by attracting top-tier talent from across Scotland, develop innovative product solutions, and explore new international markets.

Andrew Stanton CEO Proptech-PR

Andrew Stanton Founder & Editor of 'PROPTECH-X' where his insights, connections, analysis and commentary on proptech and real estate are based on writing 1.3M words annually. Plus meeting 1,000 Proptech founders, critiquing 400 decks and having had 130 clients as CEO of 'PROPTECH-PR', a consultancy for Proptech founders seeking growth and exit strategies. He also acts as an advisory for major global real estate companies on sales, acquisitions, market positioning & operations. With 200K followers & readers, he is the 'Proptech Realestate Influencer.'