Birchgrove and Hybr launch intergenerational living scheme

A unique partnership will see students, key workers and retirees live together at new north London retirement development. Birchgrove, the UK’s leading provider of rented retirement homes, and Hybr, the UK’s leading student letting platform, today announce an industry-first intergenerational living scheme which will see students and key workers live alongside retirees in the same purpose-built, privately rented retirement development.

Ayrton House is a new 60 apartment rental retirement community in Mill Hill, North London. When launched in October this year, 16 apartments across the third and fourth floors will be offered exclusively to trainee doctors and nurses from the local hospital, university post-graduates and graduate scheme students. The pioneering scheme has been designed to generate a vibrant community by harnessing the benefits of intergenerational living, with several pieces of research highlighting how the model is physically and mentally beneficial for both the young and elderly.

A 2019 UCL study highlighted how increased social contact for elderly people is associated with a lower risk of developing dementia, while an Ageing Research study has highlighted how intergenerational living benefits the elderly by giving them a greater sense of purpose and combatting loneliness, in turn leading to a greater life expectancy. Further research has also demonstrated how younger people benefit from living with elderly people – by enabling them to gain a deeper understanding of the older generation, and increasing their tolerance, empathy and understanding.

The students will live at Ayrton House on short-term tenancies running until June 2025, sharing communal facilities with the development’s retirees – including full access to the gym and the same subsidised rates in the restaurant. Furthermore, the rent on the 16 student units will be approximately 50% of market value. The project therefore means that students will have access to affordable, high-quality accommodation at a time when nearly two thirds of all students are struggling to pay their rent. At the end of the tenancies in June 2025, the 16 student units will be vacated and restored to first use state, before being let to retirees.

Ayrton House is Birchgrove’s third development in the capital, and the ninth in their portfolio. The £36m development is the centrepiece of “Ridgeway Views” residential scheme, a 47 acre, 528 home project in Mill Hill’s conservation area, and will offer residents a restaurant, club room, licensed bar and wellness suite, as well as landscaped gardens.

For over 80 years the historic art deco National Institute for Medical Research, designed by the original Wembley Stadium architect Max Ayrton, was located on the site; the new development pays testament to Ayrton’s original design both in name and by reproducing the original building’s iconic green copper roof.

Honor Barratt, Chief Executive, Birchgrove said, ‘Traditionally, intergenerational living took the form of generations of the same family residing together in a single household. Today, we are pioneering a new model: one that brings different generations together within the same purpose-built housing development. It’s a unique approach, one that we’re hugely excited about, and that we believe will really benefit both young and elderly residents alike.’

Hannah Chappatte, Founder, Hybr said, ‘We’re breaking down stereotypes and breaking the mould of traditional housing! Honor and I saw an opportunity to address the two loneliest subsections of societies – the under 25s and the over 70s. We’re tackling the housing crisis for students (where students need more available housing options) while finding a solution to the severe loneliness amongst seniors.‘

‘The seniors support the younger people by making them feel like they have a purpose and familial presence, and seniors get to be around the young to create a more upbeat environment: fostering connections that enrich lives and reduce loneliness. It’s not for everyone, but it’s a real win, win for those that buy into the concept.’

Birchgrove is creating a portfolio of high-quality retirement properties within and around the M25, offering contemporary apartments for rent in brand-new purpose-built facilities. Underlying Birchgrove’s business model is a belief that the current housing options for people over 65 exclude a large section of those who don’t want to manage another house purchase – and therefore assisted living for rent is the missing piece of the housing puzzle; not right for all, but perfect for some.

Hybr is a unique rental platform, tailor-made for students and graduates to support them through their journey of renting for the first-time. Their data-driven algorithms connect property owners directly with a vibrant, pre-qualified renter base ready to move-in. They deliver faster lease-ups, boosting NOI, and winning brand love and loyalty with young renters.

Housing market momentum continues to grow says Zoopla

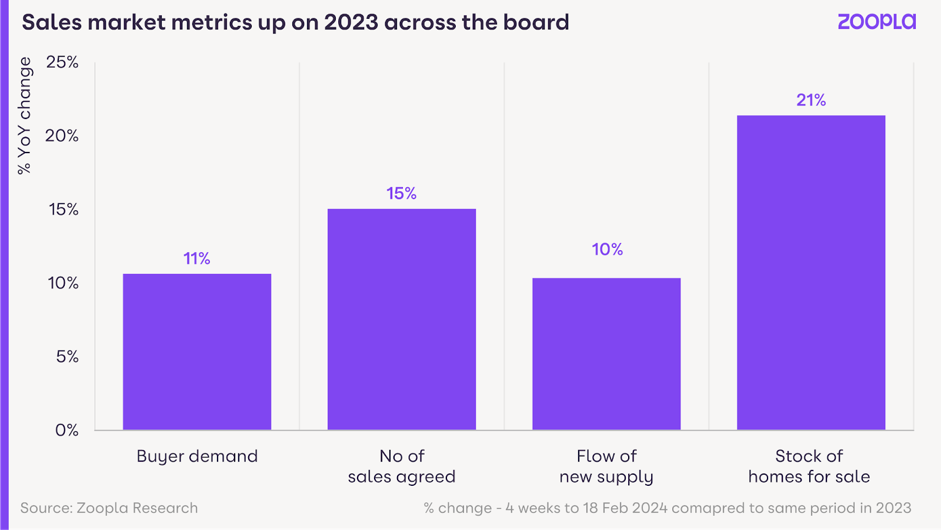

Press Release The rebound in housing market activity registered at the start of the year has continued, with property website Zoopla predicting a 10% increase of total home sales (1.1 million) in 2024 vs 1 million in 2023.

The latest Zoopla House Price Index shows that the number of homes for sale are a fifth (21%) higher than a year ago, with buyer demand also up 11% and – crucially – sales agreed 15% higher than this time last year: evidence of greater buyer confidence and more realism on pricing by sellers. The North East (+17%) and London (+16%) have led the rebound in sales.

Rate of house price falls slow on rising sales The UK rate of house price inflation has slowed to -0.5%, up from a low of -1.4% in October 2023. Slowing house price falls is a trend recorded across all regions of the UK. Five English regions are still registering annual price falls of up to -2.1%, with house price growth now in positive territory across the remaining four regions of England, as well as Wales, Scotland and Northern Ireland where annual price inflation is 4.3%.

Firmer pricing of homes is evidence that house prices do not need to fall to support sales: supported by the fact estate agents are agreeing an average of six new sales a month, versus 5.2 this time last year.

A three-speed housing market There are tangible impacts on the cost of a home depending on location, and this is contributing to a ‘three-speed’ housing market across the UK.

1) Southern England regions – covering the Eastern, South East and South West regions, outside London, these areas have registered the largest annual price falls. Rising mortgage rates and reduced household buyer power have hit these markets with the average home price at £344,000 – an increase of £80,800, or 30% above the UK average.

2) London – London performs differently to the rest of southern England. While it is the most expensive housing market, with an average price of £534,000, it is a market that has registered much lower levels of house price inflation over the last seven years. Affordability has been improving slowly over this time opening the market up to more potential buyers than before. The rebound in demand and low growth in the available supply of homes for sale (just 7% higher v 21% for the UK) explains why the annual rate of price inflation is improving more quickly than the southern England regions.

3) Rest of the UK – while house price growth has slowed rapidly over the last 12 months, annual price falls have been very limited across the rest of the UK where house prices are at or below the UK average. The impact on buying power from higher mortgage rates has been less pronounced.

What’s next for mortgage rates? Falling mortgage rates have supported the upturn in activity along with faster growth in household incomes. Mortgage rates are back to where they were a year ago with lenders now pulling mortgage deals priced below 4% as the cost of finance used to fund mortgages has increased modestly in recent weeks. Buyers should anticipate 4-5% mortgage rates over much of 2024 with mortgage rates in the 4-5% range consistent with flat to low single digit price rises.

Commenting on the latest report, Richard Donnell, Executive Director at Zoopla says: “The housing market has proved very resilient to higher mortgage rates and cost of living pressures. More sales and more sellers shows growing confidence amongst households and evidence that 4-5% mortgage rates are not a barrier to improving market conditions.

The momentum in new sales being agreed has been building for the last 5 months and the sales market is on track for 1.1m sales over 2024 supported by new sellers coming to the market. While sales are set to increase we don’t expect house price growth to accelerate further in 2024.”

Andrew Stanton’s PROPTECH-X ‘Proptech & Property News’ in association with Estate Agent Networking & News Now publications. #proptech #property #realestate #digitaltransformation #startups

Andrew Stanton Founder & Editor of 'PROPTECH-X' where his insights, connections, analysis and commentary on proptech and real estate are based on writing 1.3M words annually. Plus meeting 1,000 Proptech founders, critiquing 400 decks and having had 130 clients as CEO of 'PROPTECH-PR', a consultancy for Proptech founders seeking growth and exit strategies. He also acts as an advisory for major global real estate companies on sales, acquisitions, market positioning & operations. With 200K followers & readers, he is the 'Proptech Realestate Influencer.'