Curious how the Building Safety Regulator will impact your future projects?

Article by Will Varnals and Ed Resek Associate Director – Watts Group

‘The Building Safety Act has been described by government as the ‘Biggest Changes to Building Safety for a Generation’. Arguably, the most impactful change at project level is the implementation of the Building Safety Regulator (BSR) as the building control authority for all Higher Risk Buildings.

We have identified four key factors that project stakeholders need to understand about how the BSR will operate, and how it might impact on the delivery of projects under their remit. Please note: the following information will be most relevant to projects in England.

Four key project considerations:

What is a Higher Risk Building (HRB)? – Section 65 of the Building Safety Act 2022 states, with respect to buildings in design and construction: (1) In this Part “higher-risk building” means a building in England that – (a) is at least 18 metres in height or has at least 7 storeys, and (b) contains at least two residential units.

Examples include residential buildings, mixed-use residential, care homes, hospitals, and student accommodation. Excluded are hotels, military barracks, prisons, and other secure residential institutions. Note: the criteria are slightly different for existing buildings. When establishing height, there are some parameters to consider:

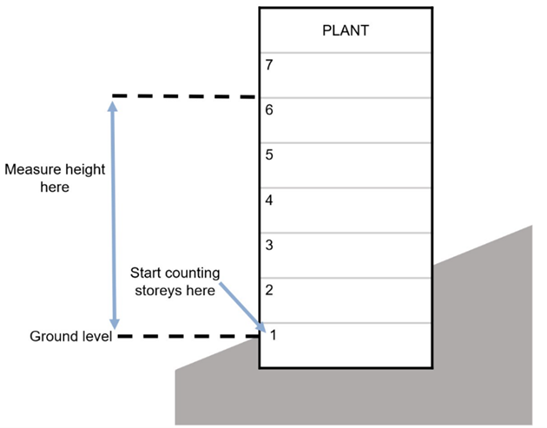

Measurement starts from ground level. If the building is on a slope, then measure from the lowest adjacent ground level. Measure to the proposed floor level of the top residential storey. Basements and below ground storeys are not counted. To qualify as a basement, all of the below ground storey’s finished ceiling must be below ground. Non-residential parts situated above residential units i.e. plant levels are not counted, as per the diagram. The building only needs to meet one of the criteria, either over 18m or 7-storeys, to be considered an HRB.

Image taken from: Image taken from: Criteria for determining whether a new building that is being designed and constructed is a “higher-risk building” – GOV.UK (www.gov.uk)

Level of Scrutiny – Although the BSR are focused on fire safety, which they define as spread of fire and structural failures posing a threat to life, they will have full responsibility over compliance with all parts of the building regulations, not just parts A and B. The BSR require several new documents at each of the 3 planning gateways, including construction control and phase plans, several other safety documents, and handover strategies.

The BSR will essentially require a complete multi-disciplinary design, aiming for projects with no changes or variations. What this means for design and build contracts is not yet fully understood, but the type of documents the BSR requires will likely drive an increase in PCSAs being used to get to detailed designs.

Programme Implications – It is clear that more time and effort will be required in the design stages to submit complete applications and secure the BSR’s approval. The BSR will have a 12-week statutory period to review and respond to applications. This means they will operate like other statutory parties such as planning authorities and consultees, who cannot be consulted throughout the design process and will only provide feedback once their full review is concluded.

Current understanding is that all applications, clarifications, and re-submissions to the BSR will be subject to the 12-week turnaround. For example, securing approval after one round of feedback and resubmission would take in excess of 24 weeks. It is imperative that project teams account for this lengthy engagement process, making allowance for the likelihood of rejected applications, within their pre-construction programmes.

To mitigate this programme (and associated cost) risk, clients/project teams are advised to retain an approved inspector as part of the consultant team to assist the design and review it for compliance prior to submitting a BSR application. It is strongly recommended that only Class 3 registered approved inspectors are engaged, as the BSR has indicated its own inspectors will be Class 3. New guidelines here: Registered building inspectors – GOV.UK (www.gov.uk).

Cost Uncertainties – Cost planning through the design stages is likely to be more uncertain because the scope, materiality, and methodology cannot be fully frozen until final approval by the BSR is secured. Typically, the design and costs would undergo an element of value engineering as a project progresses through the stages. Project teams will either need to allow for those exercises at design freeze, prior to BSR application; or run the risk of needing to re-submit and wait a further 12 weeks for subsequent approvals.

This new protracted route to design approval, driven by the BSR’s strict application and response process, will manifest a slower and more expensive pre-construction journey. Clients and project owners will need to account for this in business cases and project briefs; and may find that projects on the borderline of viability are harder to justify as a result.

Finally, while only a small part of the overall costs of any significant project, there is also inherent uncertainty of the BSR’s fees. There is an up-front £180 to be paid at the time of application, with BSR inspectors then charging £144 per hour spent reviewing applications. Forecasting these fees will be difficult, and only time will tell how the BSR will justify and seek to recover those fees.

Watts are currently delivering projects that fall under the BSR’s remit, and we have a good understanding of how to meet the BSR’s needs so that you can plan accordingly. Please get in touch with our dedicated team at Watts should you need support navigating this new landscape’.

Fine & Country Agent makes his mark on Mayfair

Luke Hammond with over a 30-years of experience in the property industry including three years in the Fine & Country network and 13-years in Central London covering everything from construction, development and agency, has now set his sights on dominating the Mayfair market.

Establishing his career in the capital before then making his return to his home town of Lincoln, where he progressed to Branch Partner at Fine & Country Lincoln, Hammond has enjoyed the trials and the successes he has experienced in selling both rural and city property in the upper quartile of the market.

Hammond comments on his time in agency, saying, “having built valuable relationships and compiled a ‘black book’ of contacts in central London over the past 30 years, focussing my efforts in Mayfair felt like a natural progression for me. I can tell that operating in this lucrative and attractive part of the capital is going to be an exciting time in my career.”

In January 2024, Hammond began his journey to adapt his extensive agency knowledge to fit the exclusive Mayfair market. Boasting an impressive portfolio of properties and developments already, he remarks, “the off-market properties I have access to have a market value climbing into the billions. It truly is an extraordinary space to work in, I am managing the sale of multi-million penthouses in Hyde Park, serviced apartments in Mayfair and townhouses which are synonymous with this illustrious part of London.”

Hammond is looking forward to growing the Fine & Country brand in the capital, inspired by this fellow London agents. “Having been part of the Fine & Country network for a few years now, I know just how passionate and experienced my counterparts are. I am neighboured by some of the most successful licensees in the country and I am looking forward to learning from them and taking advice and direction where I can,”

He adds. “Our annual conference in London is upcoming, which is a great opportunity to communicate in person with members of the national and international network and I cannot wait to forge new partnerships to the benefit of my clients. London is a hub for commerce, employment and investment prospects and the advantage of being part of Fine & Country is access to a vast and varied client base in the UK and overseas.”

Nicky Stevenson, Managing Director at Fine & Country, said, “we were delighted when Luke expressed a desire to operate in the Mayfair area, his prior experience with Fine & Country in Lincoln makes him the ideal candidate to grow the brand into previously unexplored territories in the capital. With his extensive experience, I have no doubt that he will continue to successfully build his connections in the upper quartile of the London market.’

Andrew Stanton’s PROPTECH-X ‘Proptech & Property News’ in association with Estate Agent Networking & News Now publications. #proptech #property #realestate #digitaltransformation #startups