The Web 3 Future of Real Estate – Online Panel Event by Tokenized Properties

Press Release: Leading property consultants West London City Lets has launched its new sub-agency Tokenized Properties to facilitate the sale of a real-world plot of land using a Non-Fungible Token (NFT) for the transaction.

This will be the first UK property company to support the sale of physical land through an NFT. It will also be the first time this style of land sale has taken place in the UK.

Idris Anjary, founder of West London City Lets, comments, “NFTs being paired with physical assets is becoming increasingly popular within the crypto-sphere. We truly believe that this is the future of property transactions and are delighted to be embarking on this as our next adventure.”

Tokenized Properties has announced The Web 3 Future of Real Estate event, bringing together industry leaders to discuss the future of Real Estate and the transition to Web 3.

Speakers will include industry leaders from Tokenized Properties Ltd, Mattereum Ltd and Proptech-X.

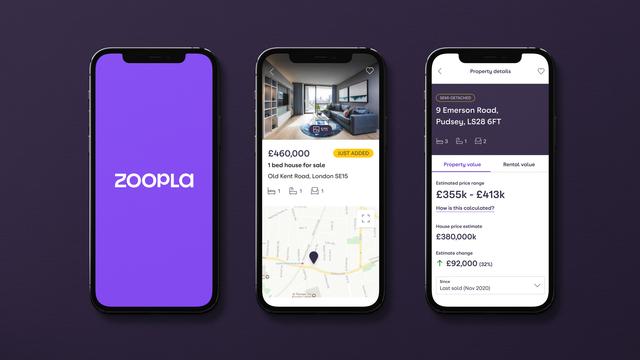

Zoopla: Accelerating rents push renters towards smaller properties and lower running costs

- There’s been a jump in demand for one and 2-bed flats as renters feel the cost-of-living squeeze, and fewer renters looking for 2- and 3-bed houses

- The average rent has increased by £115 per month since last year, reaching £1,051 per calendar month – and accounting for 34.4% of the average income of a single earner

- Rental growth has accelerated over the last 12 months – from less than 2% in July 2021 to 12.3% today – although there are signs that rental growth is starting to peak at current levels

- In a reversal of a trend seen during the pandemic, rental growth in urban markets (10.5%) is now outpacing that in rural markets (8.5%) as strong employment growth drives demand in cities

- There is no real prospect of significantly improved rental supply in the near term as private landlords continue to sell off homes due to tax and regulatory changes and renters decide to stay in their current homes

Tuesday 13th September, 2022, London: Renters are being pushed towards smaller properties and lower running costs in the face of higher rents and rising living costs including rising energy prices. This is according to Zoopla, the UK’s leading property destination, in its quarterly Rental Market Report.

Chronic shortage of supply pushes rents higher

The average rent has increased by £115 per month since last year, reaching £1,051 per calendar month – and accounting for 34.4% of the average income of a single earner. This surge in rents is heavily impacted by a severe supply and demand imbalance with the stock of homes available to rent standing at just half of the five-year average – while the average letting agent currently has just eight homes available to rent.*

This chronic supply shortage is also impacted by an increase in renters staying put in their properties to avoid rent hikes and landlords continuing to sell properties in the face of tax and regulatory changes. Currently, approximately 3 in 4 renters will decide to stay in their current property and although they will experience lower levels of rental growth of 4% or less – this will squeeze supply in the market as a result.

There’s been an acceleration in demand for one and 2-bed flats as renters feel the cost-of-living squeeze, and fewer renters looking for two and 3-bed houses. Outside of London, the average asking rent is £105 lower per month for a 2-bed flat compared to a 3-bed house.

Renters making decisions about what type of property to rent will also consider running costs and rising energy prices are likely to be playing a role in the shift in demand to smaller homes.

When it comes to energy prices, the amount of gas to heat and run a purpose-built flat for a year is 40% lower than a terraced house and 25% lower for a converted flat.** New-build city centre flats are also becoming increasingly appealing to renters seeking out smaller homes with lower running costs.

Annual rental growth nears its peak

Rental growth has accelerated over the last 12 months from an annual rate of less than 2% in July 2021 to 12.3% today, while rental growth is out-pacing earnings growth in all regions and countries of the UK. Rental growth is ranging from 7.6% in the North East to a staggering 18% in London – however, there are signs that rental growth is close to peaking.

Despite rents in London rebounding from a low base, the pace of rental growth in London is not sustainable at current levels with average rents in London currently 7.8% higher than pre-pandemic.

In a reversal of a trend seen during the pandemic, rental growth in urban markets (10.5%) is now outpacing that in rural markets (8.5%) as strong employment growth drives demand in cities.

The strongest performing urban markets are London (17.8%). Manchester (15.5%), Glasgow (14.4%) and Bristol (12.9%) – where rental growth is standing above the UK average of 12.3%. Rents are also rising faster at the top end of the market with asking rents for 2-bed flats rising more quickly at the upper end (top 25%) of the market in comparison to the lower end of the market where demand is more price sensitive.

What’s the outlook for the rental market?

There is no real prospect of significantly improved rental supply in the near term as private landlords continue to sell off homes due to tax and regulatory changes. Renters renewing their tenancies will also amplify the fierce supply squeeze and keep upward pressure on rents into 2023.

There is headroom for some renters to pay more, especially outside London and the South East, however overall, we expect the headline rental growth to slowly taper over Q4 and into 2023.

“What the rental market needs to combat these challenges is more new homes for rent.”

Richard Donnell, Zoopla

Richard Donnell, Executive Director at Zoopla comments: “Rents have surged ahead over the last year but there are signs that the pace of growth is peaking and set to slow into 2023. Renters are responding and looking for smaller, better value for money homes to rent with an eye on energy costs as much as rental levels.

“What the rental market needs to combat these challenges is more new homes for rent. Greater regulation has seen less new investment and a small but growing number of landlords selling up, meaning the rental market has stopped growing since 2016. There is a risk that more regulation to improve standards or potential new measures to dampen rental growth, as proposed in Scotland, may compound the supply problem which is pushing rents up in the first place. Policymakers need to tread a careful path between protecting consumers and ensuring a decent supply of homes for rent.”

Hannah Gretton, Lettings Director at LSL’s Your Move and Reeds Rains brands comments: “We are experiencing high levels of demand for rental properties with homes being snapped up within hours of hitting the market. With over 270 lettings branches nationwide, it’s a picture that is reflected up and down the country with particular demand in urban areas. On average, we are seeing double figures of enquiries per property with a one-bedroom property in Manchester last week receiving over 100 requests to view, highlighting just how busy our branches are and the challenges renters face when it comes to finding an appropriate property.”

Proptech and Property News in association with Estate Agent Networking.

Andrew Stanton is the founder and CEO of Proptech-PR, a consultancy for Founders of Proptechs looking to grow and exit, using his influence from decades of industry experience. Separately he is a consultant to some of the biggest names in global real estate, advising on sales and acquisitions, market positioning, and operations. He is also the founder and editor of Proptech-X Proptech & Property News, where his insights, connections and detailed analysis and commentary on proptech and real estate are second to none.