With no property to sell, is the housing market in peril?

As both an editor and owner of a publication in the property sector, and with a day job dealing with the digital transformation of real estate by helping founders of property technology companies grow their businesses, I probably talk with twenty estate agencies a week.

Some agents reported that flats, the go-to for first-time buyers or investors, were not being snapped up or indeed coming to market, because of complications surrounding the ongoing cladding and fire safety issues. If this is so, and it is estimated that as much as 10% of leasehold properties may not be mortgageable in their present condition, this will affect the supply chain of stock to be sold.

Many agents said that following the end of the stamp duty holiday, the big rush to buy was over and some properties that had been selling around the £500,000 price tag were now sticking, probably as the £15,000 SDLT was no longer a giveaway, but had to be factored into a buyer’s calculations.

Since late October there has been a murmur that despite 2021 being a bumper year for residential agents in most areas, there was some kind of change taking place.

But by November and December, a seasonal feel had overcome the market and agents said they were losing inventory as some vendors delisted to rest property over the Christmas period. And, of course, we had the pandemic factoring in too, with work from home protocols in force.

Then in January, a slow time traditionally until week three of the month when market appraisals turn into instructions, many agents said that stock was just not coming on at the rate it should. Agents said new listings correctly priced were selling in days but there was just not the usual flow.

Also, in February, many agents said that getting a property to market was extremely difficult. Prices remained buoyant but vendors were hesitant. Agents also said that interest rates from lenders would have a dampening effect.

Yes, lots of people were in fixed rate deals, but many only for two years, which means that if the BoE base rate was 0.1% when they first got a fixed-rate mortgage and if the rate goes to 0.5% or 1.0%, which seems likely by year-end, this means new borrowing would be much more expensive.

Now Katy Billany of 20Ci/20EA, which has advanced datasets around property stock data, has commented that the housing market could be in serious trouble. Data shows that estate agents have less than three months worth of property inventory to sell.

Billany said: “If the current trends continue, could it be conceivable that the whole market starts to grind to a halt as there is nothing left to sell? This then has a knock-on effect for agents, conveyancers, surveyors and so many others.”

For my money, and I have been saying this since mid-2021, we may be meeting the same market conditions following the heated market of 1988. Everyone who was going to move, moved in that year to take advantage of MIRAS for two, which the Chancellor said would be phased out in September of that year.

Then there was a period of little new inventory coming on, for years, apart from the movers in the hatched, matched and despatched verticals. And interest rates rose upwards, touching 15%. Sounds familiar, every market goes boom to bust, and Rishi Sunak, like all Chancellors, plays fast and loose with property taxation at his peril. Now BoE interest rates have gone from 0.1% to 0.5% in a matter of weeks with talk of two more rises before year-end.

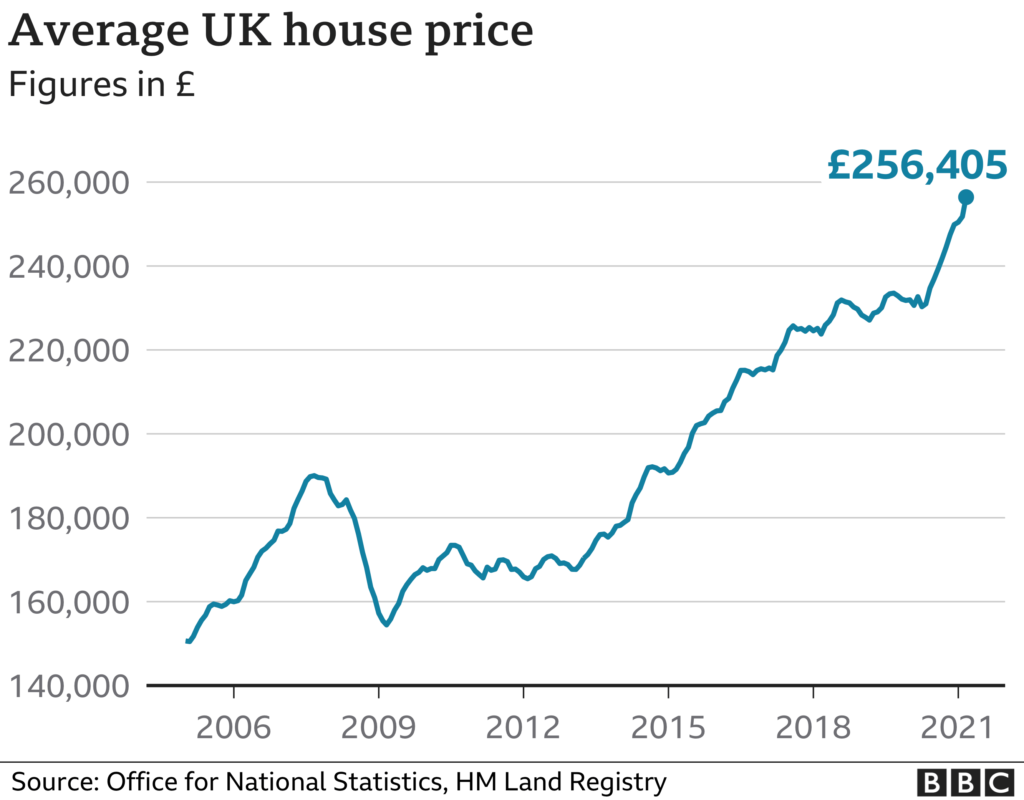

We now have hyper house inflation, wage inflation, food price and utility inflation, and all this will change the housing market, especially as one in two properties were bought last year by first time buyers, 406,000 of them.

If they sit and wait, or just cannot afford the deposits, the market will falter as they are the genesis of many chain transactions.

Freddie Savundra: Is the future website forms or chatbots?

Freddie Savundra, the founder of Meet Parker, is an incredibly bright gentleman who is all about communication.

His company Meet Parker is an AI-driven mortgage, insurance and property assistant. Backed by industry leaders and partnered with best of breed tech firms such as iPipeline and Twenty7tec, it offer a different way to engage with clients and businesses, delivering enhanced lead conversion rates and a more streamlined sales and support process.

But I do not want to talk about his company too much, rather I want to in his own words educate anyone out there who is a property professional about the advantage of utilising a chatbot or bot, rather than hoping someone comes to your company website, will stay, and then fill in a form.

As Freddie asks, website forms or chatbots? It is a heavyweight contest. Here he is, in his own words:

Let’s get something clear from the beginning. Nobody likes chatbots. Given the opportunity, 99% of people would prefer to speak to a human – it’s perfectly normal. Humans give a sense of reassurance and more often than not can help with the answer there and then, if you can stand being on hold for an hour…

Here’s the secret Chatbot companies don’t want to tell you. Any half decent software engineer can build a chatbot in an hour – it’s not hard. Just think what you could do in a day…

“So why use them?

Put in the right place, a chatbot can become something quite clever, what we like to call Assistants here at Meet Parker. Here are 5 key things we’ve learnt when looking at refreshing your website, and why we think they beat website forms.”

Data is the new gold

To be GDPR compliant – Web Forms rely on the user clicking Submit. The more questions you ask on a form, the less likely the average Joe visiting your website is going to hit that shiny button where they send all their info your way. Chatbots are quite clever here, as the data they capture can be custom to the visitor that’s hit your site. So whether they’ve DM’d your Page on Instagram or click an Ad on Facebook, you can tailor the question set to make sure you are well positioned to help your clients.

Chatbots are 24/7

They don’t sleep, they don’t rest, they don’t get tired. As good as your enquiry line may be, with Sarah smashing the calls at 10pm, the cost ratio of having staff work through the night will never balance up. Chatbots help here, they can continually nurture your digital visitors, answer questions, until you’re ready to pick up the phone.

Chatbots are multilingual

Forms can change language based on your location (if you’ve set it up) – but how many forms can take information in one language and pass it to the support team in another. Very few.

Customer Experience

Clever chatbots have sentiment analysis and confidence scoring built in. That means if your Assistant doesn’t understand the question, he’ll pass to someone else who does. Picture the perfect client experience, except rather than waiting for Sarah to get here Manager, your Assistant has already lined them up. We call that streamlining the client experience.

Chatbots can adapt

Believe it or not, digital Body Language is a real thing. Forget cookies, forget your age and income. Think the way you communicate, the way you type, the length of time you spend on a page, how many forms can change their style based on the pages you’ve visited before? Very few. Assistants do this very well.

Where very few people venture…. is a combination of an Assistant and Website Form, what we like to call Parker in a Box. Imagine giving your clients the option of how much personal data they want to provide, catering right the way through to a full fact find.

That’s where the future is, that’s what Meet Parker Assistants do.

If you want to chat with a person who I personally hold in very high regard, just go to his site www.meetparker.co.uk

I am sure their offering will be of use to you, and you will be engaged and sorted very professionally by the advanced software he has developed into a brilliant solution.

Andrew Stanton is the founder and CEO of Proptech-PR, a consultancy for Founders of Proptechs looking to grow and exit, using his influence from decades of industry experience. Separately he is a consultant to some of the biggest names in global real estate, advising on sales and acquisitions, market positioning, and operations. He is also the founder and editor of Proptech-X Proptech & Property News, where his insights, connections and detailed analysis and commentary on proptech and real estate are second to none.