Rents Rose Again During Q4 2022, Says the Deposit Protection Service

Rents increased by 8.27% between Q4 2021 and Q4 2022, with London and Scotland rents outstripping inflation

Bristol – Average UK rents increased again during Q4 2022, according to The Deposit Protection Service (The DPS).

The UK’s largest protector of deposits’ quarterly Rent Index reveals how average rents in Q4 2022 were £903: an increase of 1.57% (£14) since the previous quarter and 8.27% (£69) since the last quarter of 2021.

The report also highlights how rent increases in London and Scotland outstripped the Consumer Prices Index (CPI) 9.20%* annual rate of inflation, with the average in the capital increasing by 11.59% (£160) from £1,381 to £1,541 between Q4 2021 and Q4 2022 and costs increasing by 12.02% (£79) from £657 to £736 during the same period north of the border.

Average annual UK rent is now £1,332 higher than the same time two years ago – a rate of increase of £111 (14.02%) a month according to the report, which is based on one of the most comprehensive databases of domestic private rental prices across the country.

Matt Trevett, Managing Director at The DPS said: “The UK’s sustained rent rises are a result of a complex combination of inflationary pressures due to demand for housing.

“Higher interest rates may also be preventing those tenants who are looking to buy their own property from meeting mortgage affordability criteria, which means they must continue to stay in the private rental sector (PRS).

“Higher building material costs may also be affecting the pace and price of the construction of new homes, which is also squeezing the supply of properties for rent or purchase.

Paul Fryers, Managing Director at Zephyr Homeloans, said: “Whilst mortgage interest rates for buy-to-let properties have stabilised during the past few months, landlords must now meet stricter affordability tests.

“As a result, landlords are under pressure to increase rents to ensure they have sufficient funds.

“Landlords who want to exercise forbearance for their tenants during the present time may find themselves prioritising their mortgage-related obligations.”

Rents in Yorkshire saw the slowest annual growth between Q4 2021 and Q4 2022, up £32 (5.50%) from £582 to £614, said the organisation.

The DPS added that rents in the South East increased by £53 (5.52%) from £961 to £1,014 during the same period.

Rents in these regions still grew faster than the national average 5.30% annual rent rise during 2021, the organisation added.

| Region | Average Q4 2022 Rent | Change since Q3 2022 | Change since Q4 2021 | ||

| London | £1,541 | £1,499 | 2.80% | £160 | 11.59% |

| South East | £1,014 | £1,023 | -0.88% | £53 | 5.52% |

| South West | £894 | £882 | 1.36% | £60 | 7.19% |

| East | £945 | £937 | 0.85% | £62 | 7.02% |

| East Midlands | £685 | £679 | 0.88% | £45 | 7.03% |

| West Midlands | £743 | £705 | 5.39% | £58 | 8.47% |

| Yorkshire | £614 | £604 | 1.66% | £32 | 5.50% |

| North West | £703 | £692 | 1.59% | £58 | 8.99% |

| North East | £607 | £585 | 3.76% | £53 | 9.57% |

| Scotland | £736 | £721 | 2.08% | £79 | 12.02% |

| Wales | £679 | £669 | 1.49% | £38 | 5.93% |

| Northern Ireland | £612 | £606 | 0.99% | £41 | 7.18% |

For more information see: https://www.depositprotection.com/learning-centre/the-dps-rent-index

Growth Outlook Is Positive Among Property Management Organizations Despite Broader Economic Challenges

AppFolio, Inc. (NASDAQ:APPF), a leading provider of cloud business management solutions for the real estate industry, today released its inaugural Property Management Benchmark Report, which examines property management industry sentiment and outlook for 2023.

According to responses from nearly 5,000 employees at U.S.-based property management companies, there is a strong sense of optimism – one that significantly surpasses other industries – even as challenges such as delinquencies, hiring difficulties and inflation (the three most frequently cited concerns) persist:

- More than half (52%) intend to hire additional staff

- Four out of five respondents (81%) expect their organization’s revenue to increase in 2023

- Nearly three-quarters (72%) expect net operating income (NOI) to grow

“Property managers see the challenges before them, but still view 2023 as a year of growth, whether that means expanding their portfolios, hiring new staff and improving culture, or streamlining and automating existing processes to create a more efficient organization. Notably, there’s a strong focus on staff happiness and hiring new employees — it’s encouraging to see the property management industry contributing to U.S. job growth,” said Shane Trigg, General Manager of Real Estate at AppFolio. “We are thrilled to power the industry leaders that look at the projected challenges of 2023 not just as something to overcome but as opportunities to improve and thrive.”

Other noteworthy takeaways from the 2023 AppFolio Property Manager Benchmark Report include:

- Risks remain, but property managers see more opportunities.

- Inflation and delinquencies are the two primary concerns across all sizes of residential property management organizations, as cited by nearly half of respondents (46%).

- Hiring and retaining talent are top of mind for all, but increase in prominence amongst larger organizations with more staff.

- Expected revenue and NOI increases are driven by opportunities for growth and improvement, led by the addition of new units (cited by 55% of respondents) and improving customer service (42%).

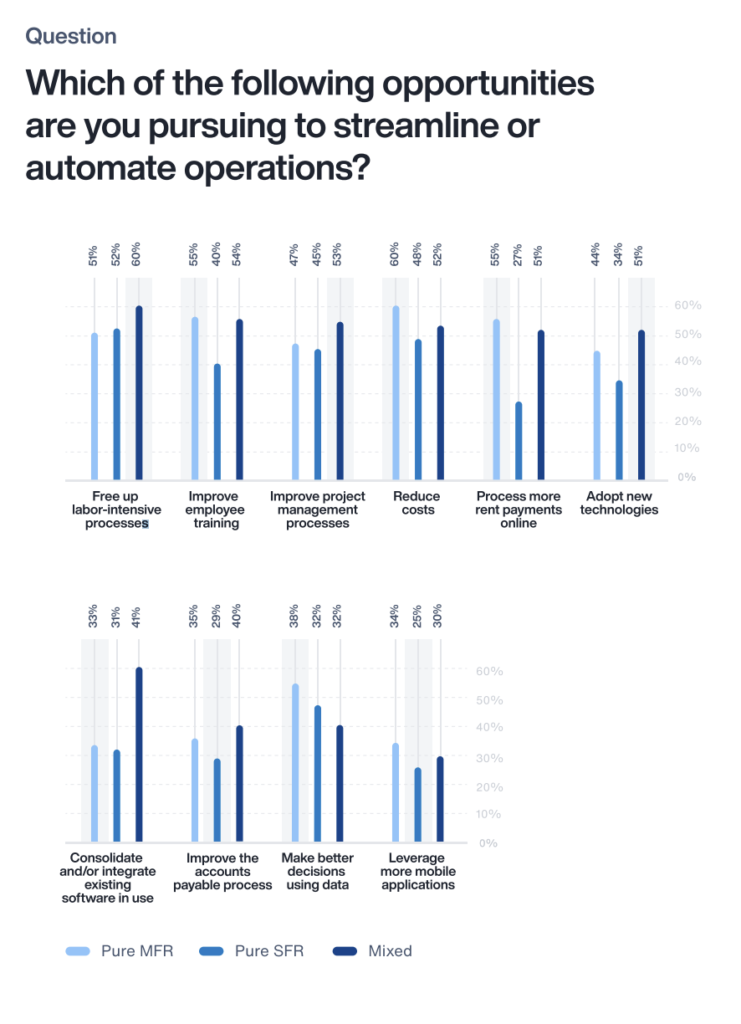

- Improving operations, particularly streamlining financial functions, is key – but motivations vary with organization size.

- Nearly three in five respondents (59%) working for a company with more than 5,000 units cite cost reduction as a top focus, while just 40% of these respondents note freeing up teams from labor-intensive processes as a top motivation.

- Across the board, however, respondents want to make financial interactions easier for both residents and the businesses they work with – 46% of all respondents want to process more rent payments online and 42% want to improve their accounts payable process.

- Property managers have room to improve their tech stacks as they scale.

- Large property management companies are much more likely to use tech built for specific functions. More than half of respondents from organizations with more than 5,000 units use document management and storage (73%), maintenance management (57%), utility management (53%), and CRM (51%) solutions.

- Fewer than a quarter of all respondents have added smart entry or IoT services (24%) or AI or chatbots for leasing communications (15%) into their existing tech stack, showing room for growth across all organizational sizes as function-specific proptech solutions, like those provided via AppFolio Stack™, become available for integration directly into core property management systems.

Download the 2023 AppFolio Property Manager Benchmark Report to review additional findings and insights.

Proptech and Property News in association with Estate Agent Networking.

Andrew Stanton is the founder and CEO of Proptech-PR, a consultancy for Founders of Proptechs looking to grow and exit, using his influence from decades of industry experience. Separately he is a consultant to some of the biggest names in global real estate, advising on sales and acquisitions, market positioning, and operations. He is also the founder and editor of Proptech-X Proptech & Property News, where his insights, connections and detailed analysis and commentary on proptech and real estate are second to none.