A changing of the guard at Leaders Romans Group

Platinum Equity, an American private equity investment firm founded by Tom Gores, is to acquire Leaders Romans Group (LRG), with its present ownership by The Bowmark Group coming to an end.

Those in the industry will know that LRG has been on a long acquisition trail, and it now has a sizeable base with 210 branches and an inventory of over 60,000 properties. LRG is the hybrid organisation that resulted from the merger of the Romans Group and Leaders Lettings less than a decade ago.

CEO Peter Kavanagh, a highly respected operator in the real estate sector said: “Our partnership with Bowmark has been instrumental in building LRG into one of the leading property services groups in the UK.

“As a result of the investment in people, operations and new services, the business is well-positioned to capitalise on the exciting opportunities that lie ahead – both from organic growth and the continuation of our successful acquisition strategy.”

Perhaps most telling of all was the comment made by the VC who had helped LRG scale up in recent years. Their spokesman Tom Shelford said: “We are delighted to have supported LRG to become the leading consolidator in the sector… The exceptional calibre of LRG’s people, and its focus on service excellence through digital transformation and product innovation, will ensure its continued success with its new investment partner.”

Speaking as a person who knew of both brands prior to them becoming the LRG group, throughout my agency days and more recently as a proptech analyst and growth consultant, it’s music to my ears when Shelford says that its “focus on service excellence through digital transformation and product innovation” will be a mainstay going forward with its new investment partner.

It reinforces what I truly think, that if you have a strong, focused person like Peter Kavanagh at the head of the real estate business, pushing through the core values of the company, and you then invest in the right people while embracing proptech and the digital transformation of real estate, you have a scalable and saleable business fit for the modern age.

A thing to think of at the micro-level for SME owners looking to sell – the more digital and efficient it is, the higher revenue and profit, and better price achieved.

Tech is not the enemy. It leverages and augments the talents of great sales and lettings team. This is why Proptech-PR has been offering an advisory service since 2017 to agents who need to modernise. It is simply unsustainable if businesses do not follow the example set by organisations like Leaders Romans.

View more Property News Briefings

Report commissioned by NRLA shows it has been a taxing time for landlords

A detailed report put together by The London School of Economics, commissioned by NRLA, and put together by Kath Scanlon, Christine Whitehead and Fay Blanc, shows that the ever-increasing and ever-changing taxation of landlords is biting, with 39% deciding not to buy another rental in the foreseeable future.

Ben Beadle, CEO of the National Residential Landlords Association, commented: “It is clear that recent tax increases have deterred investment in the sector. With the demand for homes to rent outstripping supply this will only hurt tenants as they face less choice, higher rents and find it more difficult to save for a home of their own as a result.”

Having become a landlord myself at the tail-end of the 80s, and watching over the decades of ever-tightening red-tape and changing tax regimes bought in by the ever-changing Secretaries of Housing (16 to my memory) it comes as no surprise that some landlords in the PRS have had enough.

Do not get me wrong, I am not an advocate of Rachmanism, and feel that the vertical needs to be policed and tenants and landlords looked after, but if people need somewhere to rent then dissuading landlords is not a good idea.

I would recommend that the present embattled government, and more specifically the great leveller Michael Gove, take a good read of the report that, although has a reasonably small sample size, does echo the sentiment of many.

For those who have limited time, here are the key findings of the report:

The main findings of our survey of some 1400 landlords currently active in England showed: that large proportions of landlords were concerned about the cumulative effect of tax changes.

Landlords saw the change from mortgage interest rates to 20% credit as the most important tax change with 33% seeing it as significant to the operation of the landlord business.

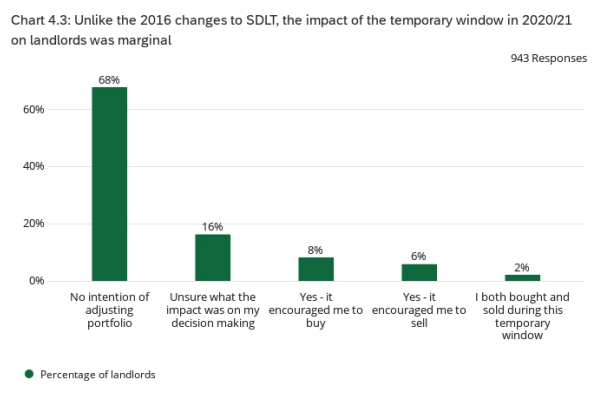

The 3% SDLT surcharge came second, with 27% of landlords seeing it as significant; followed by changes in the treatment of furniture and fittings – 26% – and in the capital expenditure allowance – at 24%.

Overall 11% of landlords thought that the tax changes had made a decisive impact on their own plans; a further 15% thought they had made a major impact; and another 26% thought there had been some impact. Only 30% said their plans had not been affected.

Those who identified the changes to mortgage tax relief (section 24) and to capital gains tax as significant were asked how each tax change had affected their landlord business: 39% said they were not proceeding with planned future purchase. 31% said they had put plans on hold. 28% said they were taking steps to leave the sector. 15% were restructuring their business

Andrew Stanton is the founder and CEO of Proptech-PR, a consultancy for Founders of Proptechs looking to grow and exit, using his influence from decades of industry experience. Separately he is a consultant to some of the biggest names in global real estate, advising on sales and acquisitions, market positioning, and operations. He is also the founder and editor of Proptech-X Proptech & Property News, where his insights, connections and detailed analysis and commentary on proptech and real estate are second to none.